Facing The Music: Social Security's 2034 Funding Shortfall And The Path Forward

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing the Music: Social Security's 2034 Funding Shortfall and the Path Forward

The ticking clock is loud. Social Security, a cornerstone of American retirement security, faces a projected funding shortfall beginning in 2034. This isn't a distant threat; it's a looming reality demanding immediate attention and decisive action. Understanding the problem and exploring potential solutions is crucial for ensuring the program's long-term viability and protecting the retirement benefits of millions.

The Problem: A Growing Deficit

The Social Security Administration (SSA) projects that by 2034, the Social Security trust funds will be unable to pay 100% of scheduled benefits. This doesn't mean the program will collapse overnight, but it does mean benefits will likely be reduced – potentially by as much as 20% – unless Congress acts. This looming shortfall is primarily driven by several factors:

- Aging Population: The post-World War II baby boomer generation is entering retirement, leading to a significant increase in the number of beneficiaries.

- Declining Birth Rates: Fewer workers are entering the workforce to support the growing number of retirees.

- Increased Life Expectancy: People are living longer, requiring Social Security benefits for an extended period.

These demographic shifts, combined with relatively stagnant wage growth, create a significant strain on the system's financial stability. The current payroll tax rate, while contributing significantly, isn't sufficient to cover the projected future obligations.

Potential Solutions: A Multi-faceted Approach

Addressing this challenge requires a comprehensive strategy, and there's no single magic bullet. Several potential solutions are currently under debate:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could alleviate some pressure on the system. This approach, however, could disproportionately affect lower-income workers who may have shorter lifespans and fewer savings.

- Increasing the Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes could generate additional revenue. This would require balancing the need for increased revenue with concerns about potential impacts on higher-income earners.

- Modifying Benefit Formulas: Adjusting the benefit calculation formulas could help ensure long-term solvency. However, such changes must carefully consider their impact on beneficiaries, particularly vulnerable populations.

- Raising Payroll Taxes: Increasing the payroll tax rate, even slightly, could inject substantial additional funds into the system. This, however, needs to be weighed against the potential impact on both employers and employees.

The Path Forward: Collaboration and Transparency

The situation demands a bipartisan, collaborative effort. Avoiding political gridlock and fostering open dialogue are essential to finding sustainable solutions. Transparency regarding the program's financial health is paramount to informing the public and building consensus on the necessary reforms. The SSA provides detailed reports and projections, readily available online, allowing citizens to understand the challenges and participate in the conversation. [Link to SSA website]

Conclusion: Securing the Future of Social Security

The 2034 funding shortfall isn't an insurmountable problem, but it does require proactive and decisive action. A comprehensive approach addressing multiple contributing factors is necessary to safeguard the future of Social Security and ensure its continued ability to provide vital retirement income for generations to come. Engaging in informed discussions and advocating for responsible solutions is crucial to protecting this vital social safety net. The future of Social Security depends on our collective commitment to finding a sustainable path forward.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing The Music: Social Security's 2034 Funding Shortfall And The Path Forward. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The New York Liberty Experiment Life Without Jones And Fiebich

