Facing A 2034 Social Security Crisis: Understanding The Potential Impact Of Congressional Inaction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing a 2034 Social Security Crisis: Understanding the Potential Impact of Congressional Inaction

The looming Social Security crisis of 2034 is no longer a distant threat; it's a rapidly approaching reality. Without decisive action from Congress, the program faces a significant shortfall, potentially impacting millions of retirees and future beneficiaries. Understanding the potential consequences of inaction is crucial for both policymakers and the American public.

What's the Problem?

The Social Security system, a cornerstone of American retirement security, funds itself primarily through payroll taxes. However, due to factors like increasing life expectancy and the aging baby boomer population, the system is projected to be unable to meet its full obligations by 2034. This means the Social Security Administration (SSA) may only be able to pay out approximately 80% of scheduled benefits without congressional intervention. This isn't a matter of the system going bankrupt; rather, it's a matter of reduced benefits for current and future retirees.

The Potential Impact of Congressional Inaction:

The impact of congressional inaction extends far beyond a simple 20% benefit reduction. Consider the following potential consequences:

-

Reduced Retirement Income: A 20% cut in benefits could push many retirees into poverty or financial hardship, especially those relying heavily on Social Security income. This would disproportionately affect low-income seniors and could lead to increased reliance on other social safety nets, potentially straining those resources as well.

-

Increased Financial Instability: For many Americans, Social Security is a crucial component of their retirement plan. A reduction in benefits could severely jeopardize their financial stability, leading to increased stress and a lower quality of life in retirement.

-

Strain on Healthcare System: Financial insecurity can significantly impact health outcomes. Reduced Social Security benefits could lead to delayed or forgone healthcare, putting further strain on an already overburdened healthcare system.

-

Economic Ripple Effects: The reduced spending power of retirees could have broader economic consequences, impacting businesses and the overall economy.

Proposed Solutions & Congressional Action:

Several solutions have been proposed to address the Social Security shortfall, including:

-

Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full Social Security benefits.

-

Increasing the Payroll Tax Cap: Expanding the amount of earnings subject to Social Security taxes.

-

Adjusting Benefit Formulas: Modifying the formulas used to calculate Social Security benefits.

-

Investing the Social Security Trust Fund: Exploring alternative investment strategies for the Social Security Trust Fund to generate higher returns.

Currently, bipartisan efforts are underway to find a solution, but reaching a consensus remains challenging. The longer Congress delays action, the more drastic the measures needed to address the impending shortfall will be.

What You Can Do:

Staying informed about the ongoing discussions surrounding Social Security reform is crucial. Contact your elected officials to express your concerns and encourage them to prioritize finding a sustainable solution. Consider exploring additional retirement savings options to supplement potential future reductions in Social Security benefits.

Keywords: Social Security, Social Security crisis, 2034, Congressional inaction, retirement benefits, retirement planning, Social Security reform, SSA, payroll tax, retirement income, financial stability, baby boomers, economic impact, bipartisan solutions.

Call to Action (subtle): Learn more about the Social Security system and the proposed solutions by visiting the official Social Security Administration website. Your informed participation is vital in shaping the future of this crucial program.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing A 2034 Social Security Crisis: Understanding The Potential Impact Of Congressional Inaction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

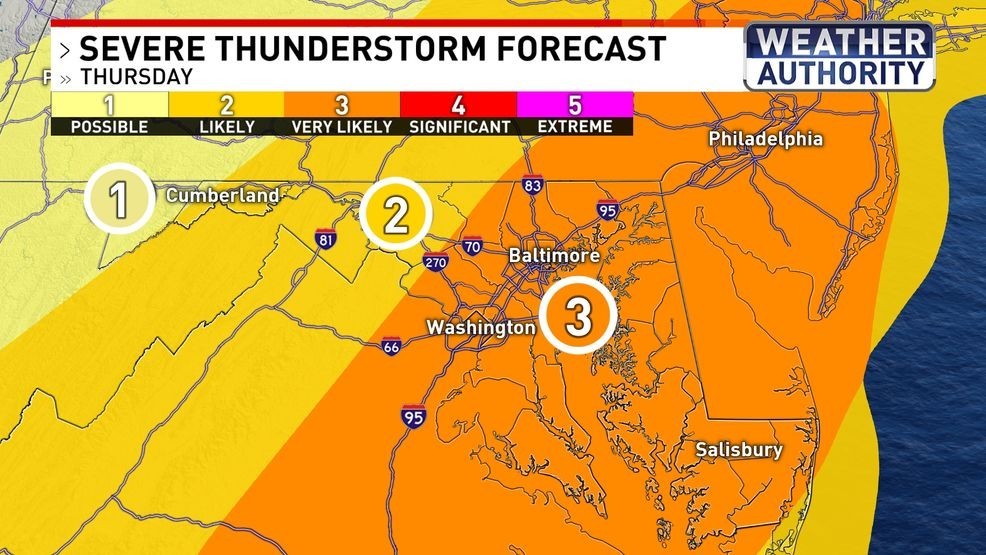

Take Action Now Severe Weather Alert Thursday Afternoon Storms

Jun 20, 2025

Take Action Now Severe Weather Alert Thursday Afternoon Storms

Jun 20, 2025 -

Rare Ntsb Bulletin Warns Of Potential Boeing 737 Max Engine Failures

Jun 20, 2025

Rare Ntsb Bulletin Warns Of Potential Boeing 737 Max Engine Failures

Jun 20, 2025 -

Karen Read Retrial Concludes Michael Proctors First Public Comments

Jun 20, 2025

Karen Read Retrial Concludes Michael Proctors First Public Comments

Jun 20, 2025 -

Navigating Change Liberty Post Leonie Fiebich

Jun 20, 2025

Navigating Change Liberty Post Leonie Fiebich

Jun 20, 2025 -

Tennis Icons Serena And Venus Williams Debut Podcast On Their Careers And Lives

Jun 20, 2025

Tennis Icons Serena And Venus Williams Debut Podcast On Their Careers And Lives

Jun 20, 2025

Latest Posts

-

Dramatic Comeback Orixs Ota Hits Crucial Grand Slam

Aug 18, 2025

Dramatic Comeback Orixs Ota Hits Crucial Grand Slam

Aug 18, 2025 -

New Orleans Mayor Faces Federal Charges Grand Jury Indictment Follows Years Long Corruption Investigation

Aug 18, 2025

New Orleans Mayor Faces Federal Charges Grand Jury Indictment Follows Years Long Corruption Investigation

Aug 18, 2025 -

Inside The Televerse How The Tv Academy Is Reimagining Emmy Celebrations

Aug 18, 2025

Inside The Televerse How The Tv Academy Is Reimagining Emmy Celebrations

Aug 18, 2025 -

New Lo L Champion Zaahen A Deep Dive Into Leaks And Rumors

Aug 18, 2025

New Lo L Champion Zaahen A Deep Dive Into Leaks And Rumors

Aug 18, 2025 -

Indian Research Reframes The Narrative On Mangoes And Diabetes Management

Aug 18, 2025

Indian Research Reframes The Narrative On Mangoes And Diabetes Management

Aug 18, 2025