Fed Rate Cut Hopes Drive Mortgage Rates Down: What Homebuyers Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Rate Cut Hopes Drive Mortgage Rates Down: What Homebuyers Need to Know

The housing market is showing signs of life as hopes for a Federal Reserve interest rate cut fuel a decline in mortgage rates. This welcome news offers a potential lifeline for prospective homebuyers who have been sidelined by persistently high borrowing costs. But what does this actually mean for you, and should you rush to buy? Let's delve into the details.

Mortgage Rates Dip Amidst Economic Uncertainty

For months, the housing market has been grappling with stubbornly high mortgage rates, a direct consequence of the Federal Reserve's aggressive interest rate hikes aimed at combating inflation. However, recent economic data showing signs of cooling inflation has sparked speculation that the Fed might soon pause, or even reverse course, leading to a decrease in the federal funds rate. This, in turn, is translating into lower mortgage rates.

While the decline isn't dramatic across the board, even a small reduction can significantly impact affordability for potential homebuyers. A decrease of even half a percentage point can save thousands of dollars over the life of a mortgage. Several major lenders are reporting decreases in average rates for both 30-year fixed and adjustable-rate mortgages (ARMs).

What Homebuyers Should Consider:

-

Don't jump to conclusions: While lower rates are encouraging, it's crucial to remember that the economic landscape remains uncertain. The Fed's decisions are data-dependent, and any rate cuts could be short-lived if inflation unexpectedly surges again.

-

Shop around: Mortgage rates vary considerably between lenders. Take the time to compare offers from multiple banks, credit unions, and mortgage brokers to secure the best possible rate. Consider using online mortgage comparison tools to streamline this process. [Link to reputable mortgage comparison site]

-

Improve your credit score: Your credit score is a major factor determining your eligibility for a mortgage and the interest rate you'll receive. Improving your credit score before applying for a mortgage can result in significant savings. [Link to article on improving credit score]

-

Consider your financial situation: Even with lower mortgage rates, buying a home is a significant financial commitment. Carefully assess your budget, including closing costs, property taxes, and potential maintenance expenses, to ensure you can comfortably afford your mortgage payments.

-

Stay informed: The housing market is dynamic. Keep abreast of the latest economic news and interest rate predictions to make informed decisions. Follow reputable financial news sources and consult with financial advisors.

The Impact of Lower Rates on the Broader Market:

The decrease in mortgage rates isn't just good news for prospective homebuyers; it could also signal a broader shift in the housing market. Lower rates could increase buyer demand, potentially leading to increased competition and a rise in home prices in some areas. However, the overall market remains cautious due to existing economic uncertainties.

Looking Ahead:

The future trajectory of mortgage rates remains intertwined with the Federal Reserve's monetary policy decisions. While the recent dip offers a glimmer of hope for prospective homebuyers, it's essential to approach the market with a realistic and well-informed perspective. By carefully considering your financial situation and staying informed about market trends, you can make sound decisions that align with your long-term goals.

Call to Action: Ready to explore your mortgage options? Connect with a financial advisor today to discuss your specific needs and circumstances.

Keywords: Mortgage rates, Fed rate cut, homebuyers, housing market, interest rates, affordability, mortgage lenders, credit score, economic uncertainty, financial advice, buying a home, adjustable-rate mortgages (ARMs), 30-year fixed mortgage.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Rate Cut Hopes Drive Mortgage Rates Down: What Homebuyers Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sex Harassment In The Bar A Reviews Disturbing Findings

Sep 10, 2025

Sex Harassment In The Bar A Reviews Disturbing Findings

Sep 10, 2025 -

Chelsea Clintons Composed Response A Photo Speaks Volumes After Trumps Unexpected Appearance

Sep 10, 2025

Chelsea Clintons Composed Response A Photo Speaks Volumes After Trumps Unexpected Appearance

