Expected Rise In U.S. Consumer Prices Confirmed: June Inflation Data Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expected Rise in U.S. Consumer Prices Confirmed: June Inflation Data Analyzed

The U.S. saw a concerning rise in consumer prices in June, confirming economists' predictions and further fueling anxieties about persistent inflation. The latest data, released by the Bureau of Labor Statistics (BLS), reveals a stubborn inflation rate that continues to challenge the Federal Reserve's efforts to cool down the economy. This jump underscores the ongoing struggle Americans face with rising costs for everyday essentials.

Key Takeaways from the June Inflation Report:

- CPI Increase: The Consumer Price Index (CPI) rose by [Insert Percentage Here]% in June, exceeding market expectations of [Insert Percentage Here]%. This marks a [Increase/Decrease] compared to May's [Insert Percentage Here]% increase.

- Core Inflation: Core inflation, which excludes volatile food and energy prices, also saw an increase of [Insert Percentage Here]%, indicating broad-based price pressures across the economy. This persistent core inflation is a significant concern for policymakers.

- Shelter Costs: A major driver of the June inflation surge was the continued rise in shelter costs, reflecting increasing rental prices and homeownership expenses. This sector continues to be a significant contributor to overall inflation.

- Food Prices: Food prices remain elevated, contributing significantly to the overall CPI increase. Specific food categories like [mention specific examples e.g., eggs, meat] saw particularly sharp price jumps.

- Energy Prices: While energy prices showed some fluctuation in June, their overall impact on inflation remains significant. [Mention specific energy price trends, e.g., gasoline prices].

What Does This Mean for Consumers?

The persistent rise in consumer prices directly impacts American households. Higher prices for groceries, housing, and transportation eat into disposable income, forcing families to make difficult choices and potentially delaying major purchases. This sustained inflationary pressure continues to erode purchasing power.

The Federal Reserve's Response:

The Federal Reserve (Fed) is expected to closely monitor this data and consider further interest rate hikes to combat inflation. The Fed's goal is to slow down economic growth and reduce demand, thereby curbing price increases. However, aggressive rate hikes also carry the risk of triggering a recession. The delicate balancing act faced by the Fed is a key factor shaping the economic outlook for the remainder of the year. [Link to a relevant article about the Fed's recent actions or statements].

Looking Ahead:

The June inflation figures solidify concerns about the persistence of inflation. Economists will be closely analyzing upcoming economic indicators to gauge the effectiveness of the Fed's monetary policy and predict future inflation trends. The coming months will be crucial in determining whether the current inflationary pressures begin to ease or continue their upward trajectory. Factors such as supply chain disruptions, global geopolitical events, and consumer demand will all play a critical role in shaping the economic landscape. [Link to an article predicting future inflation rates].

Further Research and Resources:

- Bureau of Labor Statistics (BLS): [Link to BLS website] – Access the full June inflation report and related data.

- Federal Reserve: [Link to Federal Reserve website] – Stay updated on the Fed's monetary policy and economic projections.

Call to Action: Stay informed about economic developments by regularly checking reputable news sources and government websites for updates on inflation and economic policy. Understanding the economic climate can help you make informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expected Rise In U.S. Consumer Prices Confirmed: June Inflation Data Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Zohran Mamdani Reaching Out To Police Investigation Underway

