Fiscal 2026 Guidance: Intuit Projects Continued Growth And Margin Expansion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intuit Projects Continued Growth and Margin Expansion in Fiscal 2026 Guidance

Intuit Inc. (INTU), a leading provider of financial management and compliance software, recently released its fiscal 2026 guidance, projecting continued growth and margin expansion. This announcement sent positive ripples through the market, reinforcing investor confidence in the company's long-term strategy. The projections indicate a strong outlook for Intuit, despite ongoing economic uncertainties. Let's delve into the details of this promising forecast.

Key Highlights of Intuit's Fiscal 2026 Guidance

Intuit's guidance paints a picture of sustained success across its key product lines. The company anticipates:

-

Revenue Growth: A continued increase in revenue, driven by strong performance across its core segments, including TurboTax, QuickBooks, and Credit Karma. Specific revenue figures were provided, highlighting significant year-over-year increases. [Link to Intuit's official press release]. This growth is attributed to several factors, including increased market penetration and successful product innovation.

-

Margin Expansion: Intuit projects a significant expansion of its operating margins. This reflects the company's efficiency initiatives and focus on optimizing its cost structure while maintaining its investment in innovation and growth. This is a crucial indicator of profitability and financial health. Improving margins often signals increased operational efficiency and stronger financial stability.

-

Strategic Investments: Despite the focus on margin expansion, Intuit plans to continue investing strategically in research and development, aiming to enhance its product offerings and maintain its competitive edge in the ever-evolving fintech landscape. This commitment to innovation is a key factor in its long-term growth strategy.

-

Strong Customer Base: Intuit's massive and loyal customer base continues to be a driving force behind its projected growth. The company's focus on providing valuable services and intuitive software solutions contributes significantly to customer retention and acquisition.

Factors Contributing to Intuit's Positive Outlook

Several factors contribute to Intuit's optimistic outlook for fiscal 2026:

-

Strong Brand Recognition: Intuit boasts strong brand recognition and trust among consumers and businesses alike. This brand equity is a significant asset, making it easier to acquire new customers and maintain loyalty.

-

Market Leadership: Intuit holds a dominant market position in several key segments, allowing it to capitalize on market growth and trends. Its leadership position translates to significant market share and pricing power.

-

Technological Innovation: Intuit consistently invests in technological innovation, developing new features and products to meet the changing needs of its customers. This commitment to innovation is crucial for maintaining its competitive advantage.

-

Effective Marketing Strategies: Intuit’s effective marketing strategies, both online and offline, reach a wide audience and effectively communicate the value proposition of its products.

What This Means for Investors

Intuit's fiscal 2026 guidance offers a compelling outlook for investors. The projected revenue growth and margin expansion suggest strong financial performance, making it an attractive investment opportunity for those seeking exposure to the growing fintech sector. However, as with any investment, it's crucial to conduct thorough due diligence before making any decisions. [Link to a reputable financial news source discussing INTU stock].

Conclusion

Intuit’s fiscal 2026 guidance demonstrates a clear path to continued growth and profitability. The company's strategic investments in innovation, coupled with its strong brand recognition and market leadership, position it for sustained success in the years to come. This positive outlook should instill confidence in investors and stakeholders alike. The focus on margin expansion, while maintaining strategic investments, indicates a balanced approach to growth and profitability, a crucial element for long-term success. This is a significant development for the company and the wider fintech industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fiscal 2026 Guidance: Intuit Projects Continued Growth And Margin Expansion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Denver Dui Defense New Attorney Resources Boost Client Support

Aug 23, 2025

Denver Dui Defense New Attorney Resources Boost Client Support

Aug 23, 2025 -

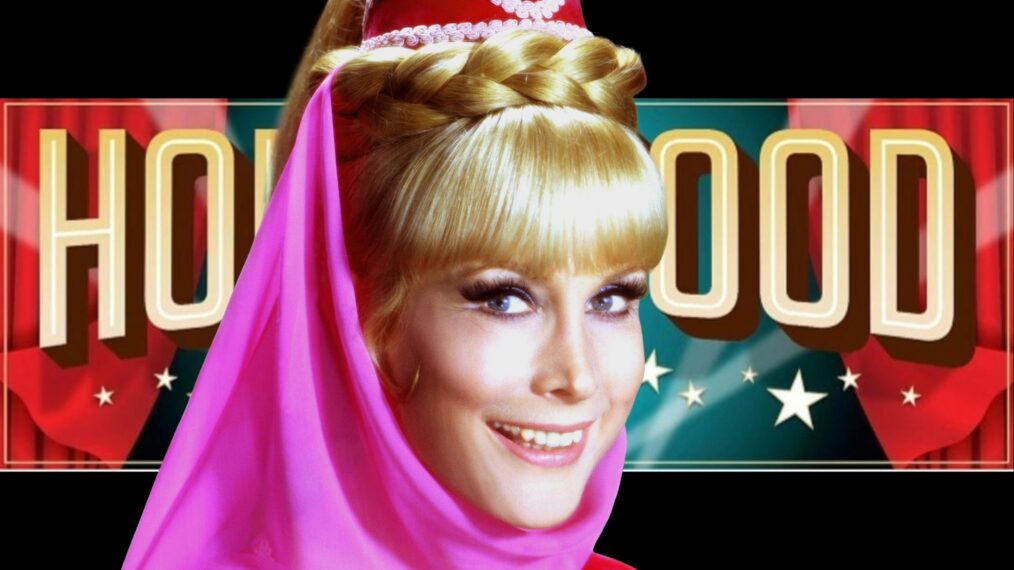

Meet Barbara Eden Your Chance To See The I Dream Of Jeannie Star This September

Aug 23, 2025

Meet Barbara Eden Your Chance To See The I Dream Of Jeannie Star This September

Aug 23, 2025 -

Improved Client Services Denver Dui Law Firm Launches New Resource Hub

Aug 23, 2025

Improved Client Services Denver Dui Law Firm Launches New Resource Hub

Aug 23, 2025 -

New York City Flooding Timing And Impact Of The Incoming Storm

Aug 23, 2025

New York City Flooding Timing And Impact Of The Incoming Storm

Aug 23, 2025 -

Trump Gate Crash Fallout Interpreting Chelsea Clintons Telling Photograph

Aug 23, 2025

Trump Gate Crash Fallout Interpreting Chelsea Clintons Telling Photograph

Aug 23, 2025

Latest Posts

-

Severe Weather Alert Orlando Faces Stormy Weekend Heavy Rain Possible

Aug 24, 2025

Severe Weather Alert Orlando Faces Stormy Weekend Heavy Rain Possible

Aug 24, 2025 -

Dc National Guard Deployment A Look At Crime Statistics In Sending States Cities

Aug 24, 2025

Dc National Guard Deployment A Look At Crime Statistics In Sending States Cities

Aug 24, 2025 -

Building Billion Dollar Ideas Expert Strategies Revealed

Aug 24, 2025

Building Billion Dollar Ideas Expert Strategies Revealed

Aug 24, 2025 -

Early Look Penn State Football Depth Chart Prediction 2025 Nevada Game

Aug 24, 2025

Early Look Penn State Football Depth Chart Prediction 2025 Nevada Game

Aug 24, 2025 -

Discover Rapid City Attractions Beyond Mount Rushmore

Aug 24, 2025

Discover Rapid City Attractions Beyond Mount Rushmore

Aug 24, 2025