Expected Rise In U.S. Consumer Prices Confirmed By June Inflation Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expected Rise in U.S. Consumer Prices Confirmed by June Inflation Data: What it Means for You

The U.S. Bureau of Labor Statistics (BLS) confirmed the anticipated increase in consumer prices for June, releasing data that paints a complex picture of the ongoing battle against inflation. While the headline inflation number showed a slight moderation, underlying price pressures remain stubbornly persistent, raising concerns about the Federal Reserve's next steps and the impact on American households.

June Inflation Numbers: A Closer Look

The Consumer Price Index (CPI) for June rose 0.2%, slightly lower than the 0.3% increase predicted by economists. This marks a slowdown from the 0.4% increase in May. However, the year-over-year increase remained elevated at 3%, exceeding expectations of 2.9%. This persistent year-over-year inflation underscores the challenges facing the Federal Reserve in its efforts to bring inflation down to its 2% target.

The core CPI, which excludes volatile food and energy prices, also saw a modest increase of 0.2%, in line with forecasts. The year-over-year core inflation rate rose to 4.8%, slightly higher than the anticipated 4.7%. This continued rise in core inflation suggests that inflationary pressures are not solely driven by temporary factors, but are becoming increasingly entrenched in the economy.

Key Drivers of Inflation:

Several factors continue to contribute to the persistent inflation:

- Shelter Costs: Housing remains a significant driver of inflation, with rent and owners' equivalent rent continuing to climb. This reflects the ongoing tightness in the housing market and increased demand.

- Sticky Services Inflation: Inflation in services, excluding housing, also remains elevated. This sector is proving more resistant to cooling down, potentially indicating a stronger wage-price spiral.

- Supply Chain Disruptions: While easing, lingering supply chain bottlenecks in certain sectors continue to impact prices.

- Strong Consumer Demand: Robust consumer spending continues to fuel demand-pull inflation, putting upward pressure on prices.

What the Data Means for the Federal Reserve:

The June inflation data complicates the Federal Reserve's decision-making process. While the slight moderation in the headline inflation rate provides some cause for optimism, the persistent upward pressure from core inflation and other factors suggests that further interest rate hikes might be on the horizon. The Fed will carefully weigh the risks of further tightening monetary policy against the potential for triggering a recession. [Link to Federal Reserve website]

Impact on American Households:

The sustained inflation continues to impact American households, squeezing budgets and reducing purchasing power. Rising costs for essential goods and services, particularly housing, food, and energy, are forcing many families to make difficult financial choices. [Link to article about budgeting during inflation]

Looking Ahead:

The fight against inflation is far from over. The coming months will be crucial in determining the effectiveness of the Federal Reserve's monetary policy and the overall trajectory of inflation. Continued monitoring of economic indicators, particularly employment data and consumer spending, will be essential in assessing the outlook.

Call to Action: Stay informed about economic developments by following reputable financial news sources and consulting with financial advisors to make informed decisions about your personal finances. Understanding the current inflationary landscape is crucial for navigating the economic climate effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expected Rise In U.S. Consumer Prices Confirmed By June Inflation Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Palantir Stock Drop Amidst Broader Chip Sector Weakness And Political Headwinds

Aug 22, 2025

Palantir Stock Drop Amidst Broader Chip Sector Weakness And Political Headwinds

Aug 22, 2025 -

Jon Stewarts Powerful Take Down Confronting The Maga World On Trumps Legacy

Aug 22, 2025

Jon Stewarts Powerful Take Down Confronting The Maga World On Trumps Legacy

Aug 22, 2025 -

Hotel Closures And Celebrity News Top Stories Of The Day

Aug 22, 2025

Hotel Closures And Celebrity News Top Stories Of The Day

Aug 22, 2025 -

200 000 Jackpot Winning Lottery Ticket Sold In Darlington

Aug 22, 2025

200 000 Jackpot Winning Lottery Ticket Sold In Darlington

Aug 22, 2025 -

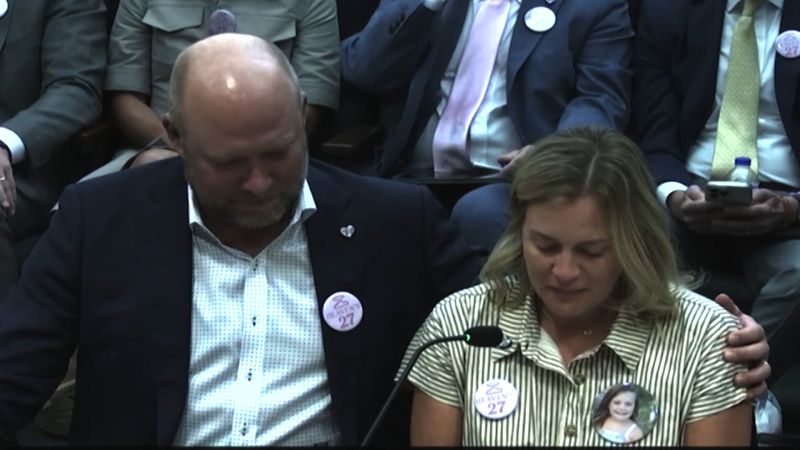

Devastating Camp Mystic Flood Parents Share Childrens Experiences

Aug 22, 2025

Devastating Camp Mystic Flood Parents Share Childrens Experiences

Aug 22, 2025

Latest Posts

-

The Rise And Fall And Rise Of A Cowboy Builder A Case Study In Construction Fraud

Aug 22, 2025

The Rise And Fall And Rise Of A Cowboy Builder A Case Study In Construction Fraud

Aug 22, 2025 -

Menendez Brothers Seek Parole Will They Be Released After 30 Years

Aug 22, 2025

Menendez Brothers Seek Parole Will They Be Released After 30 Years

Aug 22, 2025 -

Inflation Holds Steady U S Consumer Price Index Up In June

Aug 22, 2025

Inflation Holds Steady U S Consumer Price Index Up In June

Aug 22, 2025 -

Ethical Concerns Raised Doj Advisers Dismissal Under Pam Bondi

Aug 22, 2025

Ethical Concerns Raised Doj Advisers Dismissal Under Pam Bondi

Aug 22, 2025 -

What Penn State Coaches And Players Are Saying After Preseason Camp

Aug 22, 2025

What Penn State Coaches And Players Are Saying After Preseason Camp

Aug 22, 2025