Consumer Prices Climb In June: US Inflation Data Aligns With Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Prices Climb in June: US Inflation Data Aligns with Forecasts

Inflation remains stubbornly persistent, despite the Federal Reserve's aggressive interest rate hikes. The latest Consumer Price Index (CPI) data released today shows a continued, albeit slightly moderated, increase in consumer prices for June, aligning closely with economists' predictions. This news underscores the ongoing battle the Federal Reserve faces in its attempt to tame inflation without triggering a recession.

The Bureau of Labor Statistics (BLS) reported a 0.2% increase in the CPI for June, following a 0.1% rise in May. This translates to a 3.0% year-on-year increase, down from 4.0% in May, but still significantly above the Federal Reserve's 2% target. The core CPI, which excludes volatile food and energy prices, rose 0.2% for the month and 4.8% year-on-year, also in line with expectations.

What's driving the persistent inflation?

Several factors contribute to the persistent inflationary pressure:

- Strong labor market: A tight labor market with low unemployment continues to fuel wage growth, putting upward pressure on prices. Companies are competing for workers, leading to increased salary offers, which they often pass on to consumers through higher prices. [Link to article on current US unemployment rates]

- Supply chain disruptions: Although easing, lingering supply chain issues continue to impact the cost of goods, particularly in sectors like manufacturing and transportation. [Link to article on global supply chain issues]

- Elevated energy prices: While energy prices have fallen from their peak, they remain elevated compared to pre-pandemic levels, contributing significantly to the overall inflation rate. [Link to article on energy prices]

- Sticky inflation: Some price increases, particularly in services, are proving to be "sticky," meaning they are resistant to falling even as other prices moderate. This phenomenon is partially attributed to increased demand post-pandemic and wage pressures.

The Federal Reserve's response:

The Federal Reserve's monetary policy committee will carefully consider this latest data as it weighs its next move. While the moderation in inflation is a positive sign, the persistent upward pressure suggests that further interest rate hikes may be on the horizon. The Fed's commitment to bringing inflation down to its 2% target remains unwavering. However, the risk of triggering a recession remains a major concern.

What does this mean for consumers?

For consumers, the persistent inflation continues to mean higher costs for everyday goods and services. This can strain household budgets, especially for lower-income families. Careful budgeting and smart financial planning are crucial to navigate this challenging economic climate. [Link to article on budgeting tips during inflation]

Looking ahead:

The coming months will be crucial in determining the trajectory of inflation. The Federal Reserve's actions, along with global economic developments, will play a significant role in shaping the inflation outlook. Analysts will be closely watching upcoming economic indicators, such as employment data and consumer spending, for further clues. The continued battle against inflation is far from over, and consumers should brace themselves for continued price pressures in the near term.

Keywords: Inflation, CPI, Consumer Price Index, US Inflation, Federal Reserve, interest rates, economic outlook, recession, unemployment, supply chain, energy prices, monetary policy, consumer spending, budgeting, financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Prices Climb In June: US Inflation Data Aligns With Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After Target Ceo Exit Anti Dei Pastor Comments On Boycott Impact

