Congress Faces 2034 Social Security Deadline: Will Benefits Be Reduced?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Congress Faces 2034 Social Security Deadline: Will Benefits Be Reduced?

The looming Social Security crisis is no longer a distant threat; it's rapidly approaching. With the Social Security Administration (SSA) projecting the depletion of trust fund reserves by 2034, Congress faces a critical deadline to avert significant benefit cuts for millions of retirees and disabled Americans. The question on everyone's mind: will benefits be reduced, and if so, by how much?

The impending shortfall stems from a simple demographic reality: the increasing proportion of retirees to workers. As the Baby Boomer generation enters retirement, the number of contributors to the Social Security system is shrinking relative to the number of beneficiaries. This imbalance, coupled with increasing life expectancies, strains the system's ability to meet its obligations.

Understanding the 2034 Projection

The SSA's 2034 projection doesn't mean Social Security will completely disappear. Instead, it signifies that the system will only be able to pay approximately 80% of scheduled benefits without legislative intervention. This would represent a substantial cut for millions relying on Social Security for their survival. The impact would be particularly severe on lower-income retirees, who often depend on Social Security for a larger percentage of their income.

Potential Solutions: A Political Tightrope Walk

Congress has several options to address the impending shortfall, but each faces significant political hurdles. These options include:

- Raising the full retirement age: Gradually increasing the age at which individuals can receive full Social Security benefits could help extend the solvency of the system. However, this would disproportionately affect younger workers.

- Increasing the Social Security tax: Raising the payroll tax rate, either on employers, employees, or both, could generate additional revenue for the system. This approach, however, faces resistance from both employers and employees wary of increased tax burdens.

- Raising the earnings base: Currently, Social Security taxes only apply to earnings up to a certain limit. Increasing this limit could bring more high-income earners into the Social Security tax system. This, too, is a politically charged issue.

- Benefit reductions: While this is the least desirable option, reducing benefits across the board is a potential solution. This could involve cutting benefits for all recipients or targeting specific groups.

- Investing Social Security Trust Funds: While the funds are currently invested in US Treasury bonds, some argue that alternative investments could yield higher returns and extend the solvency of the program. This approach however, introduces additional risk to the system.

What Can You Do?

While the ultimate decision rests with Congress, individuals can take proactive steps:

- Stay informed: Follow the ongoing debate in Congress and understand the various proposed solutions.

- Contact your representatives: Let your elected officials know your concerns and preferences regarding Social Security reform.

- Plan for retirement: Regardless of Congressional action, securing your financial future through diverse savings and investment strategies is crucial. Consider consulting a financial advisor to create a personalized retirement plan.

The Urgency of Action

The 2034 deadline is rapidly approaching. Delaying action will only exacerbate the problem, potentially leading to more drastic benefit cuts in the future. The coming years will be critical in determining the fate of Social Security and the financial security of millions of Americans. The time for decisive action is now. Learn more about Social Security benefits and planning by visiting the official .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Congress Faces 2034 Social Security Deadline: Will Benefits Be Reduced?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tense Exchange Carlson Questions Cruzs Iran Stance On Cnn

Jun 20, 2025

Tense Exchange Carlson Questions Cruzs Iran Stance On Cnn

Jun 20, 2025 -

Eleven Dead In Gaza Israeli Shelling Targets Aid Workers Rescuers Claim

Jun 20, 2025

Eleven Dead In Gaza Israeli Shelling Targets Aid Workers Rescuers Claim

Jun 20, 2025 -

Listen Up Serena And Venus Williams Podcast Is Here

Jun 20, 2025

Listen Up Serena And Venus Williams Podcast Is Here

Jun 20, 2025 -

Can Congress Avert A Social Security Crisis In 2034

Jun 20, 2025

Can Congress Avert A Social Security Crisis In 2034

Jun 20, 2025 -

Understanding Gender Affirming Care Types Benefits And Potential Risks

Jun 20, 2025

Understanding Gender Affirming Care Types Benefits And Potential Risks

Jun 20, 2025

Latest Posts

-

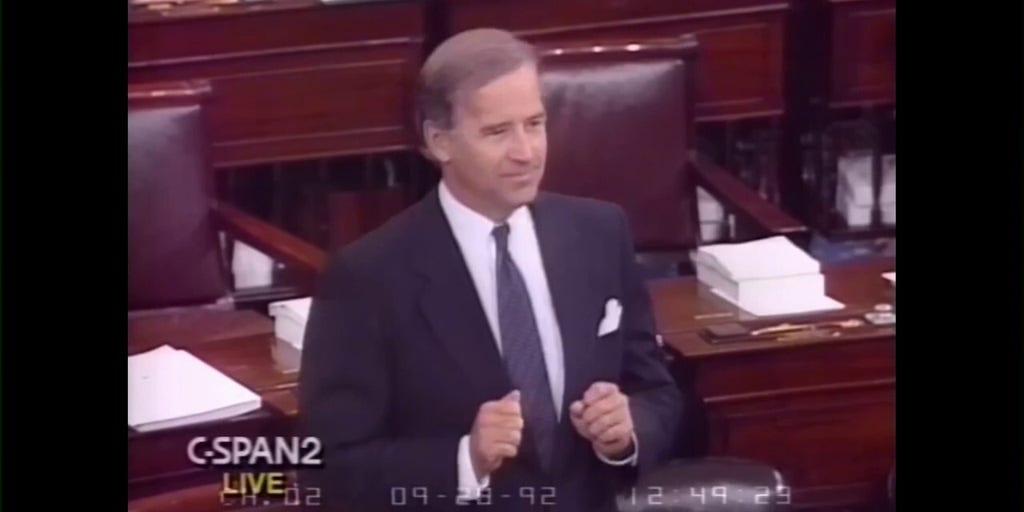

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025 -

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025 -

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025 -

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025 -

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025