CRWV Stock: $95 Debt Risk Weighs On CoreWeave's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CRWV Stock: $95 Billion Debt Risk Weighs on CoreWeave's Future

CoreWeave's rapid ascent in the cloud computing market is facing a significant headwind: a staggering $95 billion in potential debt. This looming financial burden is casting a long shadow over CRWV stock, leaving investors questioning the company's long-term viability. While CoreWeave boasts impressive technology and a growing client base, the sheer scale of this potential debt liability presents a considerable risk. This article delves into the details, examining the implications for investors and the future of the company.

CoreWeave: A High-Growth, High-Risk Investment

CoreWeave has rapidly established itself as a major player in the cloud computing sector, leveraging its specialized infrastructure for AI and high-performance computing. This rapid growth, however, has been fueled by significant investment, leading to the concerning potential debt figure. The company's innovative approach to using repurposed GPUs for its cloud services has attracted considerable attention and high-profile clients. But the question remains: can this impressive technology withstand the pressure of such substantial potential debt?

Understanding the $95 Billion Debt Risk

The $95 billion figure isn't a current debt load; rather, it represents a potential liability tied to CoreWeave's financing structure. Much of CoreWeave's growth has been fueled by private equity and venture capital, often involving convertible debt instruments. These instruments can convert into equity under certain circumstances, potentially diluting existing shareholders and significantly increasing the company's overall debt burden. The precise trigger points for this conversion are complex and depend on various factors, including CoreWeave's performance and market conditions. This uncertainty is a major source of anxiety for investors.

Impact on CRWV Stock Price

The potential for massive debt conversion is directly impacting CRWV stock's price volatility. Investors are understandably cautious, leading to price fluctuations and making it a high-risk investment. While the company's innovative technology and market position are positive factors, the uncertainty surrounding the debt situation overshadows these positives for many. This creates a challenging environment for both short-term and long-term investors.

What to Watch For:

- Debt Conversion Triggers: Closely monitoring news regarding the specific conditions that could trigger the conversion of convertible debt to equity is crucial.

- Financial Performance: CoreWeave's financial reports will be under intense scrutiny. Strong revenue growth and profitability will help alleviate investor concerns.

- Market Conditions: The overall market environment will also play a significant role. A downturn in the tech sector could exacerbate the debt concerns.

Is CRWV Stock a Buy, Sell, or Hold?

This is a complex question with no easy answer. The potential for massive debt conversion presents a significant risk, making it a high-risk, high-reward investment. Investors with a high tolerance for risk and a long-term horizon might consider it, while more risk-averse investors might want to proceed with caution or look for alternative opportunities in the cloud computing sector. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Further Reading:

Disclaimer: This article provides informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CRWV Stock: $95 Debt Risk Weighs On CoreWeave's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jennifer Aniston Reese Witherspoon And Marion Cotillard A Trio Of Stars At The Morning Show Premiere

Sep 11, 2025

Jennifer Aniston Reese Witherspoon And Marion Cotillard A Trio Of Stars At The Morning Show Premiere

Sep 11, 2025 -

Official Reveal Mega Malamar In Pokemon Legends Arceus New Trailer Analysis

Sep 11, 2025

Official Reveal Mega Malamar In Pokemon Legends Arceus New Trailer Analysis

Sep 11, 2025 -

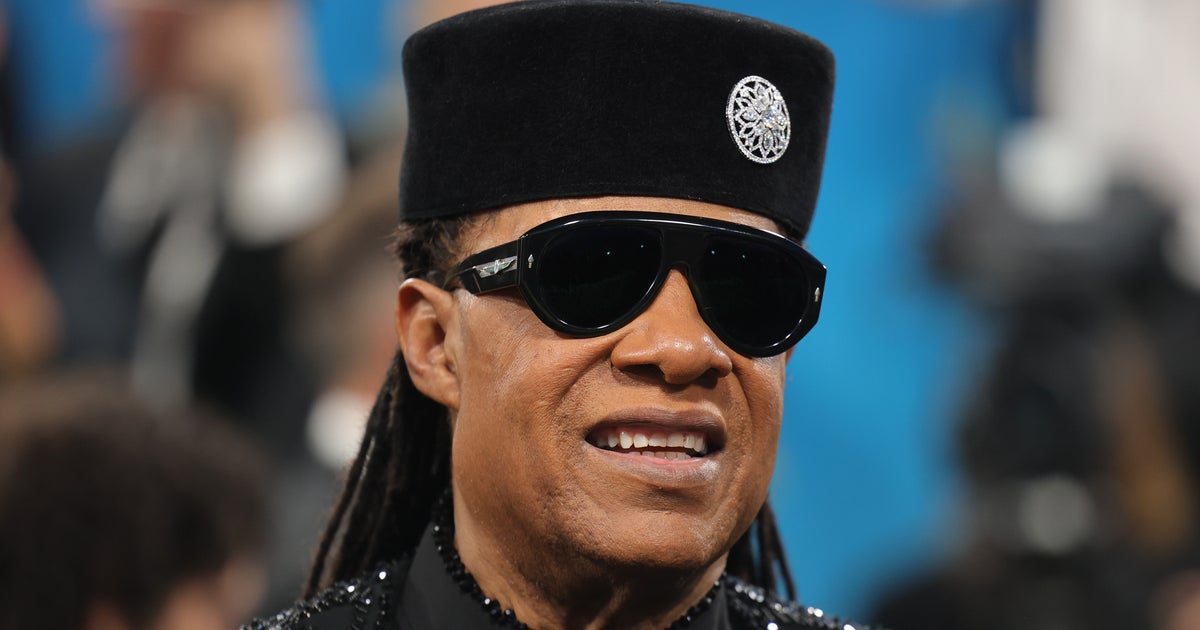

Rumor Debunked Stevie Wonder Speaks Out About His Sight

Sep 11, 2025

Rumor Debunked Stevie Wonder Speaks Out About His Sight

Sep 11, 2025 -

Asylum Hotels Spark Outrage Local Residents Demand Action Propose Shared Housing Model

