Consumer Prices Up In June: Analysis Of The Latest US Inflation Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Prices Up in June: Analysis of the Latest US Inflation Report

Inflation remains a persistent concern for American consumers, with the latest Consumer Price Index (CPI) report revealing a concerning uptick in June. The data, released by the Bureau of Labor Statistics (BLS), paints a complex picture, sparking renewed debate about the Federal Reserve's monetary policy and its impact on the everyday American. Understanding these figures is crucial for navigating the current economic climate.

Headline Inflation Continues its Climb

The headline CPI, which measures the overall change in prices for a basket of consumer goods and services, rose 0.2% in June, following a 0.1% increase in May. This translates to a 3.0% year-over-year increase, exceeding economists' expectations and surpassing the Federal Reserve's 2% inflation target. While the monthly increase may seem modest, the persistent upward trend is cause for concern. This increase indicates that the cost of living continues to rise, impacting household budgets across the country.

Core Inflation Remains Sticky

Even more concerning is the "core" CPI, which excludes volatile food and energy prices. Core inflation, often seen as a better indicator of underlying inflationary pressures, rose 0.2% in June, following a 0.3% increase in May. This translates to a 4.8% year-over-year increase – a figure that indicates persistent inflationary pressures within the economy. The stickiness of core inflation suggests that the fight against inflation is far from over.

Key Factors Driving Inflation

Several factors contributed to the June inflation increase. These include:

- Persistent Housing Costs: Shelter costs, a significant component of the CPI, continue to rise, driven by strong rental demand and limited housing supply. This remains a major driver of inflation.

- Used Car Prices Rebound: After a period of decline, used car prices experienced a slight uptick in June, adding to the overall inflationary pressure.

- Services Inflation Remains Elevated: Inflation in services, excluding housing, remains stubbornly high, indicating strong demand and limited supply in several sectors.

What Does This Mean for the Federal Reserve?

The June CPI report reinforces the likelihood of continued interest rate hikes by the Federal Reserve. The central bank's primary mandate is to control inflation, and the persistent upward trend in both headline and core inflation increases the pressure on the Fed to act. Further interest rate increases could slow economic growth and potentially lead to a recession, but inaction risks allowing inflation to become entrenched. The delicate balance between fighting inflation and avoiding a recession remains a significant challenge.

Impact on Consumers

The continued rise in consumer prices directly impacts American households. Rising costs for essential goods and services, including groceries, housing, and transportation, reduce disposable income and squeeze household budgets. Consumers are likely to feel the pinch, potentially leading to reduced spending and a slowdown in economic activity. Careful budgeting and financial planning are crucial during this period of elevated inflation.

Looking Ahead

The coming months will be critical in determining the trajectory of inflation. The Federal Reserve's monetary policy decisions, along with global economic conditions and supply chain dynamics, will play a significant role in shaping future inflation rates. Closely monitoring subsequent CPI reports and analyzing the Federal Reserve's actions will be essential for understanding the evolving economic landscape. Stay informed and adapt your financial strategies accordingly. For further in-depth analysis, you may want to explore resources from the Bureau of Labor Statistics ().

Call to Action: Understanding inflation is key to making informed financial decisions. Stay updated on economic news and consider consulting a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Prices Up In June: Analysis Of The Latest US Inflation Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dramatic Comeback Orixs Ota Hits Crucial Grand Slam

