Congress Faces 2034 Social Security Funding Cliff

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Congress Faces 2034 Social Security Funding Cliff: A Looming Crisis?

The looming Social Security funding crisis is no longer a distant threat; it's rapidly approaching. Congress faces a potentially catastrophic "fiscal cliff" in 2034, when the Social Security Trust Fund is projected to be depleted. This isn't just a concern for retirees; it affects every American worker who contributes to the system and expects future benefits. Understanding the scale of this challenge and the potential solutions is crucial for the future of this vital social safety net.

The Ticking Clock: Understanding the 2034 Projection

The Social Security Administration (SSA) consistently projects when the trust fund will be unable to pay 100% of scheduled benefits. Current projections point to 2034, meaning without congressional action, benefits could be cut by approximately 20%. This reduction wouldn't eliminate benefits entirely, but it would significantly impact the retirement security of millions of Americans. The severity of these cuts would depend on several factors, including economic growth and future legislative changes. This uncertainty only adds to the urgency of the situation.

What Causes the Funding Shortfall?

Several factors contribute to the projected shortfall:

- Aging Population: The baby boomer generation is entering retirement, leading to a surge in benefit recipients. This demographic shift places increased strain on the system.

- Declining Worker-to-Beneficiary Ratio: Fewer workers are contributing to support a growing number of retirees, impacting the system's sustainability.

- Increased Life Expectancy: People are living longer, requiring longer periods of benefit payouts.

Potential Solutions: A Political Tightrope Walk

Addressing the Social Security funding shortfall requires difficult political choices. Several solutions have been proposed, each with its own set of supporters and detractors:

- Raising the Retirement Age: Gradually increasing the full retirement age is one option, but it could disproportionately affect lower-income workers who may not be able to work longer.

- Increasing the Social Security Tax Rate: A modest increase in the payroll tax could generate substantial additional revenue, but this could be unpopular with workers and employers.

- Increasing the Social Security Taxable Wage Base: Currently, Social Security taxes only apply to earnings below a certain threshold. Raising this cap would broaden the tax base and increase revenue.

- Benefit Reductions (Beyond 2034): While current projections suggest a 20% reduction in 2034, further benefit reductions might be necessary in subsequent years without additional reforms.

- Investing the Trust Fund: Some propose alternative investments for the Social Security Trust Fund to generate higher returns. However, this approach carries significant risk and requires careful consideration.

The Urgency of Congressional Action

The 2034 deadline is fast approaching. Delaying action will only exacerbate the problem and make necessary reforms more drastic. Congress needs to engage in bipartisan discussions to find a sustainable solution that protects the retirement security of current and future generations. The longer they wait, the more difficult, and potentially disruptive, the necessary changes will become. The future of Social Security hangs in the balance.

Learn More: For more in-depth information on Social Security, visit the official Social Security Administration website:

Call to Action: Stay informed about the ongoing discussions in Congress regarding Social Security reform. Contact your representatives and share your concerns. The future of Social Security depends on active citizen engagement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Congress Faces 2034 Social Security Funding Cliff. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Navigating Gender Affirming Care A Resource For Transitioning Individuals

Jun 20, 2025

Navigating Gender Affirming Care A Resource For Transitioning Individuals

Jun 20, 2025 -

2034 Social Security Payment Cuts Will Congress Intervene

Jun 20, 2025

2034 Social Security Payment Cuts Will Congress Intervene

Jun 20, 2025 -

Royal Ascot 2024 Princess Of Wales No Show Confirmed

Jun 20, 2025

Royal Ascot 2024 Princess Of Wales No Show Confirmed

Jun 20, 2025 -

Dismissed State Trooper Releases Video Regarding Karen Read Texts

Jun 20, 2025

Dismissed State Trooper Releases Video Regarding Karen Read Texts

Jun 20, 2025 -

New Development In Bryan Kohberger Case Witness Video And Implications For Prosecution

Jun 20, 2025

New Development In Bryan Kohberger Case Witness Video And Implications For Prosecution

Jun 20, 2025

Latest Posts

-

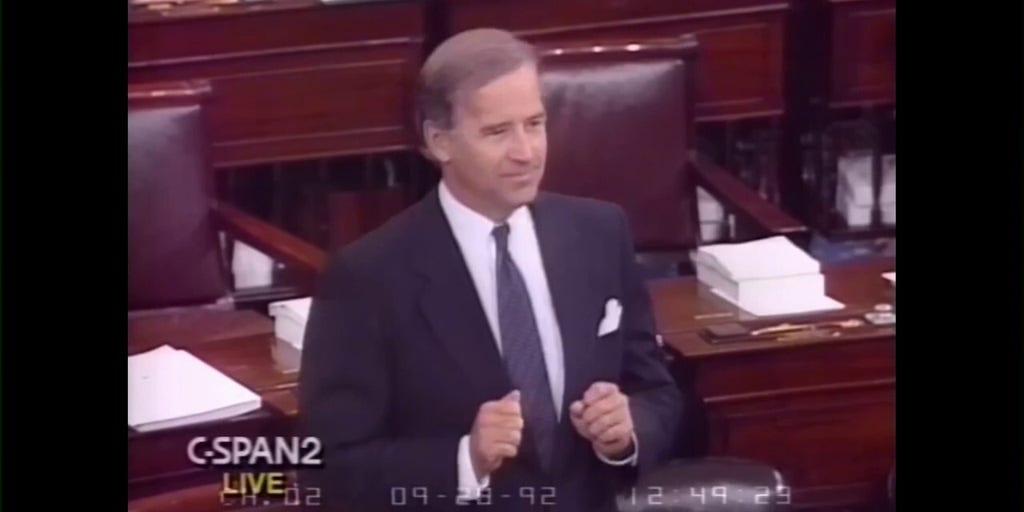

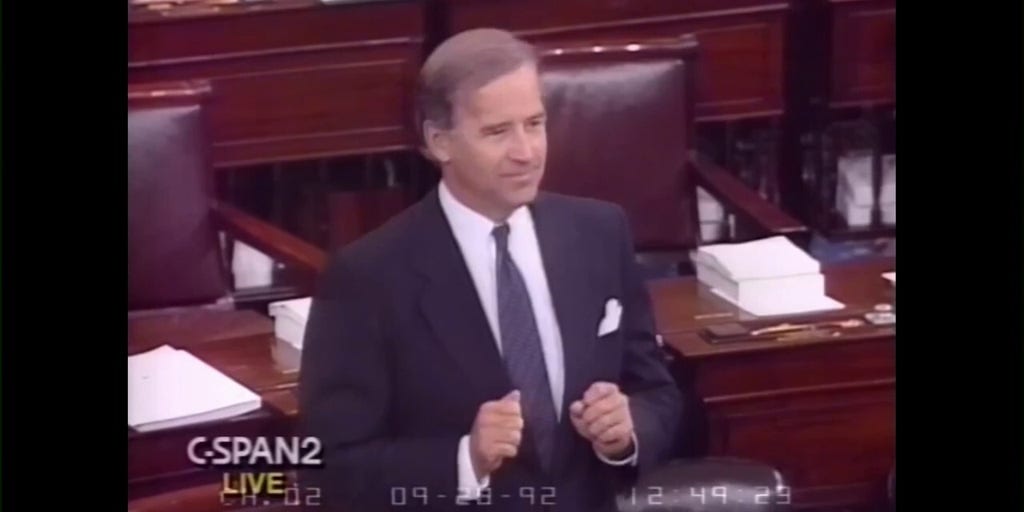

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025 -

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025 -

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025 -

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025 -

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025