Consumer Prices Inch Up In June: Expected Inflation Rise Confirmed In U.S.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Prices Inch Up in June: Expected Inflation Rise Confirmed in U.S.

Inflation remains a persistent concern for American consumers, as the latest Consumer Price Index (CPI) data confirms a modest increase in June. While the rise aligns with economists' predictions, it underscores the ongoing challenges the Federal Reserve faces in its battle to bring inflation down to its 2% target. The persistent upward pressure on prices continues to impact household budgets and fuels ongoing uncertainty in the broader economy.

Headline Inflation Holds Steady, but Underlying Pressures Persist

The Bureau of Labor Statistics (BLS) reported that the CPI rose 0.2% in June, following a 0.1% increase in May. This translates to a 3% increase over the past 12 months, slightly lower than the 4% year-over-year increase reported in May. While the headline inflation number offers a glimmer of hope, a closer examination reveals persistent underlying inflationary pressures.

Core Inflation Remains Sticky

A key metric watched by economists and policymakers is core inflation – which excludes volatile food and energy prices. Core CPI increased by 0.2% in June and is up 4.8% over the past 12 months. This relatively high core inflation rate indicates that price increases are broadening beyond just energy and food, suggesting that inflation may be more entrenched than initially thought. This stubborn core inflation presents a significant challenge to the Fed's efforts to cool down the economy without triggering a recession.

What's Driving Inflation?

Several factors contribute to the persistent inflation. These include:

- Supply chain disruptions: Although easing, lingering supply chain bottlenecks continue to impact the cost of goods.

- Strong consumer demand: Robust consumer spending, fueled by a strong labor market, keeps demand high, putting upward pressure on prices.

- Rising housing costs: Shelter costs, a significant component of the CPI, remain elevated, contributing significantly to overall inflation.

- Energy prices: While energy prices have moderated somewhat from their peak, they remain a significant factor influencing inflation.

The Federal Reserve's Response

The Federal Reserve has been aggressively raising interest rates to combat inflation. While these increases aim to curb consumer spending and cool down the economy, they also carry the risk of slowing economic growth too sharply and potentially triggering a recession. The ongoing balancing act faced by the Fed highlights the complexity of managing inflation in a dynamic economic environment. The future trajectory of interest rates will heavily depend on upcoming economic data and the Fed's assessment of the inflation outlook.

Looking Ahead: Uncertainty Remains

The June CPI data provides a mixed picture. While the headline inflation number shows a modest increase, the persistent strength in core inflation suggests the fight against inflation is far from over. The coming months will be crucial in determining whether inflation continues its downward trend or remains stubbornly high. Further analysis of upcoming economic indicators, including employment data and consumer sentiment, will be essential in gaining a clearer picture of the inflation outlook. Stay tuned for updates and further analysis as the economic situation unfolds.

Keywords: Consumer Price Index (CPI), inflation, inflation rate, US inflation, Federal Reserve, interest rates, economic growth, recession, core inflation, price increases, supply chain, consumer spending, housing costs, energy prices, BLS, Bureau of Labor Statistics.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Prices Inch Up In June: Expected Inflation Rise Confirmed In U.S.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Actress Helen Mirren Speaks Out On James Bond Gender Debate