Aug 23, 2025

After Target Ceo Exit Anti Dei Pastor Comments On Boycott Impact

Aug 23, 2025 -

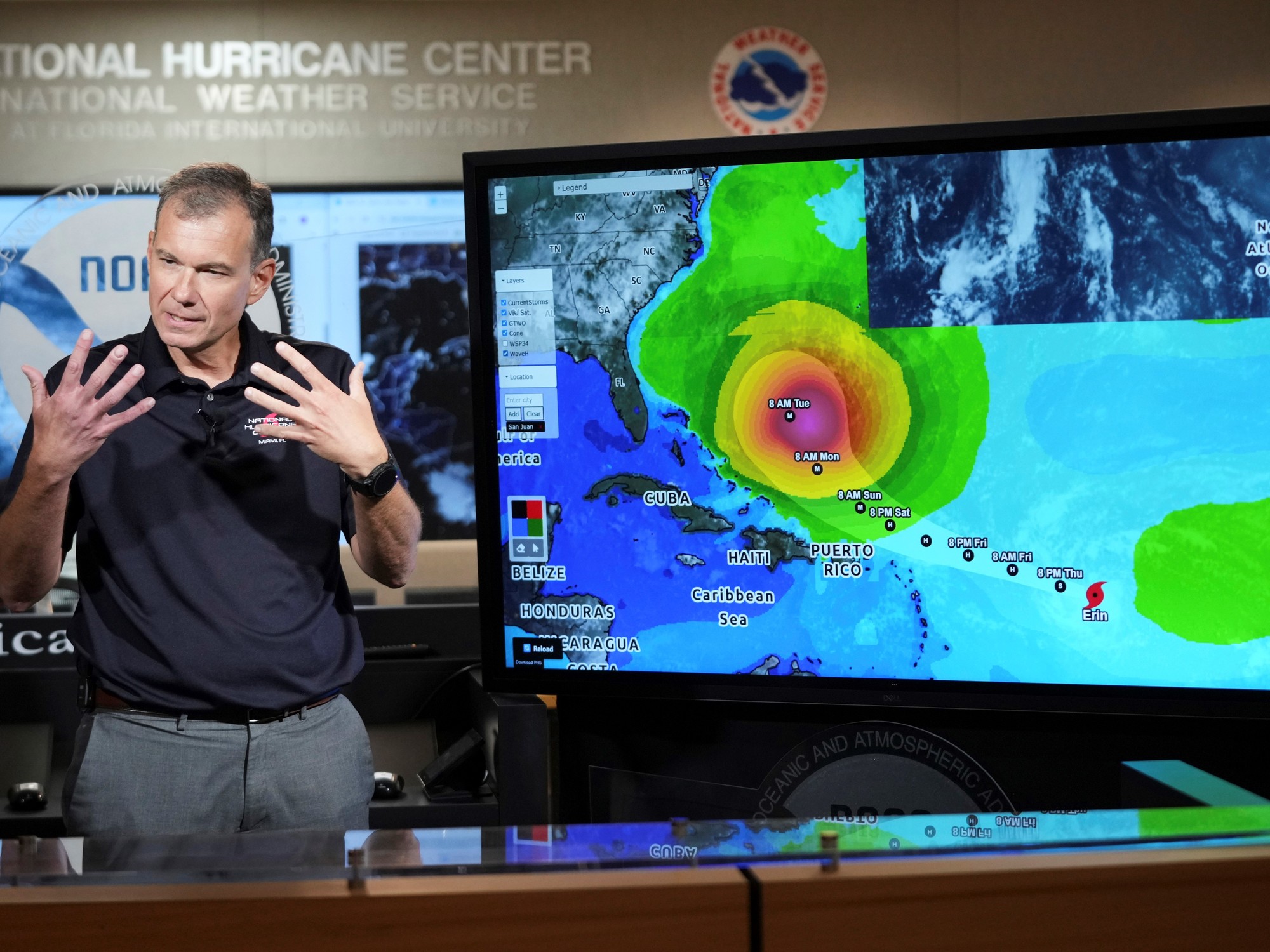

Clima En Miami 22 08 2025 Secuelas Del Huracan Erin Y Predicciones Meteorologicas

Aug 23, 2025

Clima En Miami 22 08 2025 Secuelas Del Huracan Erin Y Predicciones Meteorologicas

Aug 23, 2025 -

Whos Calling The Shots Your Guide To The 2025 Nbc Nascar Broadcast Team

Aug 23, 2025

Whos Calling The Shots Your Guide To The 2025 Nbc Nascar Broadcast Team

Aug 23, 2025 -

After 30 Years Menendez Brothers Face Parole Board What To Expect

Aug 23, 2025

After 30 Years Menendez Brothers Face Parole Board What To Expect

Aug 23, 2025 -

Investigation Launched Parents Legal Battle Against Toddler Milk Marketing Practices

Aug 23, 2025

Investigation Launched Parents Legal Battle Against Toddler Milk Marketing Practices

Aug 23, 2025

Latest Posts

-

Rhs Students Garner Top Honors At State And National Competitions

Aug 23, 2025

Rhs Students Garner Top Honors At State And National Competitions

Aug 23, 2025 -

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025 -

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025 -

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025 -

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025