Expert Predictions: Lucid Group (LCID) Stock Price To Hit $25.94?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expert Predictions: Could Lucid Group (LCID) Stock Price Hit $25.94?

Lucid Group (LCID) has been making waves in the electric vehicle (EV) market, but its stock price has experienced significant volatility. Recent predictions from several financial analysts suggest a potential surge, with some forecasting a price climb to $25.94. But is this realistic, and what factors could drive—or hinder—such growth? Let's delve into the details.

The Bull Case for Lucid:

Several factors contribute to the optimistic outlook for LCID stock. Analysts point to:

- Strong Product Line: Lucid's Air luxury sedan boasts impressive range and performance, attracting high-net-worth individuals and setting a benchmark for EV technology. This strong initial offering positions Lucid for future growth.

- Growing Production Capacity: Increased production capacity is crucial for any EV manufacturer. As Lucid ramps up its manufacturing capabilities, it's expected to meet growing demand and boost its revenue significantly.

- Government Incentives and Subsidies: Government support for the EV industry, including tax credits and subsidies, provides a considerable advantage to companies like Lucid. This financial backing can significantly impact profitability and stock valuation.

- Strategic Partnerships: Collaborations and partnerships can open up new markets and supply chains, reducing reliance on single sources and fostering expansion. Lucid's strategic moves in this area are being closely monitored by investors.

- Technological Innovation: Lucid's focus on cutting-edge battery technology and autonomous driving capabilities positions it as a leader in the EV race. Continuous innovation is crucial for maintaining a competitive edge.

Challenges Facing Lucid:

Despite the positive predictions, several challenges could impede Lucid's growth and affect its stock price:

- Competition: The EV market is becoming increasingly crowded, with established players like Tesla and new entrants constantly emerging. Intense competition can pressure pricing and profitability.

- Supply Chain Issues: The global chip shortage and other supply chain disruptions remain a significant concern, potentially hindering production and impacting financial performance.

- High Production Costs: Manufacturing EVs, especially luxury models, remains expensive. Lucid needs to efficiently manage costs to achieve profitability and compete effectively.

- Market Volatility: The overall market sentiment, including broader economic conditions, can significantly influence stock prices, irrespective of a company's fundamentals.

The $25.94 Prediction: Realistic or Overly Optimistic?

The prediction of LCID reaching $25.94 is certainly ambitious. While the factors favoring growth are substantial, the challenges are equally significant. Reaching this price target would depend on Lucid successfully navigating these challenges and exceeding expectations in production, sales, and technological advancements. It’s important to remember that stock market predictions are inherently uncertain, and this figure should be treated as one potential outcome among many.

What to Watch For:

Investors should closely monitor Lucid's upcoming financial reports, production updates, and announcements regarding new partnerships and technological breakthroughs. These updates will offer valuable insights into the company's progress and its potential to reach the predicted price target or even surpass it.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should consult with a qualified financial advisor before making any investment decisions. Always conduct your own thorough research before investing in any stock.

Keywords: Lucid Group, LCID, LCID stock, electric vehicle, EV, stock price prediction, stock market, investment, EV market, Tesla, luxury EV, stock forecast, financial analysis, market volatility, supply chain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expert Predictions: Lucid Group (LCID) Stock Price To Hit $25.94?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

