Expected June Increase In U.S. Consumer Prices Confirmed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expected June Increase in U.S. Consumer Prices Confirmed: Inflation Remains a Concern

The U.S. Bureau of Labor Statistics (BLS) confirmed today what many economists had predicted: a noticeable increase in consumer prices for June. This latest inflation report fuels ongoing concerns about the strength and longevity of the current economic recovery and the Federal Reserve's next steps in managing interest rates. The numbers paint a complex picture, demanding a closer look at the contributing factors and their potential impact on American households.

Headline Inflation Rises, Exceeding Expectations

The Consumer Price Index (CPI) for June rose 0.2%, exceeding the 0.1% increase predicted by many analysts. This brings the annual inflation rate to 3.0%, up from 4.0% in May, but still significantly above the Federal Reserve's 2% target. While the year-over-year rate shows a decrease, the month-to-month increase indicates that inflation remains stubbornly persistent. This sustained inflationary pressure continues to erode purchasing power for many Americans.

Core Inflation Shows Similar Trend

Examining core inflation, which excludes volatile food and energy prices, provides a clearer picture of underlying inflationary pressures. Core CPI increased by 0.2% in June, mirroring the headline inflation figure. This suggests that price increases are broadening across the economy and aren't solely driven by fluctuations in energy costs or food prices. The persistence of core inflation indicates that the battle against inflation is far from over.

Key Factors Driving June's Price Increases

Several factors contributed to the June increase in consumer prices. Shelter costs, a major component of the CPI, continued their upward trend, reflecting persistent high rents and home prices. Used car prices also saw a modest increase, while energy prices remained relatively stable compared to previous months. However, the broad-based increase in core inflation suggests that numerous sectors are experiencing price pressures.

The Federal Reserve's Response and Future Outlook

The latest inflation data adds complexity to the Federal Reserve's ongoing efforts to manage inflation. While the slowing year-over-year rate is encouraging, the persistent month-to-month increases suggest that further interest rate hikes remain a possibility. The Federal Open Market Committee (FOMC) will carefully analyze this data, along with other economic indicators, to determine its next move. The market is now closely watching for any signs of a potential pivot from the Fed, balancing the need to curb inflation with the risk of triggering a recession.

What This Means for Consumers

For consumers, the continued inflationary pressures mean continued uncertainty. Planning budgets and managing expenses will remain crucial as prices for essential goods and services continue to fluctuate. It's essential to remain informed about economic trends and adjust spending habits accordingly. Tools like budgeting apps and financial planning resources can help individuals navigate these challenging economic times. [Link to budgeting resource website]

Conclusion: Inflation Remains a Dynamic Situation

The June CPI report confirms that inflation, while easing from its peak, remains a significant economic concern. The persistent upward pressure on prices, particularly in core inflation, warrants close monitoring. The Federal Reserve's response, and the subsequent impact on interest rates and the broader economy, will continue to shape the financial landscape in the coming months. Staying informed about economic developments and adjusting financial strategies accordingly is crucial for both individuals and businesses alike. This situation requires continued vigilance and proactive financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expected June Increase In U.S. Consumer Prices Confirmed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Immigrant And Bystander Rights During Ice Enforcement Actions

