Consumer Prices Rise In June: US Inflation Remains Elevated

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Prices Rise in June: US Inflation Remains Elevated

Inflation continues to pose a challenge for American consumers as the Consumer Price Index (CPI) showed a concerning rise in June. The latest data reveals a persistent upward pressure on prices, keeping the Federal Reserve's focus firmly on taming inflation, even amidst growing concerns about a potential recession. This persistent inflation impacts everything from groceries and gas to housing and healthcare, leaving many Americans struggling to make ends meet.

Headline Inflation Persists: The Bureau of Labor Statistics (BLS) reported a 0.2% increase in the CPI for June, following a 0.1% rise in May. While this month-over-month increase might seem modest, the annual inflation rate remains stubbornly high at 3%, significantly above the Federal Reserve's target of 2%. This sustained increase underscores the ongoing challenges in controlling inflation.

Underlying Inflationary Pressures: Digging deeper into the data reveals persistent underlying inflationary pressures. Core inflation, which excludes volatile food and energy prices, rose by 0.2% in June, indicating broader price increases across the economy. This steady rise in core inflation signals that inflation is not merely a temporary phenomenon driven by external factors like energy prices.

<h3>Key Factors Contributing to Inflation</h3>

Several factors contributed to the June CPI increase. These include:

- Persistent Housing Costs: Housing costs continue to be a major driver of inflation, reflecting both rising rental prices and the continued elevated costs of owning a home. This sector has been particularly resistant to cooling down.

- Sticky Services Inflation: Inflation in services, which includes healthcare, education, and entertainment, remains elevated. This sector is less sensitive to changes in supply and demand, contributing to persistent upward pressure on prices.

- Supply Chain Disruptions (Lingering Effects): While supply chain issues have eased considerably, lingering effects continue to contribute to higher prices for certain goods.

- Strong Consumer Demand: Relatively robust consumer spending continues to fuel demand, which, combined with constrained supply in some sectors, contributes to inflationary pressures.

<h3>Impact on the Federal Reserve and the Economy</h3>

The persistent inflation reported in the June CPI data is likely to influence the Federal Reserve's upcoming monetary policy decisions. While the Fed has recently paused interest rate hikes, the ongoing inflation could prompt further increases in the near future. This could potentially slow economic growth and increase the risk of a recession. The delicate balancing act between controlling inflation and avoiding a recession continues to be a major challenge for policymakers.

Looking Ahead: Economists and market analysts are closely watching future CPI reports to gauge the effectiveness of the Fed's monetary policy and the trajectory of inflation. The next few months will be crucial in determining whether inflation is finally cooling down or if further measures are needed to bring it under control. The impact on consumer spending and overall economic growth will remain a key area of focus.

Further Reading: For more in-depth analysis on inflation, you can visit the Bureau of Labor Statistics website [link to BLS website]. You can also explore articles from reputable financial news sources for diverse perspectives.

Call to Action (subtle): Stay informed about the latest economic news and data to make informed financial decisions. Regularly check reliable sources for updates on inflation and its impact on your finances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Prices Rise In June: US Inflation Remains Elevated. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyc Weather Update When To Expect Heavy Rainfall And Potential Flooding

Aug 23, 2025

Nyc Weather Update When To Expect Heavy Rainfall And Potential Flooding

Aug 23, 2025 -

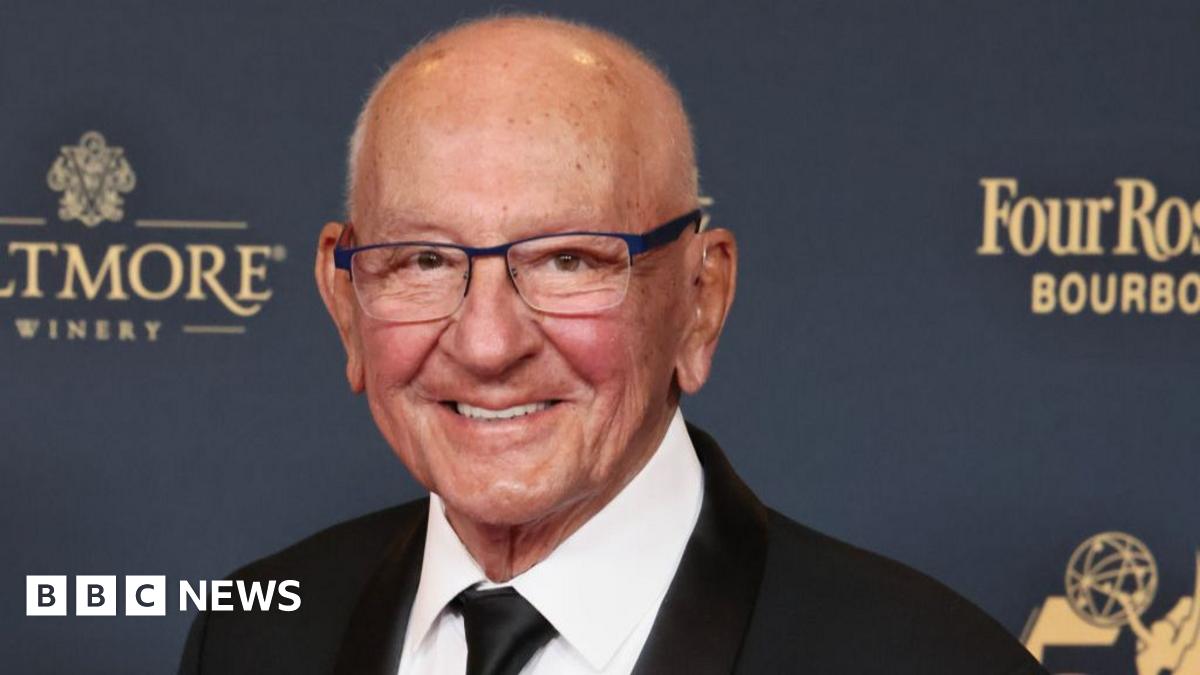

Passing Of Frank Caprio Celebrating The Life Of Rhode Islands Kindest Judge

Aug 23, 2025

Passing Of Frank Caprio Celebrating The Life Of Rhode Islands Kindest Judge

Aug 23, 2025 -

Viral Labubus 400 Profit Surge For Company Cnn Business

Aug 23, 2025

Viral Labubus 400 Profit Surge For Company Cnn Business

Aug 23, 2025 -

Worlds Oldest Person Ethel Caterham Reaches 116 Years Old

Aug 23, 2025

Worlds Oldest Person Ethel Caterham Reaches 116 Years Old

Aug 23, 2025 -

Worlds Oldest Person Ethel Caterham Turns 116

Aug 23, 2025

Worlds Oldest Person Ethel Caterham Turns 116

Aug 23, 2025

Latest Posts

-

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025 -

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025 -

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025 -

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025 -

Busy Trains And Potential Delays Expected This Bank Holiday Weekend

Aug 23, 2025

Busy Trains And Potential Delays Expected This Bank Holiday Weekend

Aug 23, 2025