Analyzing Trump's Claim: A $4 Trillion Tariff-Driven Debt Reduction? Caveats And Realities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Trump's Claim: A $4 Trillion Tariff-Driven Debt Reduction? Caveats and Realities

Introduction: Former President Donald Trump frequently touted his trade policies, particularly tariffs, as a mechanism for significantly reducing the national debt. He claimed these tariffs generated a massive revenue windfall, contributing billions to deficit reduction. But how accurate is this assertion? This in-depth analysis delves into the complexities of Trump's claim, examining the economic realities behind the rhetoric and uncovering the caveats often overlooked in the heated political discourse.

The Central Claim: A $4 Trillion Boon?

The claim that tariffs generated a $4 trillion reduction in the national debt is a bold one, often repeated by Trump and his supporters. The argument rests on the premise that increased tariffs led to a surge in government revenue, directly offsetting deficits. However, this simplistic narrative ignores several crucial economic factors.

Caveat 1: The Complexities of Tariff Revenue

While tariffs do generate revenue, attributing a specific, massive reduction in the national debt solely to them is misleading. Tariff revenue is a small portion of overall government revenue, dwarfed by income taxes and payroll taxes. Furthermore, increased tariff revenue often comes at a cost – higher prices for consumers and businesses, reduced competitiveness for American companies, and potential retaliatory tariffs from other countries. These negative economic consequences can negate any positive revenue gains.

Caveat 2: The Counterfactual Argument

Economists often utilize counterfactual analysis to assess the impact of policies. In this case, we must ask: What would the national debt have looked like without the tariffs? It's plausible that without the tariffs, economic growth might have been stronger, leading to higher tax revenues and potentially a smaller national debt. Therefore, simply pointing to increased tariff revenue as the sole cause of any debt reduction is a flawed methodology.

Caveat 3: The Shifting Economic Landscape

The economic landscape during Trump's presidency was influenced by various factors beyond tariffs, including tax cuts, increased government spending, and global economic conditions. Attributing the entire change in the national debt trajectory solely to tariffs ignores the interplay of these other powerful economic forces. A comprehensive analysis requires a multivariate approach, considering all significant economic variables.

The Reality: A More Nuanced Picture

Instead of a straightforward $4 trillion reduction, a more realistic assessment reveals a far more nuanced picture. While tariffs may have contributed to a slight increase in government revenue, this contribution is dwarfed by the overall complexities of the national debt and the numerous factors affecting its trajectory. Independent economic analyses rarely support such a dramatic claim. [Link to a reputable source showing alternative analysis of tariff impact].

Conclusion: Separating Fact from Fiction

President Trump's claim of a $4 trillion tariff-driven debt reduction is a simplification that ignores crucial economic realities. While tariffs generate some revenue, attributing such a significant debt reduction solely to this mechanism is an oversimplification that overlooks the significant counterarguments and economic complexities. A more comprehensive analysis necessitates considering various economic factors and employing robust methodologies like counterfactual analysis to arrive at a more accurate and nuanced understanding. Therefore, it is crucial to treat such claims with skepticism and rely on evidence-based economic analysis rather than political rhetoric.

Keywords: Trump tariffs, national debt, tariff revenue, economic analysis, counterfactual analysis, trade policy, deficit reduction, economic impact of tariffs, fiscal policy, US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Trump's Claim: A $4 Trillion Tariff-Driven Debt Reduction? Caveats And Realities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Senator Klobuchar Targeted By Ai Deepfake In Controversial Sydney Sweeney Ad