Aug 18, 2025

Dramatic Comeback Orixs Ota Hits Crucial Grand Slam

Aug 18, 2025 -

Economist Paul Krugman The Fatal Flaw In Trumps Harsh Immigration Policy

Aug 18, 2025

Economist Paul Krugman The Fatal Flaw In Trumps Harsh Immigration Policy

Aug 18, 2025 -

Beyond The Textbook Uncovering The Realities Of College Hookups

Aug 18, 2025

Beyond The Textbook Uncovering The Realities Of College Hookups

Aug 18, 2025 -

Trumps Policy Under Fire Krugman Exposes A Deep Seated Flaw

Aug 18, 2025

Trumps Policy Under Fire Krugman Exposes A Deep Seated Flaw

Aug 18, 2025 -

Yvette Cooper Defends Palestine Action Ban Amidst 60 New Charges

Aug 18, 2025

Yvette Cooper Defends Palestine Action Ban Amidst 60 New Charges

Aug 18, 2025

Latest Posts

-

Spike Lees Work Celebrated At The Smithsonian A Look Back And Forward

Aug 18, 2025

Spike Lees Work Celebrated At The Smithsonian A Look Back And Forward

Aug 18, 2025 -

Paul Krugman On Trumps Immigration Policies A Critique Of Its Fundamental Flaw

Aug 18, 2025

Paul Krugman On Trumps Immigration Policies A Critique Of Its Fundamental Flaw

Aug 18, 2025 -

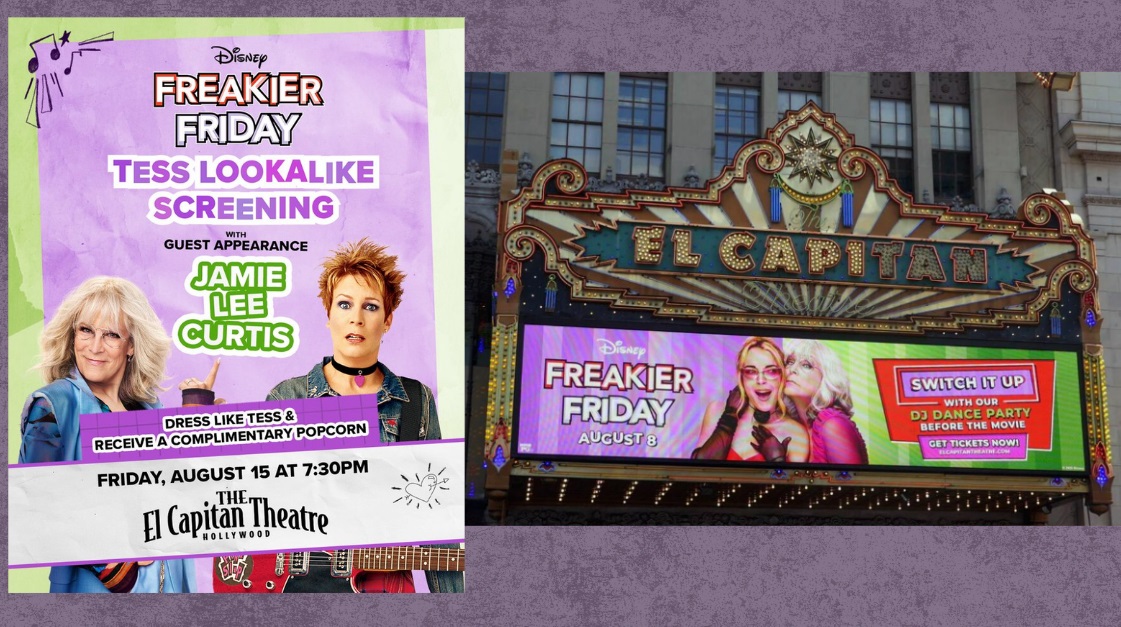

Experience Freakier Friday Fan Event At The El Capitan Theatre

Aug 18, 2025

Experience Freakier Friday Fan Event At The El Capitan Theatre

Aug 18, 2025 -

Public Opinion Shift Cnns Data Shows Americans Abandoning Trump

Aug 18, 2025

Public Opinion Shift Cnns Data Shows Americans Abandoning Trump

Aug 18, 2025 -

Next Superman Movie James Gunn Unveils Key Production Details

Aug 18, 2025

Next Superman Movie James Gunn Unveils Key Production Details

Aug 18, 2025