Falling Chip Stocks Drag Down Palantir: Examining The Trump Era's Legacy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Falling Chip Stocks Drag Down Palantir: Examining the Trump Era's Legacy

The tech sector is reeling, and Palantir Technologies, the data analytics firm synonymous with the Trump administration, is feeling the pinch. A sharp downturn in chip stocks has sent ripples throughout the market, significantly impacting Palantir's share price and raising questions about its long-term prospects and the enduring legacy of its close ties to the previous administration. This downturn highlights the interconnectedness of the tech industry and the vulnerability of companies heavily reliant on specific technological components and government contracts.

The Chip Shortage's Lingering Impact:

The global semiconductor shortage, which began to bite hard in 2020, continues to plague the tech industry. This shortage, exacerbated by geopolitical tensions and supply chain disruptions, has driven up the cost of chips, squeezing profit margins for companies across the board. Palantir, while not directly a chip manufacturer, relies heavily on the availability and affordability of advanced computing power to run its complex data analytics platforms. The increased chip costs are therefore a significant headwind for the company's profitability.

Palantir's Dependence on Government Contracts:

A key element of Palantir's business model has been its close relationship with government agencies, particularly during the Trump administration. While this initially fuelled significant growth, it has also created a degree of vulnerability. Changes in government priorities and budget allocations can significantly impact Palantir's revenue stream. The current administration's approach to government contracting differs from its predecessor's, leading to uncertainty about future contracts and potential delays in securing new ones. This uncertainty adds to the pressure already exerted by rising chip costs.

Beyond the Headlines: A Deeper Dive into Palantir's Challenges:

- Competition: Palantir faces increasing competition in the data analytics market from established tech giants and agile startups. Maintaining a competitive edge requires continuous innovation and investment, further straining resources already impacted by rising chip costs and fluctuating government contracts.

- Profitability Concerns: While Palantir has demonstrated significant revenue growth, achieving consistent profitability remains a challenge. The current economic climate, coupled with the factors mentioned above, intensifies the pressure to improve operational efficiency and streamline costs.

- Long-Term Strategy: Palantir needs a clear and adaptable long-term strategy to navigate the evolving technological landscape and the shifting dynamics of the government contracting market. Diversifying its revenue streams and reducing dependence on specific sectors are crucial for long-term sustainability.

The Trump Era's Legacy: A Double-Edged Sword:

Palantir's association with the Trump administration was initially a significant boon, providing access to lucrative government contracts. However, this close relationship has also become a double-edged sword. The change in administration has created uncertainty, and Palantir now needs to demonstrate its value proposition beyond its previous political affiliations to secure future contracts and investor confidence.

Looking Ahead:

The current downturn presents a significant challenge for Palantir. However, the company's ability to adapt to the changing market dynamics, diversify its revenue streams, and demonstrate its value proposition in a competitive landscape will determine its long-term success. The next few quarters will be critical in determining whether Palantir can navigate these headwinds and emerge stronger. Investors will be closely watching for signs of improved profitability and a clearer strategic direction. The company's future depends on successfully addressing the challenges posed by rising chip costs, fluctuating government contracts, and intense competition.

Call to Action: What are your thoughts on Palantir's future? Share your insights in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Falling Chip Stocks Drag Down Palantir: Examining The Trump Era's Legacy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Armed And Dangerous Vermont Suspect Arrested After Trooper Drag Incident

