Consumer Prices Up In June: US Inflation Remains Consistent

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Prices Up in June: US Inflation Remains Stubbornly Consistent

Inflation remains a persistent concern for American consumers, as the latest data from the Bureau of Labor Statistics (BLS) reveals a continued increase in consumer prices during June. While the overall rate didn't drastically surge, the persistent upward trend keeps the Federal Reserve's fight against inflation ongoing. This news impacts everyone, from families managing household budgets to businesses strategizing for the coming months.

The BLS reported a 0.2% increase in the Consumer Price Index (CPI) for June, following a 0.1% rise in May. This translates to a 3% increase year-over-year, slightly higher than many economists' predictions. While the monthly increase may seem modest, the consistent upward movement signals a sustained inflationary pressure that continues to erode purchasing power.

What Drove the June Increase?

Several factors contributed to the June CPI increase. Shelter costs, a significant component of the CPI, continued their upward climb, reflecting persistent increases in rental prices and homeownership costs. Used car prices also saw a slight uptick, though this sector has seen significantly less volatility in recent months than previously.

-

Shelter Costs: The largest contributor to the June inflation increase was the continued rise in shelter costs. This reflects the ongoing tightness in the housing market and the persistent demand for rental properties. Experts predict this sector will remain a key driver of inflation in the coming months. Learn more about the . (This is an example link, replace with a relevant, authoritative source)

-

Energy Prices: While energy prices experienced some fluctuation, they didn't significantly contribute to the overall inflation increase in June. However, continued monitoring of global energy markets remains crucial, as any significant price swings could quickly impact the CPI.

-

Food Prices: Food prices showed a more moderate increase compared to previous months, offering a small degree of relief to consumers struggling with grocery bills. However, food costs remain a significant concern for many low-income households.

What Does This Mean for the Federal Reserve?

The persistent inflation, even at a seemingly moderate rate, is unlikely to deter the Federal Reserve from its current monetary policy. The Fed is likely to remain focused on its goal of bringing inflation down to its 2% target. Further interest rate hikes remain a possibility, although the pace and extent of future increases will depend on incoming economic data. The continued strength of the labor market adds another layer of complexity to the Fed's decision-making process.

How Can Consumers Cope?

The persistent inflation continues to present significant challenges for consumers. Budgeting carefully, prioritizing essential expenses, and exploring ways to reduce spending are all crucial strategies for navigating the current economic climate. Consider:

- Tracking your spending: Use budgeting apps or spreadsheets to monitor your expenses and identify areas where you can cut back.

- Seeking out deals and discounts: Take advantage of sales, coupons, and loyalty programs to save money on groceries and other essential items.

- Negotiating bills: Contact your service providers (internet, phone, insurance) to negotiate lower rates.

Looking Ahead:

The coming months will be crucial in determining the trajectory of inflation. Close monitoring of the CPI, employment data, and other economic indicators will be essential for understanding the effectiveness of the Federal Reserve's monetary policy and its impact on American consumers. The fight against inflation is far from over, and consumers should prepare for the possibility of continued price increases.

Keywords: US inflation, Consumer Price Index (CPI), inflation rate, June inflation, Federal Reserve, monetary policy, interest rates, economic data, consumer prices, rising prices, inflation impact, budgeting tips, financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Prices Up In June: US Inflation Remains Consistent. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

