CoreWeave's $95M Debt Vs. Nebulous's $19.4B Microsoft Investment: Which Stock To Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave's $95M Debt vs. Nebulous's $19.4B Microsoft Investment: Which Stock to Buy?

The cloud computing landscape is heating up, with two prominent players, CoreWeave and Nebulous, attracting significant attention – albeit for very different reasons. CoreWeave, a rapidly expanding cloud provider, recently secured a substantial $95 million debt facility. Meanwhile, Nebulous, a lesser-known entity focusing on decentralized cloud infrastructure, boasts a staggering $19.4 billion investment from Microsoft. So, which company presents a better investment opportunity? The answer, as always, is complex and depends on your risk tolerance and investment horizon.

This article delves into a comparative analysis of both companies, examining their financial standing, technological advantages, and future potential to help you make an informed decision.

CoreWeave: A Solid Foundation with Debt Leverage?

CoreWeave, a leader in GPU-accelerated cloud computing, has carved a niche for itself by providing powerful infrastructure for AI and machine learning applications. Their recent $95 million debt facility, while seemingly a negative, can be viewed as a strategic move to fuel further growth and expansion. This debt allows CoreWeave to aggressively pursue new clients and invest in infrastructure upgrades, ultimately driving revenue growth.

- Strengths: Strong market position in GPU cloud computing, rapid growth trajectory, strategic debt financing.

- Weaknesses: High debt load introduces financial risk, dependence on the continued growth of the AI and machine learning market.

- Investment Considerations: Investors comfortable with moderate risk and a belief in the long-term growth of the AI sector may find CoreWeave attractive. However, careful monitoring of their debt-to-equity ratio is crucial.

Nebulous: A Giant Leap with Microsoft's Backing

Nebulous, on the other hand, operates in a more nascent market, focusing on decentralized cloud infrastructure. Their $19.4 billion investment from Microsoft is a monumental endorsement, showcasing the tech giant's belief in the potential of their technology. This massive investment provides Nebulous with significant resources to scale their operations and potentially disrupt the existing cloud computing landscape.

- Strengths: Massive investment from a tech giant, potential to revolutionize cloud infrastructure, strong strategic partnership.

- Weaknesses: Unproven technology in a highly competitive market, dependence on Microsoft's continued support, relatively unknown compared to established players.

- Investment Considerations: This is a high-risk, high-reward proposition. While the Microsoft investment is a significant positive, the technology's success is far from guaranteed. This is an investment for those with a high risk tolerance and a long-term perspective.

Which Stock to Buy? A Detailed Comparison

| Feature | CoreWeave | Nebulous |

|---|---|---|

| Market | Established GPU cloud computing | Decentralized cloud infrastructure |

| Investment | $95M Debt Facility | $19.4B Microsoft Investment |

| Risk | Moderate | High |

| Potential | Strong, based on current market | Transformative, but uncertain |

Ultimately, the "better" stock depends entirely on your individual investment strategy. CoreWeave offers a more established, albeit riskier, opportunity for near-term growth. Nebulous represents a potentially revolutionary but highly speculative long-term bet.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. Always remember to diversify your portfolio to mitigate risk.

Further Reading:

This comprehensive analysis provides a balanced perspective on both CoreWeave and Nebulous, allowing readers to make informed investment choices based on their individual risk profiles and financial goals. Remember to always conduct your own research before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave's $95M Debt Vs. Nebulous's $19.4B Microsoft Investment: Which Stock To Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Real Trump Jon Stewart Delivers A Harsh Wake Up Call To Maga World