Aug 21, 2025

Armed And Dangerous Vermont Suspect Arrested After Trooper Drag Incident

Aug 21, 2025 -

Mass Tourisms Negative Impacts Why European Cities Are Pushing Back

Aug 21, 2025

Mass Tourisms Negative Impacts Why European Cities Are Pushing Back

Aug 21, 2025 -

Stewart Delivers Stark Warning To Trump Supporters A Maga World Reality Check

Aug 21, 2025

Stewart Delivers Stark Warning To Trump Supporters A Maga World Reality Check

Aug 21, 2025 -

Southwest Us Braces For Extreme Heat Wave Temperatures To Soar Above 110 F

Aug 21, 2025

Southwest Us Braces For Extreme Heat Wave Temperatures To Soar Above 110 F

Aug 21, 2025 -

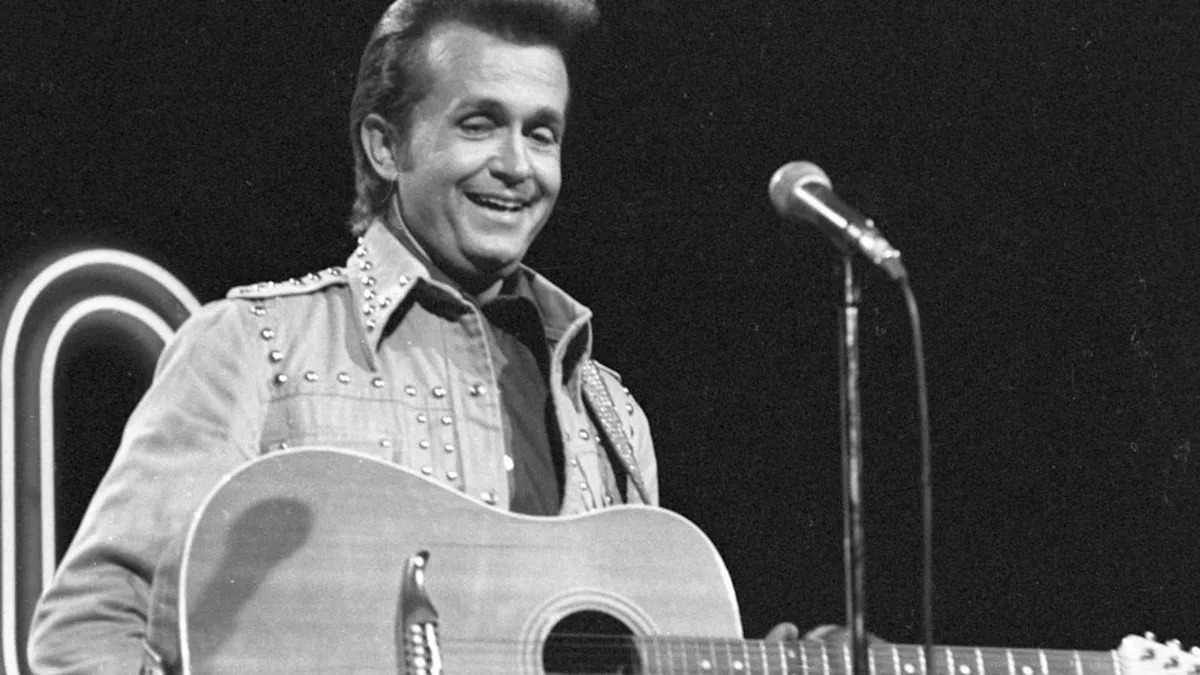

Veteran Country Singers Freak Accident Results In Show Cancellation

Aug 21, 2025

Veteran Country Singers Freak Accident Results In Show Cancellation

Aug 21, 2025

Latest Posts

-

Mass Tourisms Dark Side Why Europe Is Pushing Back

Aug 21, 2025

Mass Tourisms Dark Side Why Europe Is Pushing Back

Aug 21, 2025 -

From Jackpot To Jackpot Woman Wins Second Lottery Prize After 40 Years

Aug 21, 2025

From Jackpot To Jackpot Woman Wins Second Lottery Prize After 40 Years

Aug 21, 2025 -

Californias Worst Heatwave Of 2024 Impacts And Emergency Preparedness

Aug 21, 2025

Californias Worst Heatwave Of 2024 Impacts And Emergency Preparedness

Aug 21, 2025 -

Chelsea Clintons Photo Response A Masterclass In Political Messaging

Aug 21, 2025

Chelsea Clintons Photo Response A Masterclass In Political Messaging

Aug 21, 2025 -

Country Star Bill Anderson Injured Forces Grand Ole Opry Show Cancellation

Aug 21, 2025

Country Star Bill Anderson Injured Forces Grand Ole Opry Show Cancellation

Aug 21, 2025