Gold Reaches Record High: Why Investors Are Seeking Safety In Precious Metals

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Reaches Record High: Why Investors Are Seeking Safety in Precious Metals

Gold prices have surged to record highs, leaving many wondering why investors are flocking to this precious metal. The answer, experts say, is multifaceted, driven by a combination of economic uncertainty, geopolitical tensions, and inflation fears. This unprecedented climb in gold prices signals a significant shift in the global investment landscape.

The Perfect Storm: Inflation, Recession Fears, and Geopolitical Instability

The current surge isn't simply a fleeting market fluctuation. Several key factors are converging to create a perfect storm for gold investment:

-

Inflationary Pressures: Persistent inflation erodes the purchasing power of fiat currencies. Gold, historically a hedge against inflation, becomes an attractive safe haven as the value of paper money declines. The recent increase in consumer price indexes across many global economies has fueled this demand. [Link to reputable inflation data source, e.g., the Bureau of Labor Statistics]

-

Recessionary Fears: Concerns about a looming global recession are also driving investors towards the safety of gold. During economic downturns, investors often move away from riskier assets like stocks and bonds, opting for the perceived stability of precious metals. This "flight to safety" phenomenon is well-documented in financial history.

-

Geopolitical Instability: Global geopolitical tensions, including the ongoing war in Ukraine and rising tensions in other parts of the world, further contribute to the increased demand for gold. Uncertainty and instability often push investors towards assets considered safe havens, like gold and other precious metals. [Link to reputable news source covering geopolitical events]

Why Gold? Understanding its Appeal as a Safe Haven Asset

Gold's appeal as a safe haven asset stems from several key characteristics:

-

Tangibility: Unlike digital assets or stocks, gold is a physical commodity. This tangible nature provides a sense of security for investors worried about market volatility.

-

Limited Supply: The finite supply of gold contributes to its inherent value. Unlike fiat currencies, which can be printed at will, the scarcity of gold makes it a valuable, long-term store of wealth.

-

Historical Performance: Gold has historically performed well during times of economic uncertainty and inflation, solidifying its reputation as a safe haven asset. Its ability to maintain or even increase its value during market downturns makes it attractive to risk-averse investors.

Beyond Gold: Diversification with Other Precious Metals

While gold is currently dominating headlines, other precious metals like silver, platinum, and palladium also offer diversification opportunities within the precious metals sector. These metals have their own unique industrial applications and market dynamics, potentially offering different risk-reward profiles. [Link to article discussing other precious metals investment]

Investing in Gold: A Cautious Approach

It's crucial to remember that investing in gold, like any investment, carries risks. While it's considered a safe haven asset, its price can fluctuate significantly. Before investing in gold, it's recommended to:

-

Consult a Financial Advisor: A qualified financial advisor can help you assess your risk tolerance and create a diversified investment portfolio that aligns with your financial goals.

-

Conduct Thorough Research: Understand the different ways to invest in gold, including physical gold, gold ETFs, and gold mining stocks. Each option has its own set of advantages and disadvantages.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk.

The record-high gold prices reflect a growing global unease. While the future remains uncertain, the current trend highlights the enduring appeal of gold as a safe haven asset in times of economic and geopolitical instability. Understanding the factors driving this surge is crucial for investors navigating the current market landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Reaches Record High: Why Investors Are Seeking Safety In Precious Metals. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Find Out If You Won Tuesdays West Virginia Cash Pop Results

Sep 04, 2025

Find Out If You Won Tuesdays West Virginia Cash Pop Results

Sep 04, 2025 -

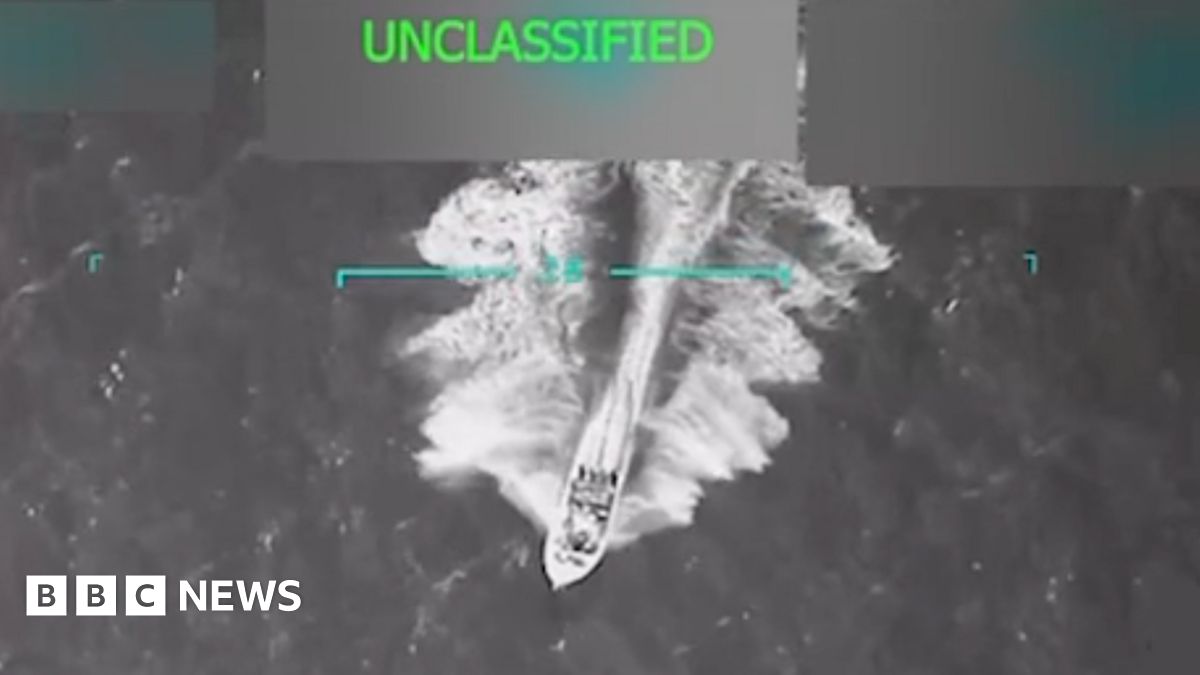

Trump Claims 11 Dead In Us Strike Targeting Venezuelan Drug Vessel

Sep 04, 2025

Trump Claims 11 Dead In Us Strike Targeting Venezuelan Drug Vessel

Sep 04, 2025 -

Nyt Spelling Bee Solution September 3rd Hints And Answers

Sep 04, 2025

Nyt Spelling Bee Solution September 3rd Hints And Answers

Sep 04, 2025 -

Could You Win 1 3 Billion Powerball Jackpot On The Line Tonight

Sep 04, 2025

Could You Win 1 3 Billion Powerball Jackpot On The Line Tonight

Sep 04, 2025 -

Ai Deepfake Venezuela Questions Video Evidence Of Drug Shipment

Sep 04, 2025

Ai Deepfake Venezuela Questions Video Evidence Of Drug Shipment

Sep 04, 2025