170 Million Jewellery Scam Vashi Bosss Staff Impersonation Scheme Exposed

Sep 03, 2025

170 Million Jewellery Scam Vashi Bosss Staff Impersonation Scheme Exposed

Sep 03, 2025 -

Howard Sterns Controversial Return Cancelled Due To Family Emergency

Sep 03, 2025

Howard Sterns Controversial Return Cancelled Due To Family Emergency

Sep 03, 2025 -

Your Regions La Nina Winter Forecast Snow Cold Or Mild

Sep 03, 2025

Your Regions La Nina Winter Forecast Snow Cold Or Mild

Sep 03, 2025 -

Colorado Airport Plane Crash One Killed Three Injured In Mid Air Collision

Sep 03, 2025

Colorado Airport Plane Crash One Killed Three Injured In Mid Air Collision

Sep 03, 2025 -

Howard Sterns Radio Return Uncertain After Family Emergency Cancels Plans

Sep 03, 2025

Howard Sterns Radio Return Uncertain After Family Emergency Cancels Plans

Sep 03, 2025

Latest Posts

-

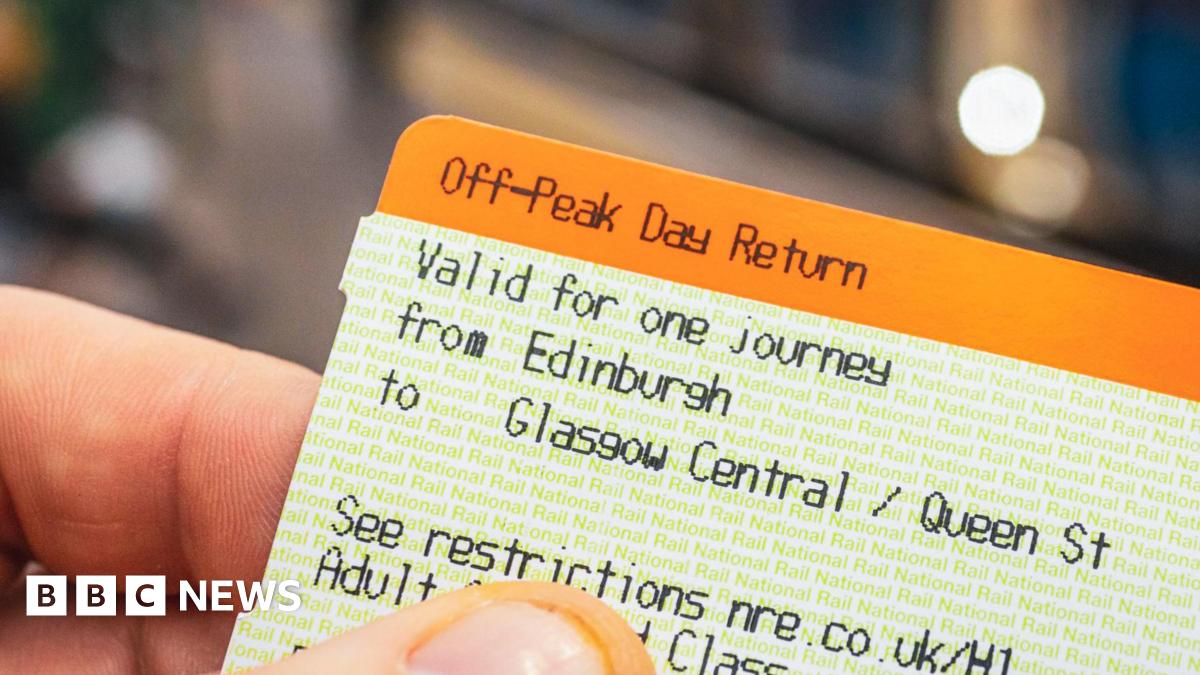

Permanent Fare Changes Scot Rail Scraps Peak Time Pricing

Sep 03, 2025

Permanent Fare Changes Scot Rail Scraps Peak Time Pricing

Sep 03, 2025 -

Lucid Group Lcid Stock Forecast 25 94 Average Broker Target Price

Sep 03, 2025

Lucid Group Lcid Stock Forecast 25 94 Average Broker Target Price

Sep 03, 2025 -

Asylum Reforms New Restrictions On Family Reunification

Sep 03, 2025

Asylum Reforms New Restrictions On Family Reunification

Sep 03, 2025 -

E Bay Labor Day Sale Top Deal On Lg C5 4 K Oled Tv 2025 Model

Sep 03, 2025

E Bay Labor Day Sale Top Deal On Lg C5 4 K Oled Tv 2025 Model

Sep 03, 2025 -

Colorado Airport Plane Crash One Killed Three Injured In Mid Air Collision

Sep 03, 2025

Colorado Airport Plane Crash One Killed Three Injured In Mid Air Collision

Sep 03, 2025