Facing The Music: Social Security's 2034 Funding Challenge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing the Music: Social Security's 2034 Funding Challenge

The looming Social Security shortfall is no longer a distant threat; it's a rapidly approaching reality. By 2034, the Social Security Administration (SSA) projects its trust funds will be depleted, triggering potentially drastic benefit cuts unless significant action is taken. This isn't just a problem for future generations; current retirees and those nearing retirement are directly impacted by this impending crisis. Understanding the challenges and potential solutions is crucial for everyone.

What's the Problem?

The core issue lies in the changing demographics of the United States. As the baby boomer generation enters retirement, the number of beneficiaries receiving Social Security benefits is dramatically increasing, while the proportion of working-age individuals contributing to the system is shrinking. This imbalance, coupled with increased life expectancy, creates a significant strain on the system's financial sustainability.

- Increased Beneficiaries: Millions more Americans are drawing Social Security benefits each year, placing a greater demand on the existing funds.

- Decreased Contributors: The ratio of workers to retirees is declining, meaning fewer people are contributing to the system to support a growing number of recipients.

- Rising Healthcare Costs: Longer lifespans lead to higher healthcare expenses, indirectly impacting the financial needs of retirees and the overall burden on Social Security.

The 2034 Deadline: What Does it Mean?

The SSA projects that by 2034, the trust funds will be unable to cover 100% of scheduled benefits. This doesn't mean Social Security will immediately disappear. However, without reform, benefits could be cut by approximately 20%, a significant reduction for millions of Americans relying on Social Security for their retirement income. This potential cut would affect:

- Retirees: Current retirees would see a reduction in their monthly payments.

- Future Retirees: Individuals nearing retirement would receive lower benefits than initially projected.

- Disabled Individuals: Those receiving disability benefits would also experience a reduction.

Potential Solutions: A Difficult Balancing Act

Addressing the Social Security funding gap requires a multifaceted approach, and finding solutions that satisfy all stakeholders is a major political challenge. Some frequently discussed options include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full Social Security benefits.

- Increasing the Social Security Tax Rate: Slightly raising the payroll tax rate to generate more revenue for the system.

- Raising the Taxable Earnings Base: Increasing the maximum amount of earnings subject to Social Security taxes.

- Benefit Reductions (as projected): While a last resort, benefit reductions are a potential outcome if no other reforms are enacted.

- Investing Excess Funds: Exploring alternative investments to enhance the fund's return, while carefully mitigating risks.

What Can You Do?

Staying informed about Social Security reforms is crucial. Engage with your elected officials, urging them to prioritize finding sustainable solutions. Understand your own Social Security benefits and plan accordingly, considering potential adjustments based on the ongoing debates.

Looking Ahead: The Need for Urgent Action

The 2034 deadline is a stark reminder of the urgent need for comprehensive Social Security reform. Delaying action will only exacerbate the problem, making future solutions more difficult and potentially more drastic. The time for decisive action is now. Learn more about Social Security by visiting the official . Understanding the challenges and advocating for solutions is essential to securing the future of this vital social safety net.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing The Music: Social Security's 2034 Funding Challenge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serena Vs Venus Vs Navratilova A Deep Dive Into Their Grass Court Success Rates In The Wta

Jun 20, 2025

Serena Vs Venus Vs Navratilova A Deep Dive Into Their Grass Court Success Rates In The Wta

Jun 20, 2025 -

Transgender Rights Sotomayors Dissent Highlights Supreme Courts Controversial Ruling

Jun 20, 2025

Transgender Rights Sotomayors Dissent Highlights Supreme Courts Controversial Ruling

