Can Congress Avert Social Security Benefit Reductions By 2034?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Congress Avert Social Security Benefit Reductions by 2034? A Look at the Looming Crisis

The looming Social Security crisis is no longer a distant threat. By 2034, the Social Security Administration (SSA) projects the trust fund will be depleted, leading to potential benefit reductions unless Congress acts. This isn't just a problem for future retirees; current beneficiaries could see their checks shrink if lawmakers fail to find a solution. The question on everyone's mind is: can Congress avert this impending disaster?

The short answer is: it's complicated. While the situation is dire, several potential solutions are on the table, each with its own set of political and economic challenges.

Understanding the Social Security Funding Gap

The Social Security system faces a significant funding shortfall due to a combination of factors:

- Aging Population: The proportion of retirees to workers is steadily increasing, meaning fewer workers are contributing to support a larger number of beneficiaries.

- Increased Life Expectancy: People are living longer, drawing Social Security benefits for an extended period.

- Declining Birth Rates: A lower birth rate means fewer individuals entering the workforce to contribute to the system.

These factors create a growing gap between incoming payroll taxes and outgoing benefit payments. The SSA's projections show that without legislative intervention, benefits could be cut by approximately 20% in 2034. This would significantly impact millions of Americans who rely on Social Security for a substantial portion of their retirement income.

Potential Solutions: A Political Tightrope Walk

Several proposals aim to address the Social Security funding gap, but reaching a consensus in Congress remains a formidable challenge. These proposals broadly fall into the following categories:

1. Increasing Revenue:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full Social Security benefits.

- Increasing the Social Security Tax Rate: Raising the current payroll tax rate (currently 12.4%, split evenly between employers and employees).

- Taxing Higher Incomes: Expanding the amount of income subject to Social Security taxes. Currently, earnings above a certain threshold are not taxed.

2. Reducing Expenditures:

- Modifying COLA Adjustments: Adjusting the annual cost-of-living adjustment (COLA) formula to reduce benefit increases.

- Increasing the Retirement Age: Similar to raising the full retirement age, but potentially applying this to existing beneficiaries as well, a politically difficult move.

3. A Combination of Approaches:

Many experts believe a multi-pronged approach—combining revenue increases and expenditure reductions—is the most feasible and sustainable solution. This would require a complex negotiation process within Congress, balancing the needs of different demographics and political priorities.

The Political Landscape: A Roadblock to Reform?

The biggest obstacle to Social Security reform is the deeply partisan political climate. Republicans and Democrats have fundamentally different approaches to the problem, making bipartisan compromise exceptionally difficult. Recent legislative efforts have yielded little progress, further highlighting the urgency of the situation.

What Happens Next?

The coming years will be critical in determining the future of Social Security. The longer Congress delays action, the more drastic the necessary measures will become. While the possibility of benefit reductions in 2034 remains a real threat, effective and timely bipartisan cooperation could still prevent this outcome. Stay informed, engage with your elected officials, and advocate for solutions that protect the future of Social Security for all Americans.

Call to Action: Contact your senators and representatives to urge them to prioritize Social Security reform and find a sustainable solution. Your voice matters in protecting this vital safety net. Learn more about Social Security and the proposed reforms by visiting the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Congress Avert Social Security Benefit Reductions By 2034?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding The Global Response To Juneteenth Celebrations

Jun 20, 2025

Understanding The Global Response To Juneteenth Celebrations

Jun 20, 2025 -

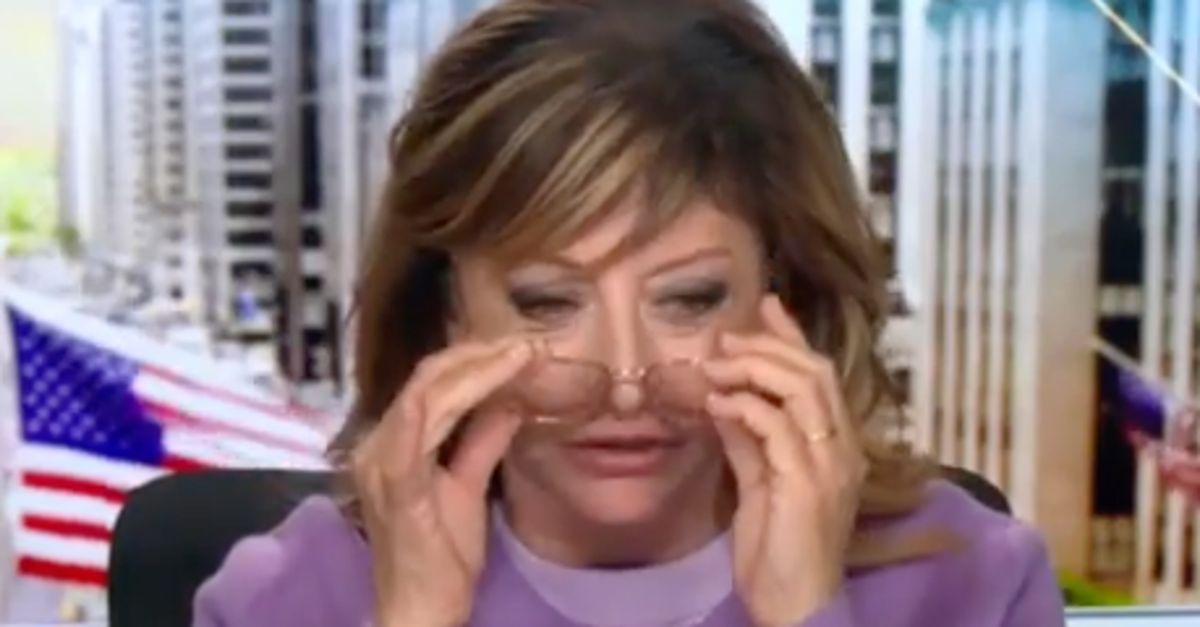

Fact Check Maria Bartiromo And The Deceptive Trump Social Media Post

Jun 20, 2025

Fact Check Maria Bartiromo And The Deceptive Trump Social Media Post

Jun 20, 2025 -

Minnesota Wild Trade Predictions Whos In And Whos Out This Offseason

Jun 20, 2025

Minnesota Wild Trade Predictions Whos In And Whos Out This Offseason

Jun 20, 2025 -

Phoenix Mercury Vs Connecticut Sun Game Day Tv Channel Time And Streaming Details

Jun 20, 2025

Phoenix Mercury Vs Connecticut Sun Game Day Tv Channel Time And Streaming Details

Jun 20, 2025 -

Unprecedented Iberian Power Outage Authorities Identify Root Cause

Jun 20, 2025

Unprecedented Iberian Power Outage Authorities Identify Root Cause

Jun 20, 2025

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure