CoreWeave (NASDAQ:CRWV): Evaluating The Recent Stock Price Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (NASDAQ:CRWV): Deciphering the Recent Stock Price Dip

CoreWeave (NASDAQ:CRWV), a prominent player in the rapidly expanding cloud computing market, specializing in high-performance computing (HPC) and artificial intelligence (AI) solutions, has recently experienced a noticeable drop in its stock price. This article delves into the potential factors contributing to this decline, examining both market-wide influences and company-specific concerns. Understanding these factors is crucial for investors evaluating CoreWeave's long-term prospects.

The Plunge Explained: Market Sentiment and Company-Specific Factors

The recent downturn in CoreWeave's stock price isn't isolated. The broader technology sector has faced headwinds in 2024, with many high-growth stocks experiencing corrections. Increased interest rates, concerns about inflation, and a potential economic slowdown have all contributed to a more cautious investor sentiment. This macroeconomic climate disproportionately impacts companies like CoreWeave, whose valuation relies heavily on future growth projections.

However, beyond the general market volatility, several company-specific factors might have played a role in CoreWeave's recent price drop:

-

Increased Competition: The cloud computing market is fiercely competitive. Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) constantly innovate and expand their offerings. CoreWeave needs to differentiate itself effectively to maintain its market share and attract new customers. Any perceived weakening of its competitive advantage could trigger investor concerns.

-

Profitability Concerns: As a rapidly growing company, CoreWeave is currently focused on scaling its operations and expanding its market presence. This often translates to prioritizing growth over immediate profitability. Investors scrutinize the company's path to profitability, and any perceived delays or uncertainties in this area could negatively impact the stock price.

-

Dependence on Specific Industries: While CoreWeave's HPC and AI solutions are versatile, its client base might be concentrated within certain sectors. A downturn in these specific industries could impact CoreWeave's revenue streams and overall financial performance. This dependence on a few key sectors presents a risk that investors carefully assess.

-

Analyst Ratings and Price Target Adjustments: Changes in analyst ratings and price targets can significantly influence investor sentiment and drive stock price movements. Negative revisions or downgrades from influential analysts could contribute to a sell-off.

Looking Ahead: Potential Catalysts for Growth

Despite the recent price drop, CoreWeave boasts several potential catalysts for future growth:

-

Continued Growth in AI: The burgeoning AI market presents a significant opportunity for CoreWeave. Its specialized infrastructure is well-suited to meet the intense computational demands of AI model training and deployment. Further advancements in AI and increased adoption are likely to benefit CoreWeave.

-

Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions could broaden CoreWeave's reach, enhance its technological capabilities, and open up new market segments. Successful partnerships could significantly boost investor confidence.

-

Technological Innovation: CoreWeave's continued investment in research and development (R&D) could lead to innovative solutions that further differentiate it from competitors. Keeping ahead of the technological curve is paramount in the dynamic cloud computing landscape.

Conclusion: A Long-Term Perspective

The recent decline in CoreWeave's stock price reflects a combination of market-wide factors and company-specific concerns. However, a long-term perspective is crucial when evaluating high-growth technology companies. CoreWeave operates in a rapidly expanding market with significant growth potential. Investors should carefully consider the company's strategic initiatives, financial performance, and competitive landscape before making any investment decisions. Conduct thorough due diligence and consult with a financial advisor before investing in any stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (NASDAQ:CRWV): Evaluating The Recent Stock Price Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tim Davie On Bbc Scandals No Individual Is Indispensable