Aug 25, 2025

Immigrant And Bystander Rights During Ice Enforcement Actions

Aug 25, 2025 -

Ai Slop Investigating The Mystery Of Unauthorized Music Releases Using Ai

Aug 25, 2025

Ai Slop Investigating The Mystery Of Unauthorized Music Releases Using Ai

Aug 25, 2025 -

Crystal Palace Nottingham Forest Match Preview And Prediction By Chris Sutton

Aug 25, 2025

Crystal Palace Nottingham Forest Match Preview And Prediction By Chris Sutton

Aug 25, 2025 -

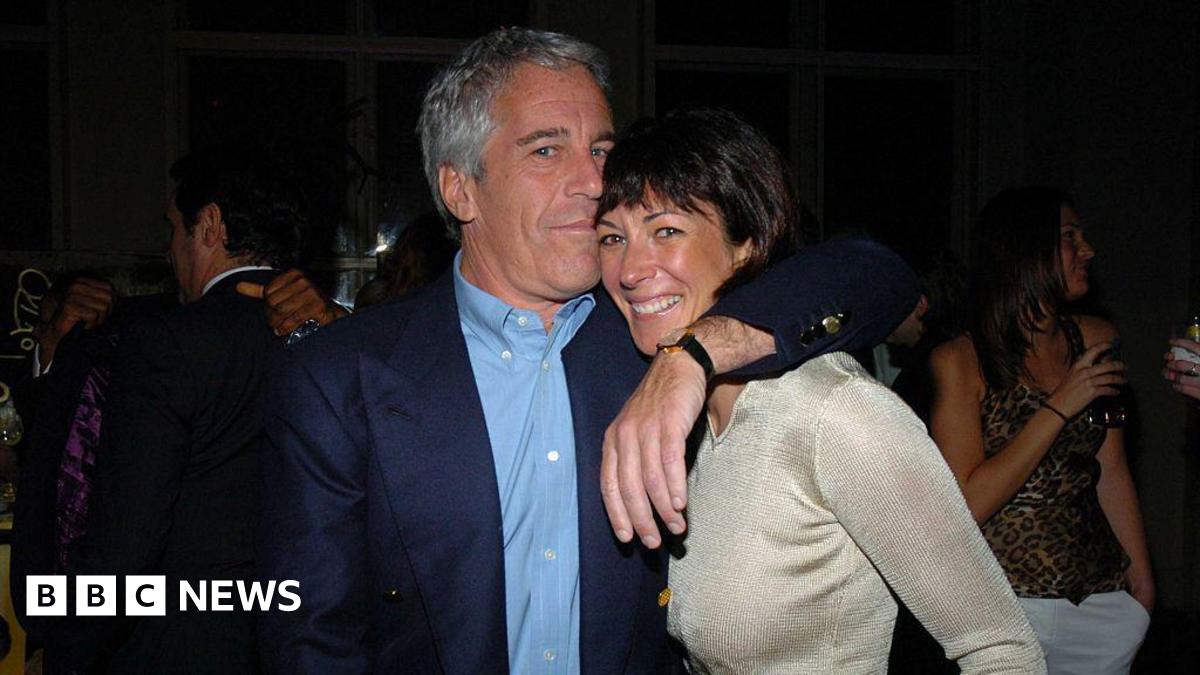

Us Justice Department Unveils Ghislaine Maxwell Interview Documents

Aug 25, 2025

Us Justice Department Unveils Ghislaine Maxwell Interview Documents

Aug 25, 2025 -

Excel Parking Firm To Pay 10 240 After Failed Appeal

Aug 25, 2025

Excel Parking Firm To Pay 10 240 After Failed Appeal

Aug 25, 2025

Latest Posts

-

Trumps Immigration Policy Krugman Highlights Its Central Flaw And Inhumanity

Aug 25, 2025

Trumps Immigration Policy Krugman Highlights Its Central Flaw And Inhumanity

Aug 25, 2025 -

Review Chappell Roans Fairytale Inspired Reading Festival Show

Aug 25, 2025

Review Chappell Roans Fairytale Inspired Reading Festival Show

Aug 25, 2025 -

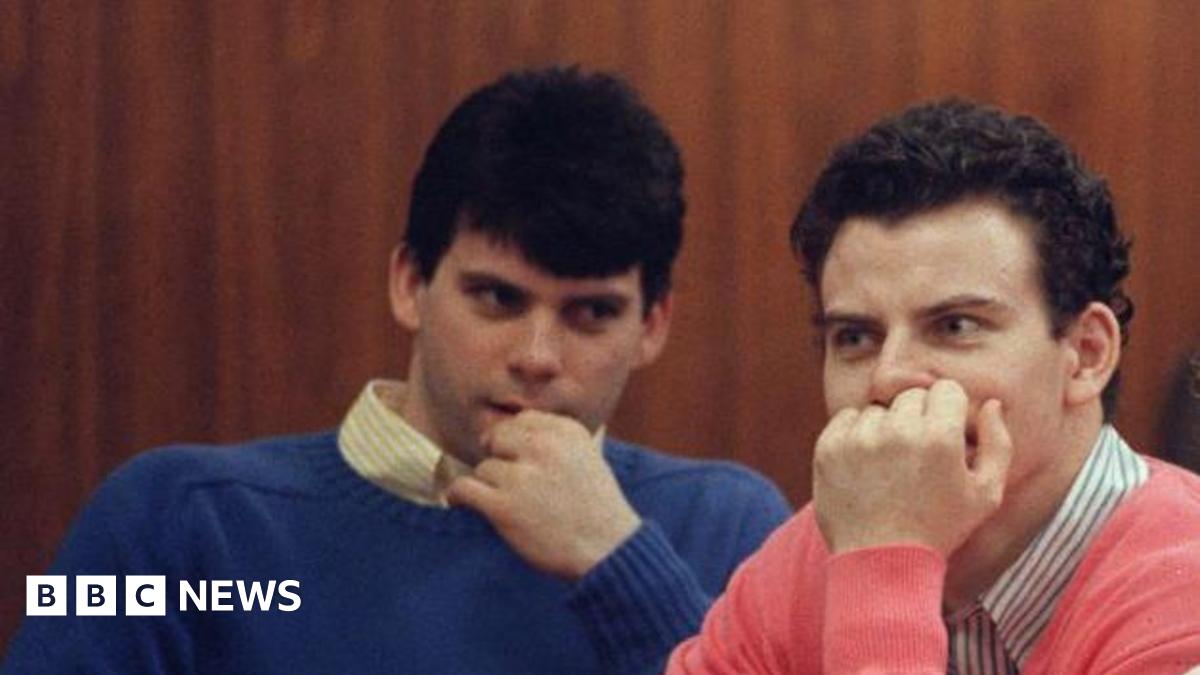

Menendez Brothers A Comprehensive Overview Of The Case And Future Prospects

Aug 25, 2025

Menendez Brothers A Comprehensive Overview Of The Case And Future Prospects

Aug 25, 2025 -

Following The Trail A Reporters Account Of An Ice Arrest And Its Aftermath

Aug 25, 2025

Following The Trail A Reporters Account Of An Ice Arrest And Its Aftermath

Aug 25, 2025 -

Septa Route 12 Bus Discontinuation Impact On Riders

Aug 25, 2025

Septa Route 12 Bus Discontinuation Impact On Riders

Aug 25, 2025