Expected Inflation Confirmed: U.S. Consumer Prices Rise In June

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expected Inflation Confirmed: U.S. Consumer Prices Rise in June

Inflation remains a persistent concern as the Consumer Price Index (CPI) reports a continued increase in June, solidifying expectations and raising questions about the Federal Reserve's next move. The latest data released by the Bureau of Labor Statistics (BLS) confirms a steady climb in consumer prices, fueling ongoing debates about the strength of the U.S. economy and the potential for further interest rate hikes.

The headline CPI figure for June showed a modest increase, aligning with analyst predictions. However, the underlying details reveal a more complex picture, with certain sectors exhibiting stronger inflationary pressures than others. Understanding these nuances is crucial for both consumers and investors navigating this persistent economic challenge.

Deeper Dive into the June CPI Report

The BLS report revealed a [insert specific percentage change] increase in the CPI for June, following a [insert previous month's percentage change] rise in May. While this represents a [describe the rate of change – slowing, accelerating, etc.], it continues the trend of inflation remaining above the Federal Reserve's target rate of 2%.

Several key factors contributed to the June inflation figures:

- Energy Prices: Energy costs played a significant role, with [explain the specific impact of energy prices – e.g., gasoline prices increasing, etc.]. This volatility in energy prices often creates ripple effects across the economy.

- Food Prices: Food prices also continued to climb, impacting household budgets. [Explain specific food categories showing significant price increases]. This ongoing pressure on food costs is a major concern for many families.

- Shelter Costs: Shelter costs, a significant component of the CPI, remain elevated. [Explain the current state of the housing market and its contribution to inflation]. The persistent rise in rental costs continues to contribute substantially to overall inflation.

- Core Inflation: Core inflation, which excludes volatile food and energy prices, [explain the movement of core inflation – increasing, decreasing, stabilizing, etc.]. This metric provides a clearer picture of underlying inflationary pressures within the economy.

The Federal Reserve's Response and Future Outlook

The June CPI report will undoubtedly influence the Federal Reserve's upcoming monetary policy decisions. Economists are closely watching for indications of whether the central bank will opt for another interest rate hike in its efforts to curb inflation. [Insert expert opinion on the likely Fed response and its potential impact on the economy]. The possibility of further rate hikes raises concerns about potential negative consequences for economic growth.

What does this mean for consumers? The persistent inflation means consumers should expect to continue facing higher prices for essential goods and services. Careful budgeting, comparison shopping, and exploring ways to reduce expenses remain crucial strategies for navigating this economic climate.

Looking Ahead: The coming months will be crucial in determining the trajectory of inflation. The impact of recent interest rate hikes, supply chain dynamics, and global economic conditions will all play a significant role in shaping the inflation outlook. Continued monitoring of economic indicators like the CPI is essential for understanding the evolving economic landscape.

Learn More: For further details on the June CPI report, visit the Bureau of Labor Statistics website: [Insert BLS Website Link]. You can also stay informed about economic trends by following reputable financial news sources.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expected Inflation Confirmed: U.S. Consumer Prices Rise In June. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Political Showdown Schwarzenegger Vs Newsom Over Californias Redistricting

Aug 16, 2025

Political Showdown Schwarzenegger Vs Newsom Over Californias Redistricting

Aug 16, 2025 -

Affordable Chic How Brittany Snow Styles Her Favorite 25 Home Fragrance

Aug 16, 2025

Affordable Chic How Brittany Snow Styles Her Favorite 25 Home Fragrance

Aug 16, 2025 -

Brittany Snows Affordable Home Fragrance Choice Scent Layering And Blending Tips

Aug 16, 2025

Brittany Snows Affordable Home Fragrance Choice Scent Layering And Blending Tips

Aug 16, 2025 -

Actress Brittany Snows Favorite Home Fragrance Details And Where To Buy

Aug 16, 2025

Actress Brittany Snows Favorite Home Fragrance Details And Where To Buy

Aug 16, 2025 -

Taylor Swifts Showgirl Era A Style Evolution

Aug 16, 2025

Taylor Swifts Showgirl Era A Style Evolution

Aug 16, 2025

Latest Posts

-

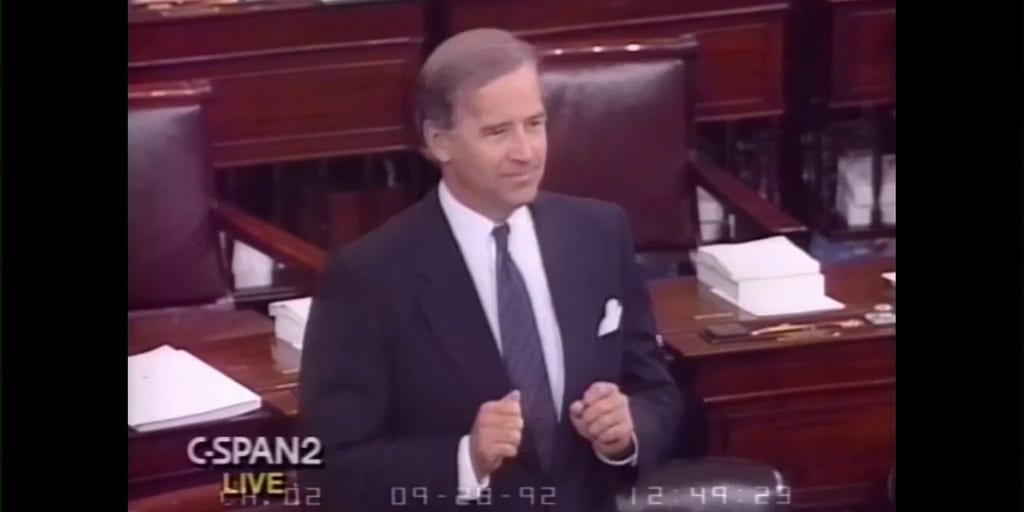

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025