Sep 01, 2025

Zohran Mamdani Reaching Out To Police Investigation Underway

Sep 01, 2025 -

The Moral And Economic Failures Of Trumps Immigration Policy A Krugman Analysis

Sep 01, 2025

The Moral And Economic Failures Of Trumps Immigration Policy A Krugman Analysis

Sep 01, 2025 -

Streaming Success Mel Gibsons 52 Rotten Tomatoes Movie Finds Audience

Sep 01, 2025

Streaming Success Mel Gibsons 52 Rotten Tomatoes Movie Finds Audience

Sep 01, 2025 -

Showmans Desperate Plea Eviction Threatens Family Home

Sep 01, 2025

Showmans Desperate Plea Eviction Threatens Family Home

Sep 01, 2025 -

Jalen Coker Injury Update Panthers Wr To Miss Significant Time

Sep 01, 2025

Jalen Coker Injury Update Panthers Wr To Miss Significant Time

Sep 01, 2025

Latest Posts

-

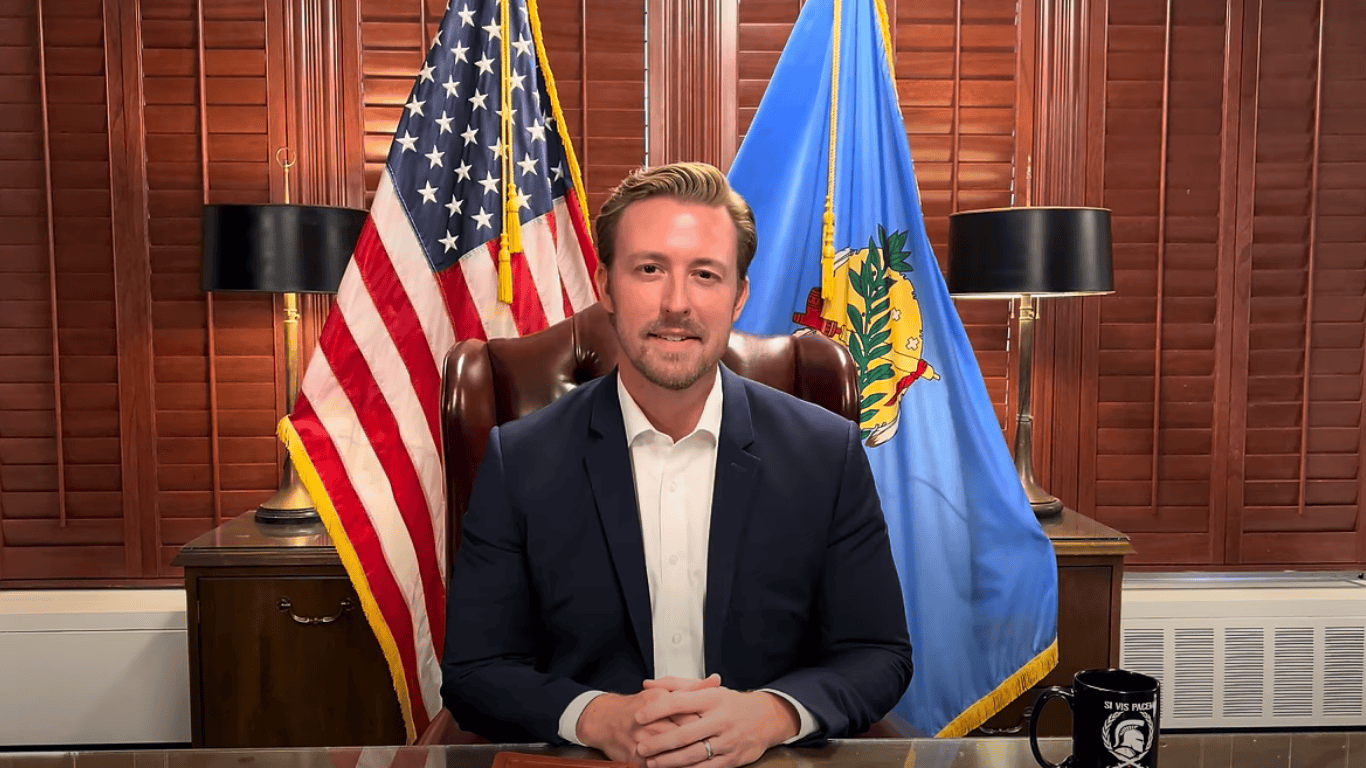

Ryan Walters Influence Prager Us New Teacher Assessment Sparks Debate

Sep 01, 2025

Ryan Walters Influence Prager Us New Teacher Assessment Sparks Debate

Sep 01, 2025 -

Nba Analyst Patrick Beverley Weighs In Durant Dominates Over Bird

Sep 01, 2025

Nba Analyst Patrick Beverley Weighs In Durant Dominates Over Bird

Sep 01, 2025 -

Oklahomas America First Teacher Certification Exam Questions Unveiled By Prager U

Sep 01, 2025

Oklahomas America First Teacher Certification Exam Questions Unveiled By Prager U

Sep 01, 2025 -

Yemen In Turmoil Houthi Prime Minister Dies After Airstrike

Sep 01, 2025

Yemen In Turmoil Houthi Prime Minister Dies After Airstrike

Sep 01, 2025 -

Ted Lasso Actress Involved In Violent Incident After Boyfriend Discovers Infidelity

Sep 01, 2025

Ted Lasso Actress Involved In Violent Incident After Boyfriend Discovers Infidelity

Sep 01, 2025