Jun 20, 2025 -

Princess Catherine Cancels Royal Ascot Appearance Official Statement Released

Jun 20, 2025

Princess Catherine Cancels Royal Ascot Appearance Official Statement Released

Jun 20, 2025 -

Karen Read Case Investigator Michael Proctor Breaks Silence In New Interview

Jun 20, 2025

Karen Read Case Investigator Michael Proctor Breaks Silence In New Interview

Jun 20, 2025 -

New Podcast Serena And Venus Williams Share Their Unfiltered Stories

Jun 20, 2025

New Podcast Serena And Venus Williams Share Their Unfiltered Stories

Jun 20, 2025

Latest Posts

-

Fishermans Mississippi River Find A 1967 Cold Case Reopened

Aug 18, 2025

Fishermans Mississippi River Find A 1967 Cold Case Reopened

Aug 18, 2025 -

Historic Pembrokeshire Fortress Thorne Islands 3m Makeover Unveiled

Aug 18, 2025

Historic Pembrokeshire Fortress Thorne Islands 3m Makeover Unveiled

Aug 18, 2025 -

Nico Landria Couples A Look Back At Reality Tv Romance

Aug 18, 2025

Nico Landria Couples A Look Back At Reality Tv Romance

Aug 18, 2025 -

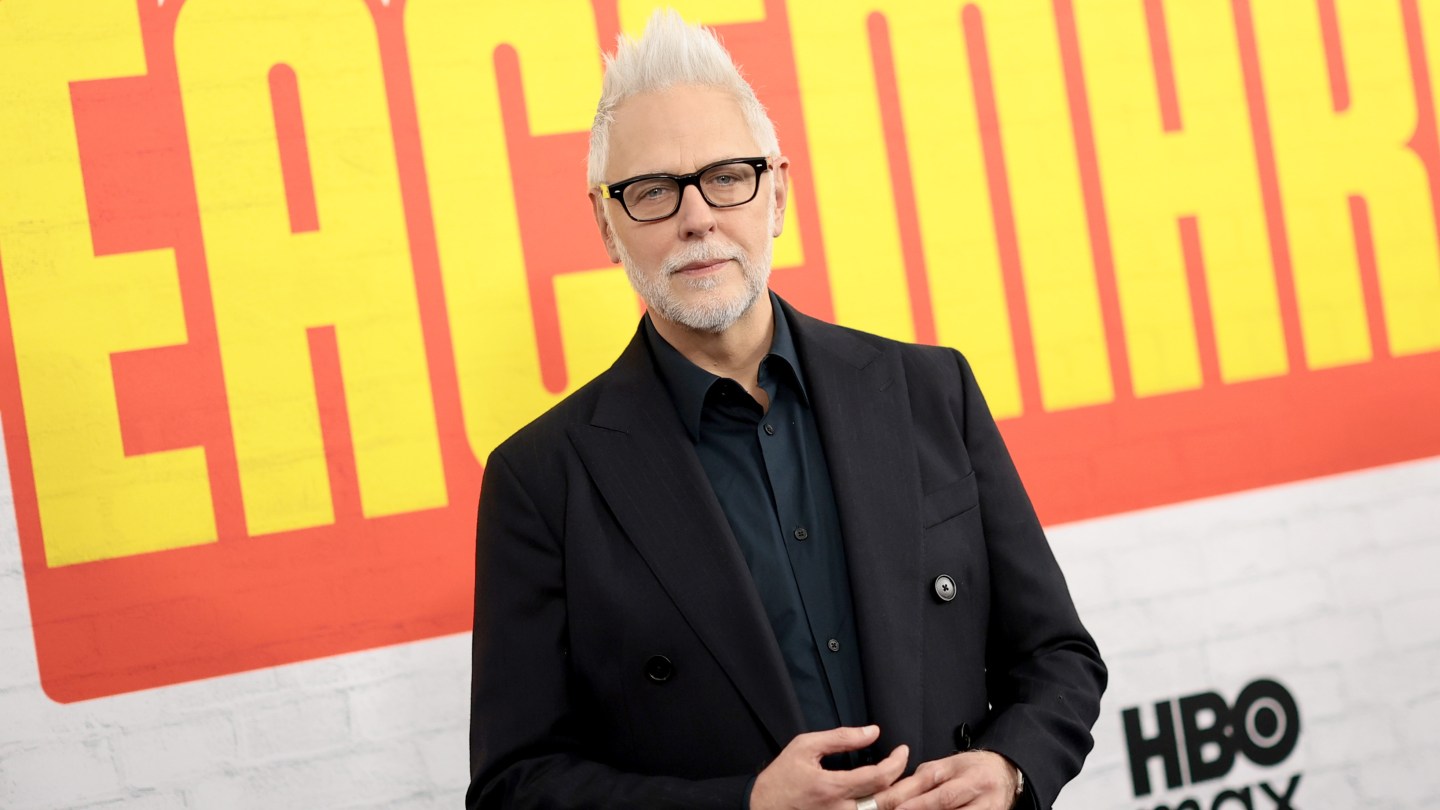

James Gunn Unveils New Details On Upcoming Superman Movie

Aug 18, 2025

James Gunn Unveils New Details On Upcoming Superman Movie

Aug 18, 2025 -

Dcus Future James Gunn Reveals Peacemakers Involvement And Supermans Status

Aug 18, 2025

Dcus Future James Gunn Reveals Peacemakers Involvement And Supermans Status

Aug 18, 2025