Consumer Price Index (CPI) June Update: U.S. Inflation Remains On Expected Trajectory

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Price Index (CPI) June Update: U.S. Inflation Remains on Expected Trajectory

The June 2024 Consumer Price Index (CPI) report is in, and while inflation remains a concern, the data largely aligns with economists' predictions, suggesting the Federal Reserve's efforts to cool the economy are bearing fruit, albeit slowly. The headline inflation number, while still elevated, shows a continued, albeit gradual, deceleration. This offers a glimmer of hope for consumers grappling with persistently high prices, but also underscores the ongoing challenges facing the Federal Reserve in its fight against inflation.

Headline Inflation Slows, But Remains Above Target

The Bureau of Labor Statistics (BLS) reported a [insert actual CPI percentage change here]% increase in the CPI for June, compared to the same month last year. While this represents a [insert comparison to previous month's percentage change here] compared to May, it still sits above the Federal Reserve's target inflation rate of 2%. This sustained, albeit slower, rise highlights the persistent pressures on prices impacting various sectors of the U.S. economy.

Core Inflation: A Key Indicator to Watch

To gain a clearer picture of underlying inflationary pressures, economists often look beyond the headline CPI figure to the core CPI, which excludes volatile food and energy prices. The core CPI for June showed a [insert actual core CPI percentage change here]% increase year-over-year. This [insert analysis comparing core CPI to headline CPI and previous month’s data] suggests [insert interpretation of core CPI data and its implications for the overall economic outlook].

What's Driving Inflation? A Look at Key Components

Several factors continue to contribute to elevated inflation. These include:

- Persistent Supply Chain Issues: While improving, global supply chains remain disrupted, leading to higher prices for certain goods. Read more about the ongoing impact of supply chain disruptions on inflation [link to relevant article/report].

- Strong Consumer Demand: Robust consumer spending, fueled by a still-strong labor market, continues to put upward pressure on prices. Learn more about the current state of the U.S. job market [link to relevant article/report].

- Elevated Energy Prices: Fluctuations in global energy markets continue to impact inflation, although the recent price decreases offer some relief. For an in-depth look at energy prices, visit [link to relevant energy price data source].

- Housing Costs: Housing remains a significant contributor to inflation, reflecting both rising rents and home prices. This persistent pressure underscores the need for long-term solutions to address the housing affordability crisis in the United States.

The Federal Reserve's Response and Future Outlook

The Federal Reserve is closely monitoring the CPI data and will likely adjust its monetary policy accordingly. While the June report suggests progress, the central bank is expected to remain vigilant in its efforts to bring inflation down to its 2% target. Further interest rate hikes remain a possibility, depending on future economic data. Experts are divided on whether the Fed will continue to raise rates, or pause to assess the impact of previous increases. This uncertainty adds to the complexity of navigating the current economic climate.

What it Means for Consumers

The June CPI report offers a mixed bag for consumers. While the slowdown in inflation is encouraging, elevated prices remain a significant challenge for many households. Careful budgeting and financial planning remain crucial strategies for managing expenses in this environment. Consider exploring resources for financial literacy and budgeting strategies [link to relevant resource].

Conclusion: A Cautiously Optimistic Outlook

The June CPI update offers a cautiously optimistic outlook on inflation. While the fight against inflation is far from over, the continued deceleration suggests that the Federal Reserve's measures are having an impact. However, persistent underlying pressures and the possibility of future interest rate increases warrant continued vigilance and careful monitoring of economic indicators in the months to come. Stay tuned for further updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Price Index (CPI) June Update: U.S. Inflation Remains On Expected Trajectory. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