Aug 28, 2025

Senator Klobuchar Targeted By Ai Deepfake In Controversial Sydney Sweeney Ad

Aug 28, 2025 -

Parents Of Missing 7 Month Old Face Murder Charges In First Court Appearance

Aug 28, 2025

Parents Of Missing 7 Month Old Face Murder Charges In First Court Appearance

Aug 28, 2025 -

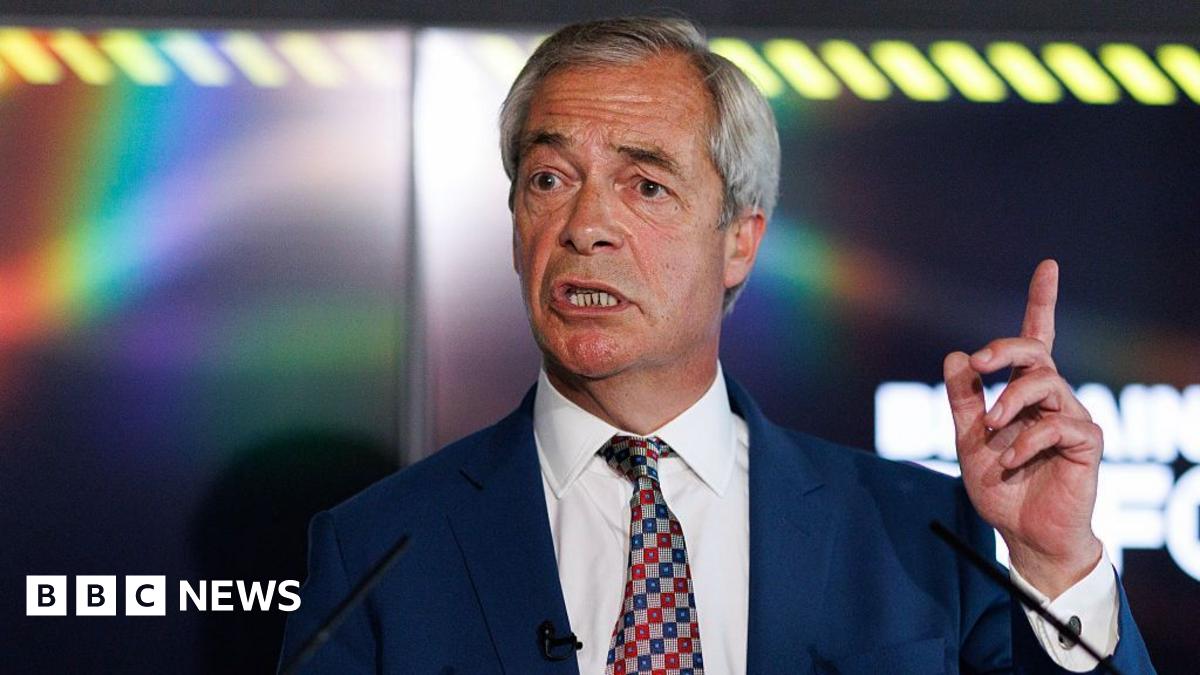

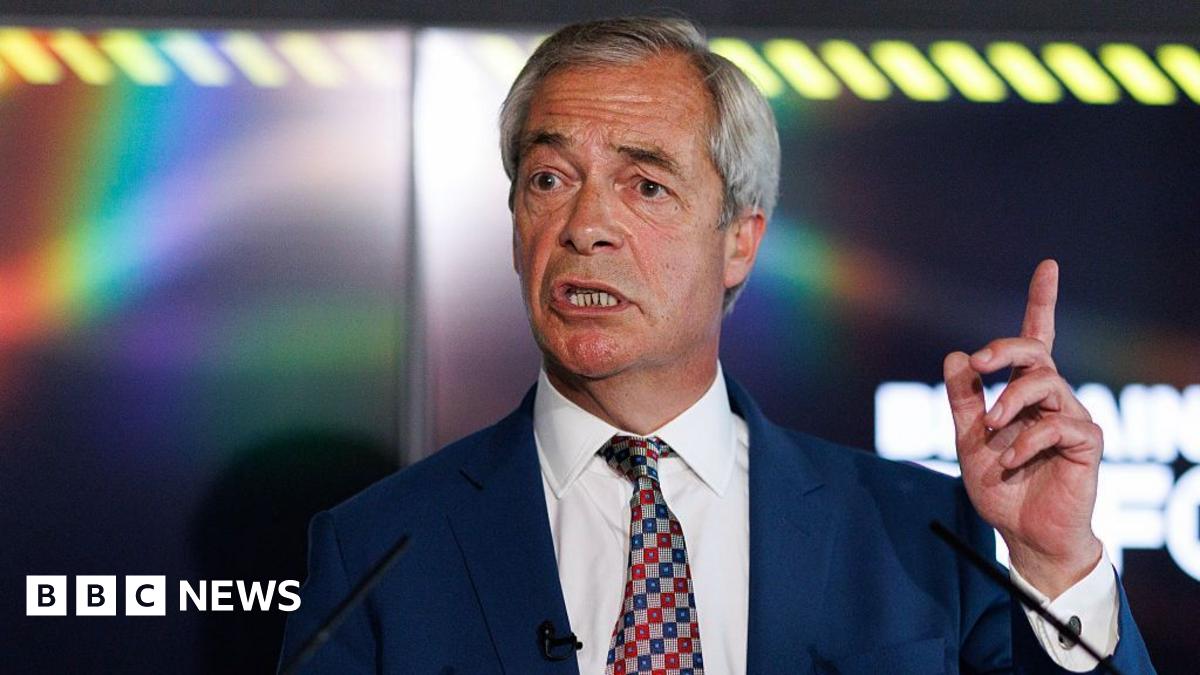

Illegal Immigration Farage Calls For Stricter Border Controls

Aug 28, 2025

Illegal Immigration Farage Calls For Stricter Border Controls

Aug 28, 2025 -

Looted Artwork From Nazi Era Discovered In Unexpected Estate Agent Ad

Aug 28, 2025

Looted Artwork From Nazi Era Discovered In Unexpected Estate Agent Ad

Aug 28, 2025 -

A Worldie Potential Southamptons Matsuki Shows Promise

Aug 28, 2025

A Worldie Potential Southamptons Matsuki Shows Promise

Aug 28, 2025

Latest Posts

-

Former Top Doj Ethics Adviser Accuses Pam Bondi Of Unlawful Firing

Aug 28, 2025

Former Top Doj Ethics Adviser Accuses Pam Bondi Of Unlawful Firing

Aug 28, 2025 -

Paramount Show Cancellation Sparks Outrage After Renewal Promise

Aug 28, 2025

Paramount Show Cancellation Sparks Outrage After Renewal Promise

Aug 28, 2025 -

Real Or Replica Trumps Possession Of Fifa Trophy Raises Questions

Aug 28, 2025

Real Or Replica Trumps Possession Of Fifa Trophy Raises Questions

Aug 28, 2025 -

Illegal Immigration Farage Calls It A Scourge On Britain

Aug 28, 2025

Illegal Immigration Farage Calls It A Scourge On Britain

Aug 28, 2025 -

Paul Krugman Highlights The Core Defect In Trumps Harsh Immigration Stance

Aug 28, 2025

Paul Krugman Highlights The Core Defect In Trumps Harsh Immigration Stance

Aug 28, 2025