Sep 10, 2025 -

Us Open Final Alcarazs Path Back To World No 1

Sep 10, 2025

Us Open Final Alcarazs Path Back To World No 1

Sep 10, 2025 -

Positive Earnings Outlook Boosts United Health Unh Stock

Sep 10, 2025

Positive Earnings Outlook Boosts United Health Unh Stock

Sep 10, 2025 -

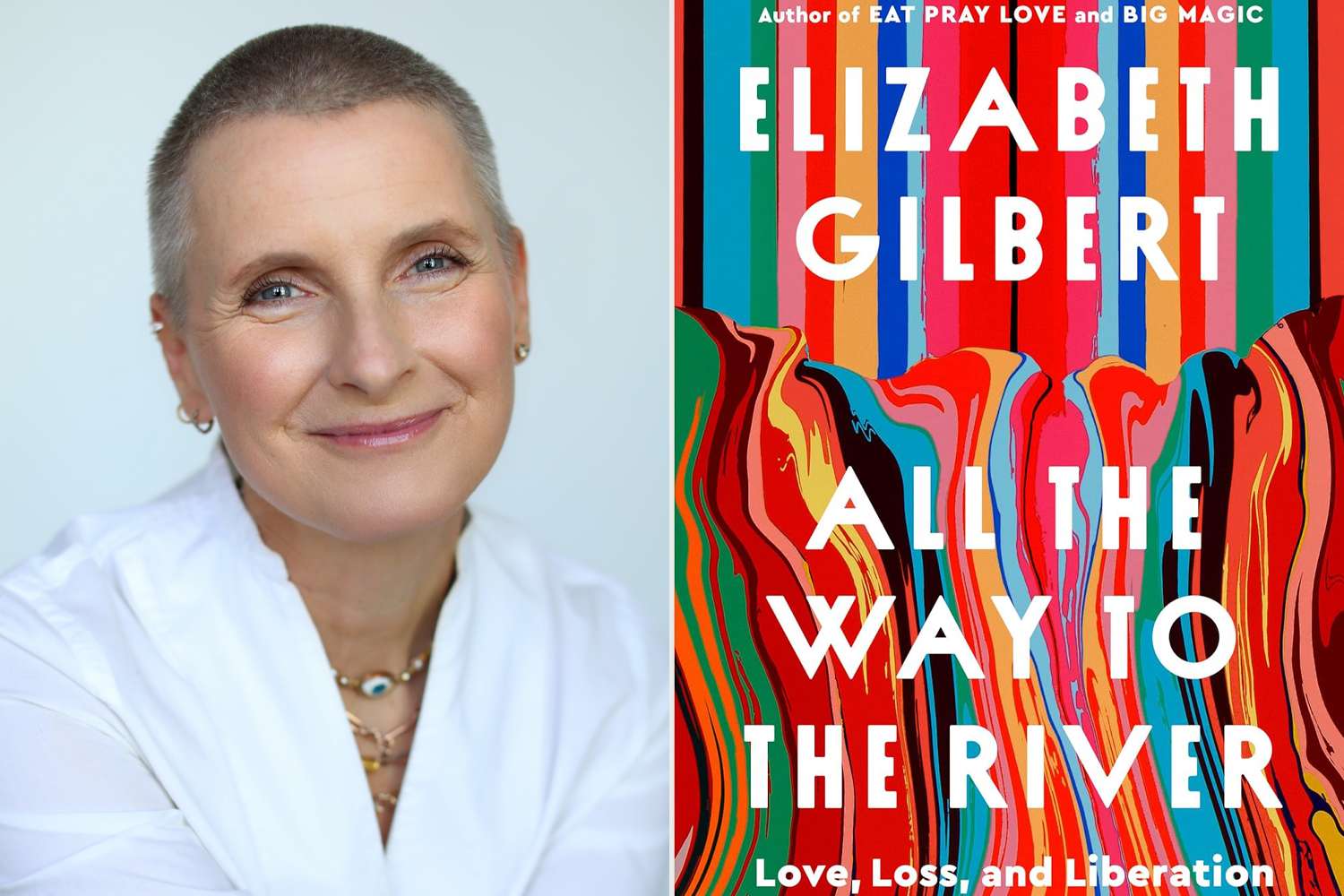

Sex Drugs And A Murder Plot The Untold Story Of Elizabeth Gilbert

Sep 10, 2025

Sex Drugs And A Murder Plot The Untold Story Of Elizabeth Gilbert

Sep 10, 2025

Latest Posts

-

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025 -

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025 -

Sabalenkas Us Open Reign Continues Highlights From The Anisimova Final

Sep 10, 2025

Sabalenkas Us Open Reign Continues Highlights From The Anisimova Final

Sep 10, 2025 -

United Health Stock Jumps Earnings Outlook Reaffirmed

Sep 10, 2025

United Health Stock Jumps Earnings Outlook Reaffirmed

Sep 10, 2025 -

Public Rallying Behind Dolly Parton A Response To Jd Vances Walkout

Sep 10, 2025

Public Rallying Behind Dolly Parton A Response To Jd Vances Walkout

Sep 10, 2025