110 F Heat Wave Imminent Prepare For Extreme Heat In The Southwest

Aug 21, 2025

110 F Heat Wave Imminent Prepare For Extreme Heat In The Southwest

Aug 21, 2025 -

Results Day Stress Strategies For Neurodivergent Individuals

Aug 21, 2025

Results Day Stress Strategies For Neurodivergent Individuals

Aug 21, 2025 -

Key Takeaways From The Trump Zelenskyy European Leaders Summit

Aug 21, 2025

Key Takeaways From The Trump Zelenskyy European Leaders Summit

Aug 21, 2025 -

August 11 2025 Michigan Lottery Daily 3 And Daily 4 Winning Numbers

Aug 21, 2025

August 11 2025 Michigan Lottery Daily 3 And Daily 4 Winning Numbers

Aug 21, 2025 -

87 Year Old Country Icon Postpones Grand Ole Opry Performance Health Update

Aug 21, 2025

87 Year Old Country Icon Postpones Grand Ole Opry Performance Health Update

Aug 21, 2025

Latest Posts

-

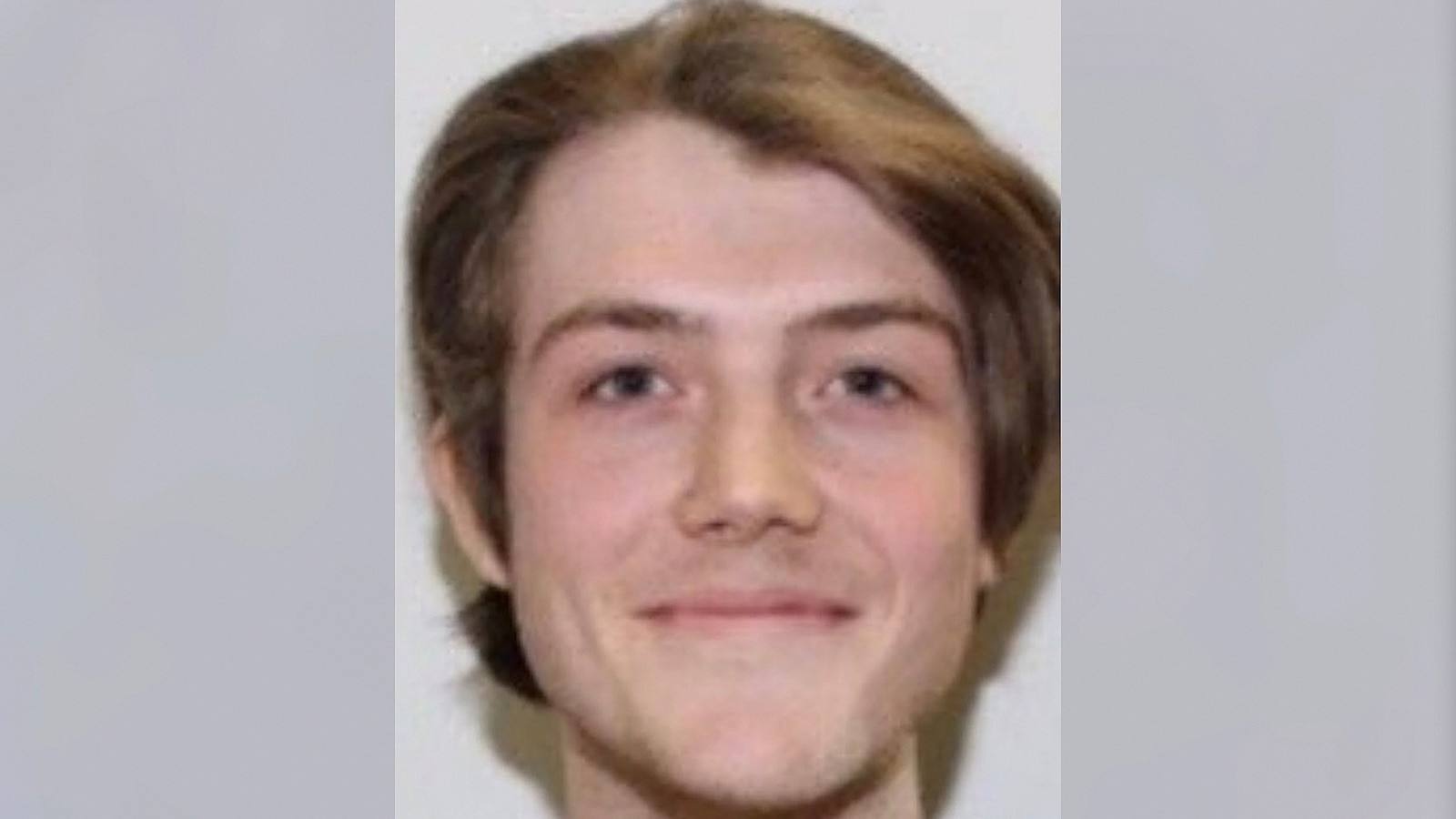

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025 -

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025 -

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025 -

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025 -

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025