Sep 11, 2025

The Real Trump Jon Stewart Delivers A Harsh Wake Up Call To Maga World

Sep 11, 2025 -

Survey Uncovers Potential Damage To England Flag On Westbury White Horse

Sep 11, 2025

Survey Uncovers Potential Damage To England Flag On Westbury White Horse

Sep 11, 2025 -

Local Outrage Over Asylum Hotels Is Shared Housing A Realistic Alternative

Sep 11, 2025

Local Outrage Over Asylum Hotels Is Shared Housing A Realistic Alternative

Sep 11, 2025 -

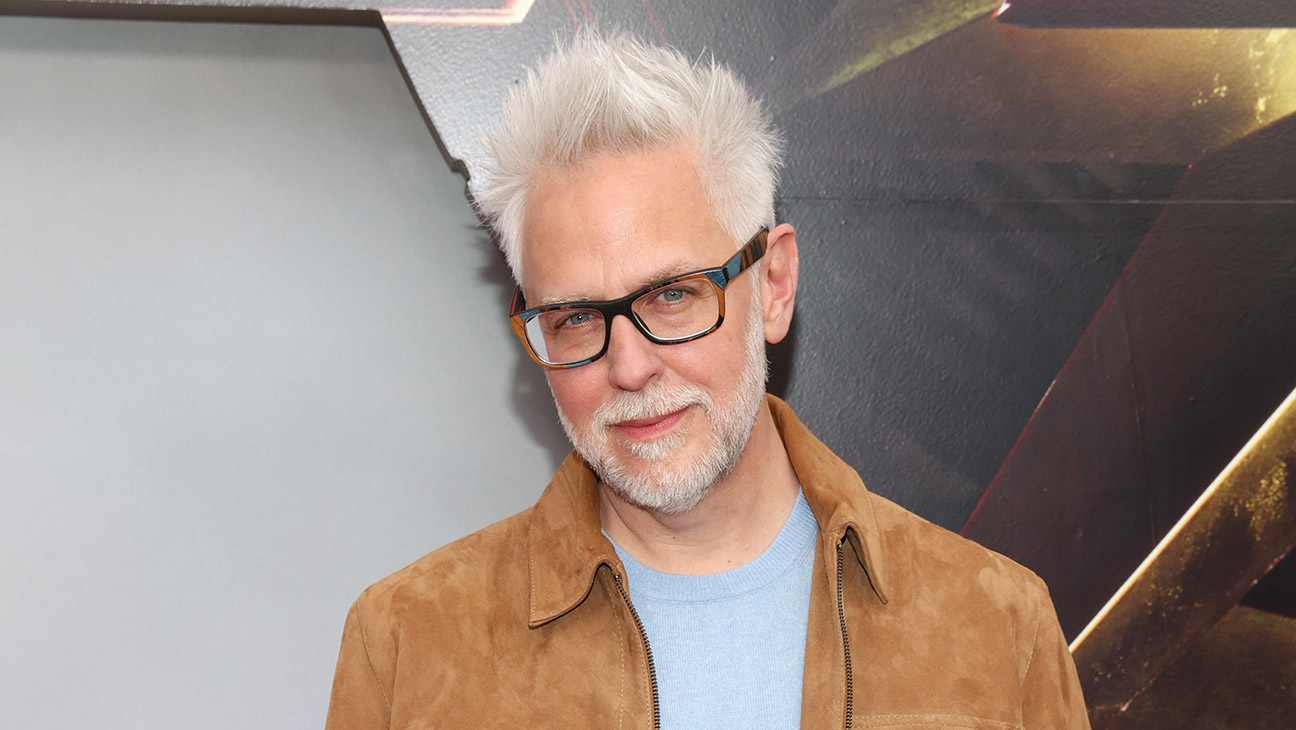

Beyond Superman James Gunn Introduces Man Of Tomorrow Film

Sep 11, 2025

Beyond Superman James Gunn Introduces Man Of Tomorrow Film

Sep 11, 2025 -

Exclusive Cnn Data Chief On The Issue Driving Americans Away From Trump

Sep 11, 2025

Exclusive Cnn Data Chief On The Issue Driving Americans Away From Trump

Sep 11, 2025

Latest Posts

-

Bbc Chief Davie No One Irreplaceable After Recent Scandals

Sep 11, 2025

Bbc Chief Davie No One Irreplaceable After Recent Scandals

Sep 11, 2025 -

Superman Sequel Man Of Tomorrows July 2027 Release Date Announced

Sep 11, 2025

Superman Sequel Man Of Tomorrows July 2027 Release Date Announced

Sep 11, 2025 -

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025 -

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025