Sep 11, 2025

Asylum Hotels Spark Outrage Local Residents Demand Action Propose Shared Housing Model

Sep 11, 2025 -

Karoline Leavitts My Own Two Eyes And Trump A Controversial Claim And Its Repercussions

Sep 11, 2025

Karoline Leavitts My Own Two Eyes And Trump A Controversial Claim And Its Repercussions

Sep 11, 2025

Latest Posts

-

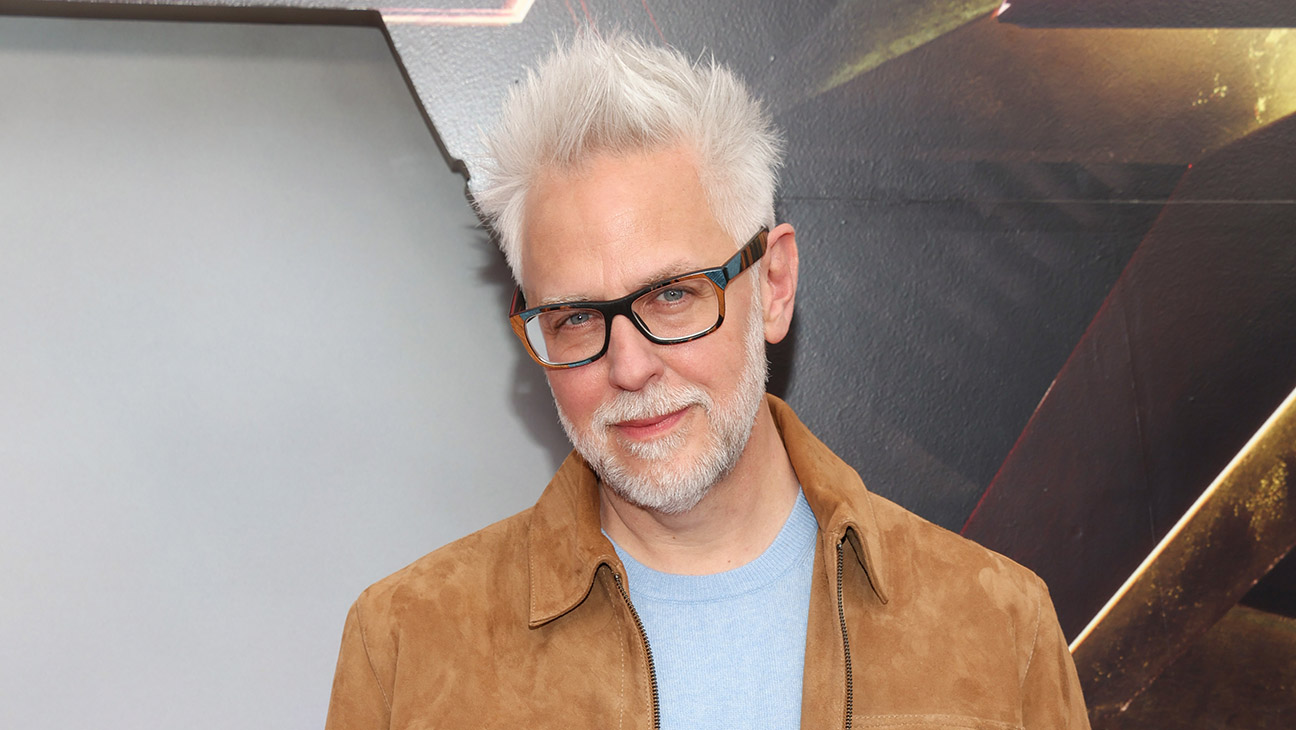

James Gunns Man Of Tomorrow A New Chapter For Superman

Sep 11, 2025

James Gunns Man Of Tomorrow A New Chapter For Superman

Sep 11, 2025 -

Alex Winters Reflections On Life Beyond Bill And Ted

Sep 11, 2025

Alex Winters Reflections On Life Beyond Bill And Ted

Sep 11, 2025 -

Heartland On Netflix Jessica Chastain In A Tense Country Music Thriller

Sep 11, 2025

Heartland On Netflix Jessica Chastain In A Tense Country Music Thriller

Sep 11, 2025 -

Inspection Of Westbury White Horse Reveals Flag Damage Concerns

Sep 11, 2025

Inspection Of Westbury White Horse Reveals Flag Damage Concerns

Sep 11, 2025 -

Alex Winter Discusses The Realities Of Growing Up

Sep 11, 2025

Alex Winter Discusses The Realities Of Growing Up

Sep 11, 2025