Sep 11, 2025

Tim Davie On Bbc Scandals No Individual Is Indispensable

Sep 11, 2025 -

Irreplaceability Myth Debunked Bbc Chief Davie Speaks Out After Scandals

Sep 11, 2025

Irreplaceability Myth Debunked Bbc Chief Davie Speaks Out After Scandals

Sep 11, 2025 -

Six Stab Wounds Girls Act Of Bravery In Southport Attack

Sep 11, 2025

Six Stab Wounds Girls Act Of Bravery In Southport Attack

Sep 11, 2025 -

Marion Cotillard Nouveau Look Capillaire Decouvrez Sa Transformation

Sep 11, 2025

Marion Cotillard Nouveau Look Capillaire Decouvrez Sa Transformation

Sep 11, 2025 -

Ben And Jerry S Founders Distance Themselves From Unilevers Direction

Sep 11, 2025

Ben And Jerry S Founders Distance Themselves From Unilevers Direction

Sep 11, 2025

Latest Posts

-

Mandelsons Birthday Message Reveals Close Ties With Epstein

Sep 11, 2025

Mandelsons Birthday Message Reveals Close Ties With Epstein

Sep 11, 2025 -

The Rise Of Ai In High School Education Benefits And Drawbacks

Sep 11, 2025

The Rise Of Ai In High School Education Benefits And Drawbacks

Sep 11, 2025 -

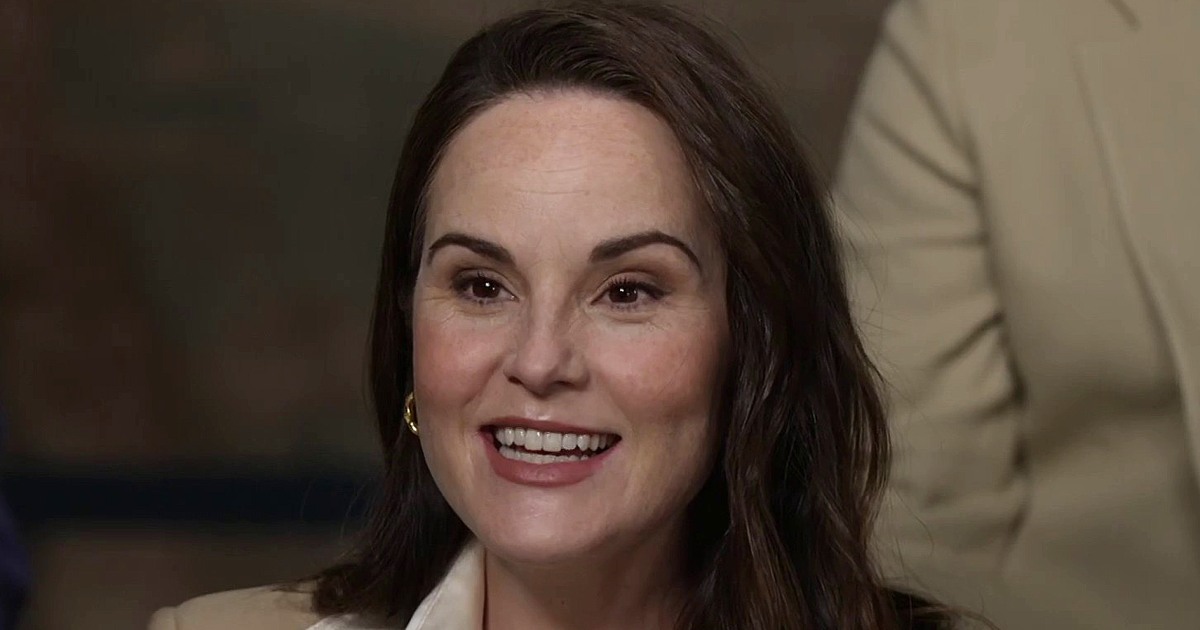

Exclusive Michelle Dockery Discusses Her First Pregnancy And Motherhood

Sep 11, 2025

Exclusive Michelle Dockery Discusses Her First Pregnancy And Motherhood

Sep 11, 2025 -

Unilever And Ben And Jerry S A Growing Rift Between Founders And Corporation

Sep 11, 2025

Unilever And Ben And Jerry S A Growing Rift Between Founders And Corporation

Sep 11, 2025 -

Banksy Strikes Again Fresh Artwork Discovered In London

Sep 11, 2025

Banksy Strikes Again Fresh Artwork Discovered In London

Sep 11, 2025