Aug 19, 2025

Actress Helen Mirren Speaks Out On James Bond Gender Debate

Aug 19, 2025 -

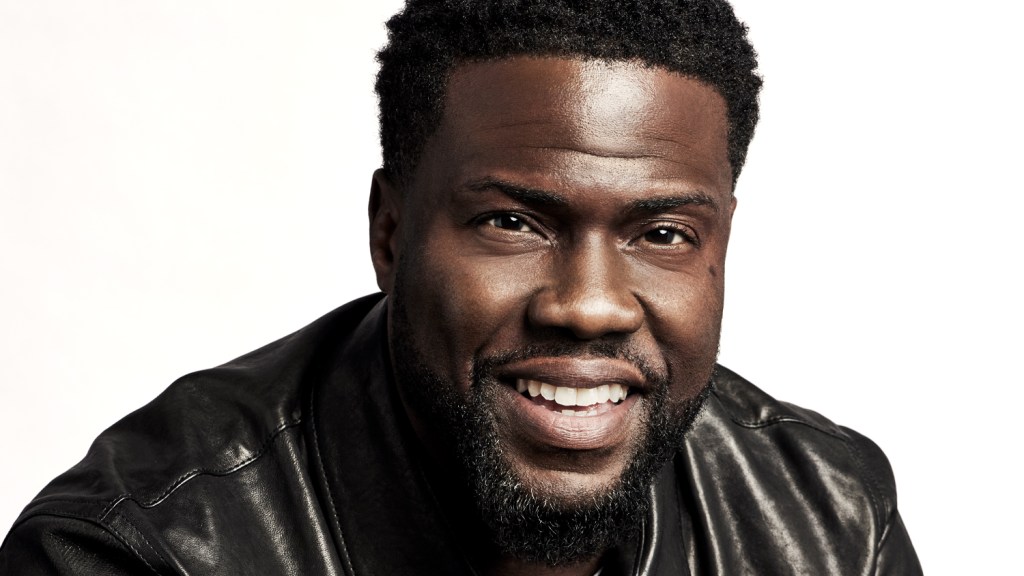

Kevin Harts Netflix Stand Up Competition A New Series Announced

Aug 19, 2025

Kevin Harts Netflix Stand Up Competition A New Series Announced

Aug 19, 2025 -

Biodiversity Photography A Massive Collection Of 17 000 Species

Aug 19, 2025

Biodiversity Photography A Massive Collection Of 17 000 Species

Aug 19, 2025 -

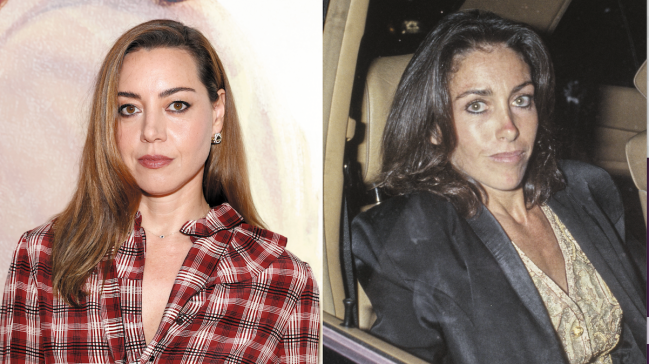

From Parks And Rec To Madam Aubrey Plaza Embraces Heidi Fleiss Role

Aug 19, 2025

From Parks And Rec To Madam Aubrey Plaza Embraces Heidi Fleiss Role

Aug 19, 2025 -

Cnn Anchor Debunks Republican Epstein Claims With Forceful Rebuttal

Aug 19, 2025

Cnn Anchor Debunks Republican Epstein Claims With Forceful Rebuttal

Aug 19, 2025

Latest Posts

-

Strictly Come Dancing Faces Met Police Investigation Following Drug Use Claims

Aug 19, 2025

Strictly Come Dancing Faces Met Police Investigation Following Drug Use Claims

Aug 19, 2025 -

A Look Back Indias Potential For Chip Manufacturing Dominance In 1964

Aug 19, 2025

A Look Back Indias Potential For Chip Manufacturing Dominance In 1964

Aug 19, 2025 -

Karoline Leavitts My Own Two Eyes Claim A Critical Examination Of Trumps Role

Aug 19, 2025

Karoline Leavitts My Own Two Eyes Claim A Critical Examination Of Trumps Role

Aug 19, 2025 -

Witnessing Death How Caring For The Dying Transformed An Atheists View Of Faith

Aug 19, 2025

Witnessing Death How Caring For The Dying Transformed An Atheists View Of Faith

Aug 19, 2025 -

White House Discussions Overshadow Alaska Us Russia Summit

Aug 19, 2025

White House Discussions Overshadow Alaska Us Russia Summit

Aug 19, 2025