Jun 20, 2025

The New York Liberty Experiment Life Without Jones And Fiebich

Jun 20, 2025 -

Supreme Court Abandons Transgender Children Sotomayors Powerful Dissent

Jun 20, 2025

Supreme Court Abandons Transgender Children Sotomayors Powerful Dissent

Jun 20, 2025 -

Nba Finals Game 6 Analysis Predicting A Thunder Win Or Pacers Comeback

Jun 20, 2025

Nba Finals Game 6 Analysis Predicting A Thunder Win Or Pacers Comeback

Jun 20, 2025 -

Spain Portugal Blackout Unveiling The Official Cause Of The Widespread Outage

Jun 20, 2025

Spain Portugal Blackout Unveiling The Official Cause Of The Widespread Outage

Jun 20, 2025 -

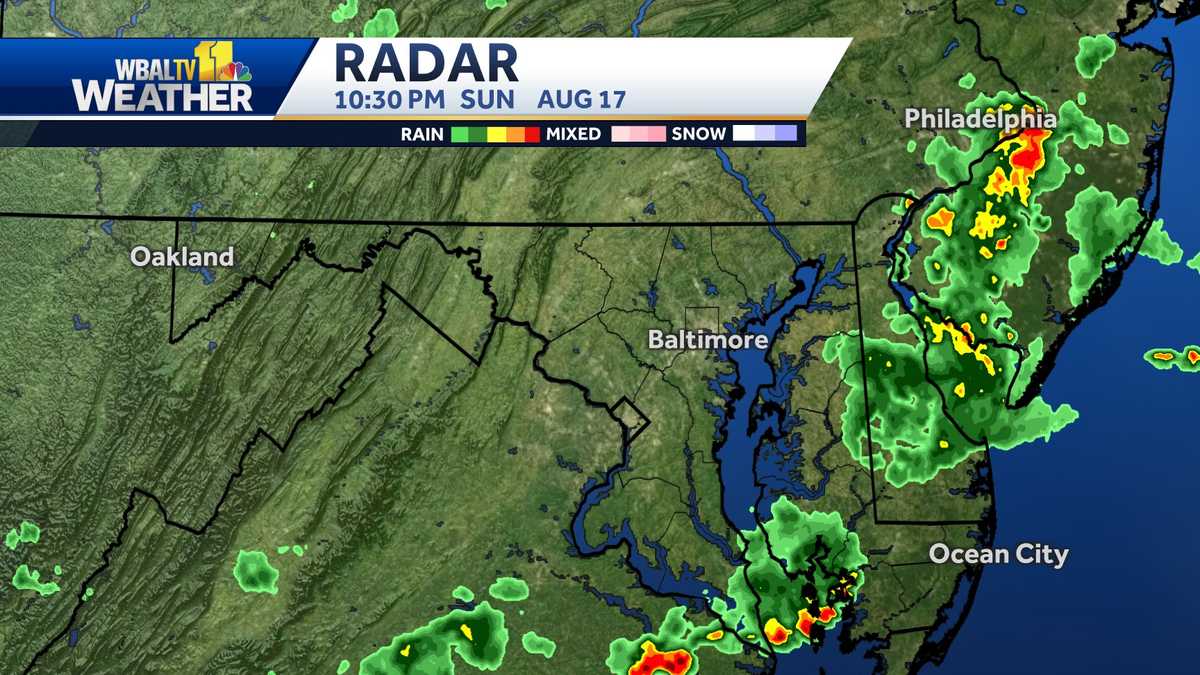

Severe Thunderstorm Warning Maryland Facing Second Wave Of Storms Tonight

Jun 20, 2025

Severe Thunderstorm Warning Maryland Facing Second Wave Of Storms Tonight

Jun 20, 2025

Latest Posts

-

Sheetz Expands Entertainment Offerings With New Partnership

Aug 20, 2025

Sheetz Expands Entertainment Offerings With New Partnership

Aug 20, 2025 -

A Lifetime Of Lenses Photographer Captures 17 000 Species

Aug 20, 2025

A Lifetime Of Lenses Photographer Captures 17 000 Species

Aug 20, 2025 -

Kevin Hart Seeks The Funniest A New Comedy Show Announced

Aug 20, 2025

Kevin Hart Seeks The Funniest A New Comedy Show Announced

Aug 20, 2025 -

China Condemns Swatch Ad Featuring Slanted Eyes Imagery

Aug 20, 2025

China Condemns Swatch Ad Featuring Slanted Eyes Imagery

Aug 20, 2025 -

Another Sheetz Surprise Concert Pittsburgh Saturday Ticket Guide

Aug 20, 2025

Another Sheetz Surprise Concert Pittsburgh Saturday Ticket Guide

Aug 20, 2025