August 29 2025 Hoosier Lottery Results Mega Millions And Cash 5

Sep 02, 2025

August 29 2025 Hoosier Lottery Results Mega Millions And Cash 5

Sep 02, 2025 -

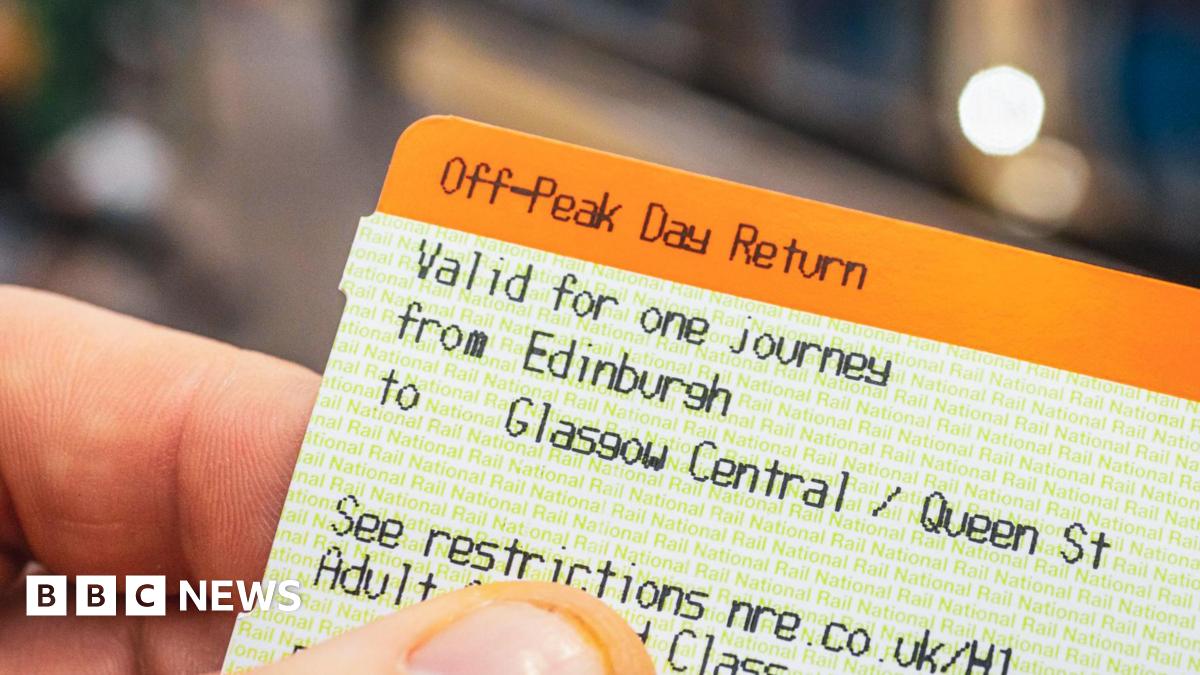

No More Peak Fares Scot Rails Permanent Pricing Shift Explained

Sep 02, 2025

No More Peak Fares Scot Rails Permanent Pricing Shift Explained

Sep 02, 2025 -

Royal Book Exposes Attempted Assault On Young Camilla

Sep 02, 2025

Royal Book Exposes Attempted Assault On Young Camilla

Sep 02, 2025 -

Howard Sterns Controversial Comeback Officially Cancelled Due To Tragedy

Sep 02, 2025

Howard Sterns Controversial Comeback Officially Cancelled Due To Tragedy

Sep 02, 2025 -

Rayner Lobby Row And Gift Of The Jab A Comparative News Analysis

Sep 02, 2025

Rayner Lobby Row And Gift Of The Jab A Comparative News Analysis

Sep 02, 2025

Latest Posts

-

Trumps Immigration Policy Krugman Highlights A Critical Inhumane Defect

Sep 02, 2025

Trumps Immigration Policy Krugman Highlights A Critical Inhumane Defect

Sep 02, 2025 -

Trumps Presidential Medal Of Freedom Award For Rudy Giuliani

Sep 02, 2025

Trumps Presidential Medal Of Freedom Award For Rudy Giuliani

Sep 02, 2025 -

Colorado Airport Witnessing Fatal Mid Air Collision One Fatality Three Injuries

Sep 02, 2025

Colorado Airport Witnessing Fatal Mid Air Collision One Fatality Three Injuries

Sep 02, 2025 -

Shock Jock Howard Sterns Return Postponed Indefinitely

Sep 02, 2025

Shock Jock Howard Sterns Return Postponed Indefinitely

Sep 02, 2025 -

Lucid Group Lcid Stock Price Target Set At 25 94 By Analysts

Sep 02, 2025

Lucid Group Lcid Stock Price Target Set At 25 94 By Analysts

Sep 02, 2025