CoreWeave's Plunge: Is This A Rare Entry Point For Investors? (NASDAQ:CRWV)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave's Plunge: Is This a Rare Entry Point for Investors? (NASDAQ:CRWV)

CoreWeave (NASDAQ: CRWV), a leading provider of cloud computing infrastructure built specifically for generative AI workloads, has experienced a significant stock price drop recently. This sharp decline has left many investors wondering: is this a buying opportunity, or a sign of deeper trouble? This article delves into the reasons behind CoreWeave's fall, examining the potential risks and rewards for investors considering entering the market at this price point.

The Recent Dip: Understanding the Market Sentiment

CoreWeave's stock price has taken a substantial hit in recent weeks, fueled by a combination of factors. The overall tech sector downturn, coupled with concerns about the broader AI market's valuation and a recent secondary offering diluting existing shares, has contributed to the negative sentiment surrounding CRWV. While the company's fundamentals remain strong, the market's reaction highlights the volatility inherent in the rapidly evolving AI landscape.

CoreWeave's Strengths: A Foundation for Future Growth?

Despite the recent plunge, CoreWeave boasts several key strengths that could position it for long-term success:

- Specialized Infrastructure: CoreWeave differentiates itself by offering a cloud infrastructure specifically designed and optimized for the demanding needs of generative AI. This niche focus provides a competitive advantage in a rapidly growing market segment.

- Strategic Partnerships: The company has forged key partnerships with prominent players in the AI industry, further solidifying its position and access to valuable resources. These partnerships provide crucial validation and potential for future growth opportunities.

- Strong Leadership: CoreWeave's leadership team possesses a wealth of experience in the technology and cloud computing sectors. Their expertise is crucial in navigating the complexities of the market and driving the company's strategic direction.

Risks to Consider Before Investing

While the potential upside is significant, investors should carefully consider the inherent risks:

- Market Volatility: The tech sector, and particularly the AI sub-sector, is notoriously volatile. Investors need to have a high risk tolerance and a long-term investment horizon to weather potential market fluctuations.

- Competition: The cloud computing market is fiercely competitive. Established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) present significant challenges. CoreWeave's ability to maintain its market share will be crucial.

- Dependence on AI Market Growth: CoreWeave's success is heavily tied to the continued growth and adoption of generative AI. Any slowdown in this market could negatively impact the company's performance.

Is it a Buy? Weighing the Potential Rewards and Risks

The recent decline in CoreWeave's stock price presents a complex scenario for investors. While the risks are undeniable, the company's strong fundamentals, strategic partnerships, and specialized infrastructure offer a compelling argument for long-term growth potential.

For experienced investors with a high-risk tolerance and a long-term perspective, this could represent a rare entry point into a promising company. However, thorough due diligence and careful consideration of the risks are essential before making any investment decisions. Remember to consult with a qualified financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave's Plunge: Is This A Rare Entry Point For Investors? (NASDAQ:CRWV). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Movie Review Adulthood A Disappointing Noir Comedy

Sep 11, 2025

Movie Review Adulthood A Disappointing Noir Comedy

Sep 11, 2025 -

Alex Winters Crime Comedy Adulthood Starring Josh Gad And Kaya Scodelario Coming To Uk Cinemas

Sep 11, 2025

Alex Winters Crime Comedy Adulthood Starring Josh Gad And Kaya Scodelario Coming To Uk Cinemas

Sep 11, 2025 -

Nhs Trust Performance Englands Best And Worst Revealed

Sep 11, 2025

Nhs Trust Performance Englands Best And Worst Revealed

Sep 11, 2025 -

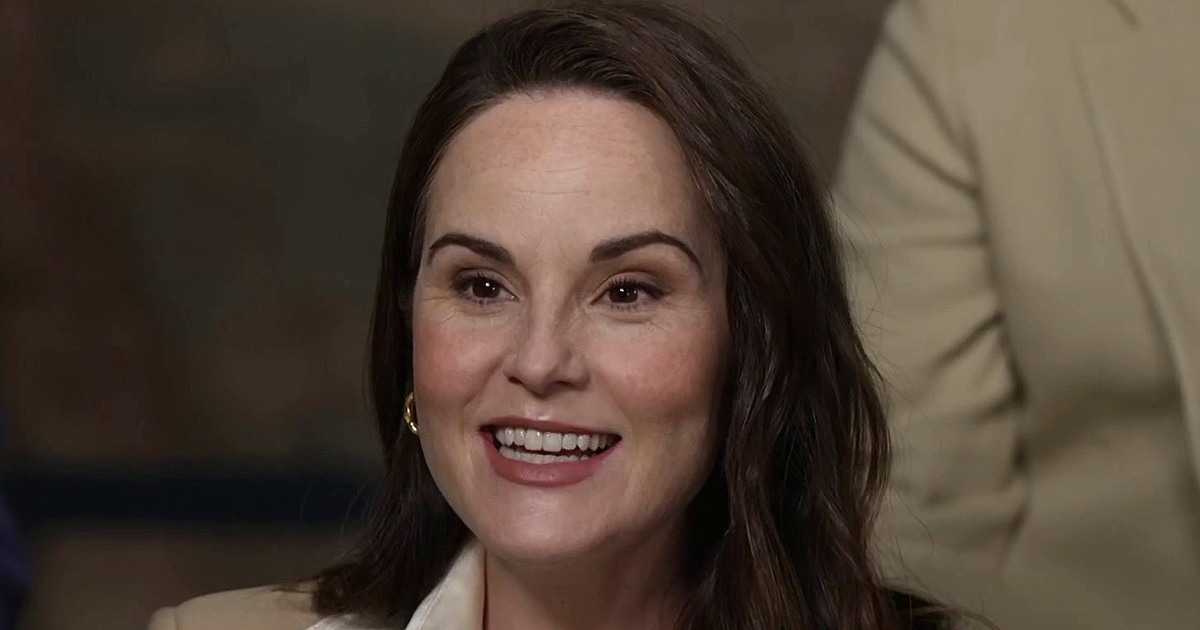

Michelle Dockery Downton Abbey Star Opens Up About Her First Pregnancy

Sep 11, 2025

Michelle Dockery Downton Abbey Star Opens Up About Her First Pregnancy

Sep 11, 2025 -

Popular Girl Scout Cookie Lineup Expands With New Addition

Sep 11, 2025

Popular Girl Scout Cookie Lineup Expands With New Addition

Sep 11, 2025

Latest Posts

-

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025 -

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025 -

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025 -

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025