Analyzing Trump's Assertion: $4 Trillion Debt Reduction Through Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Trump's Assertion: Could Tariffs Really Slash $4 Trillion in Debt?

The Claim: During his 2016 presidential campaign and subsequent presidency, Donald Trump repeatedly asserted that his proposed tariffs on imported goods would generate massive revenue, ultimately reducing the national debt by a staggering $4 trillion. This bold claim, however, faced significant scrutiny from economists and analysts across the political spectrum. This article delves into the feasibility of such a dramatic debt reduction through tariffs.

The Mechanics of Tariff Revenue: The core of Trump's argument rested on the idea that tariffs would force foreign companies to pay the import taxes, thus directly increasing government revenue. This revenue, he suggested, would be substantial enough to significantly chip away at the national debt. While tariffs do indeed generate revenue, the reality is far more nuanced. The amount of revenue generated depends heavily on the elasticity of demand for imported goods. If demand is inelastic – meaning consumers are willing to pay higher prices even with tariffs – then revenue will increase. However, if demand is elastic – meaning consumers significantly reduce purchases due to higher prices – then the revenue gain could be minimal or even negative, as import volumes shrink.

The Counterarguments and Economic Realities: Critics immediately pointed out several flaws in Trump's assertion. Firstly, the assumption that foreign companies would bear the entire burden of the tariffs is questionable. Economic theory suggests that the burden is often shared between importers, consumers (through higher prices), and potentially even domestic producers if the tariffs lead to retaliatory measures. Secondly, the predicted $4 trillion figure lacked transparency and credible supporting evidence. Independent analyses consistently failed to replicate this projection.

Furthermore, the imposition of tariffs often leads to trade wars, with retaliatory tariffs from other countries impacting American exports and potentially harming domestic industries. This negative impact on the economy could offset any revenue gained through tariffs, and may even increase the national debt through reduced economic activity and increased government spending on support programs for affected businesses and workers.

The Impact on Consumers and Businesses: The effect of tariffs extends beyond government revenue. Higher prices for imported goods directly impact consumers, reducing their disposable income and potentially slowing consumer spending – a major driver of the US economy. Businesses relying on imported materials also face increased costs, potentially leading to job losses or price increases for their products. This ripple effect can significantly harm overall economic growth, undermining the potential benefits of any tariff-generated revenue.

Beyond the Numbers: The Broader Economic Context: It's crucial to remember that a nation's debt is a complex issue influenced by a multitude of factors, extending far beyond tariff revenue. Government spending, tax policies, economic growth, and global economic conditions all play significant roles. Focusing solely on tariff revenue as a solution for debt reduction presents an oversimplified and potentially misleading perspective.

Conclusion: A Highly Unlikely Scenario: While tariffs can generate revenue, the assertion that they could reduce the national debt by $4 trillion is highly unlikely and lacks credible economic backing. The complexities of international trade, the potential for trade wars, and the impact on consumers and businesses all suggest that any revenue generated through tariffs would likely be far less than projected, and potentially offset by negative economic consequences. A holistic approach to debt reduction requires a comprehensive strategy encompassing fiscal responsibility and sustainable economic growth, rather than relying on the simplistic solution of tariffs.

Further Reading: For a deeper dive into the economic effects of tariffs, we recommend researching publications from reputable organizations like the Congressional Budget Office (CBO) and the International Monetary Fund (IMF). You can also explore articles and analysis from various economic journals and think tanks for a more comprehensive understanding of this complex issue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Trump's Assertion: $4 Trillion Debt Reduction Through Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmed Russian Forces In Dnipropetrovsk Ukraines Statement

Aug 28, 2025

Confirmed Russian Forces In Dnipropetrovsk Ukraines Statement

Aug 28, 2025 -

Ethics Scandal Rocks Pam Bondis Legacy Former Adviser Details Dismissal

Aug 28, 2025

Ethics Scandal Rocks Pam Bondis Legacy Former Adviser Details Dismissal

Aug 28, 2025 -

Manning Faces Backlash Following Latest Home Game Loss

Aug 28, 2025

Manning Faces Backlash Following Latest Home Game Loss

Aug 28, 2025 -

Yildiz Oyuncunun Tek Basina Antrenmani Fenerbahce De Sakatlik Endiselerini Artirdi

Aug 28, 2025

Yildiz Oyuncunun Tek Basina Antrenmani Fenerbahce De Sakatlik Endiselerini Artirdi

Aug 28, 2025 -

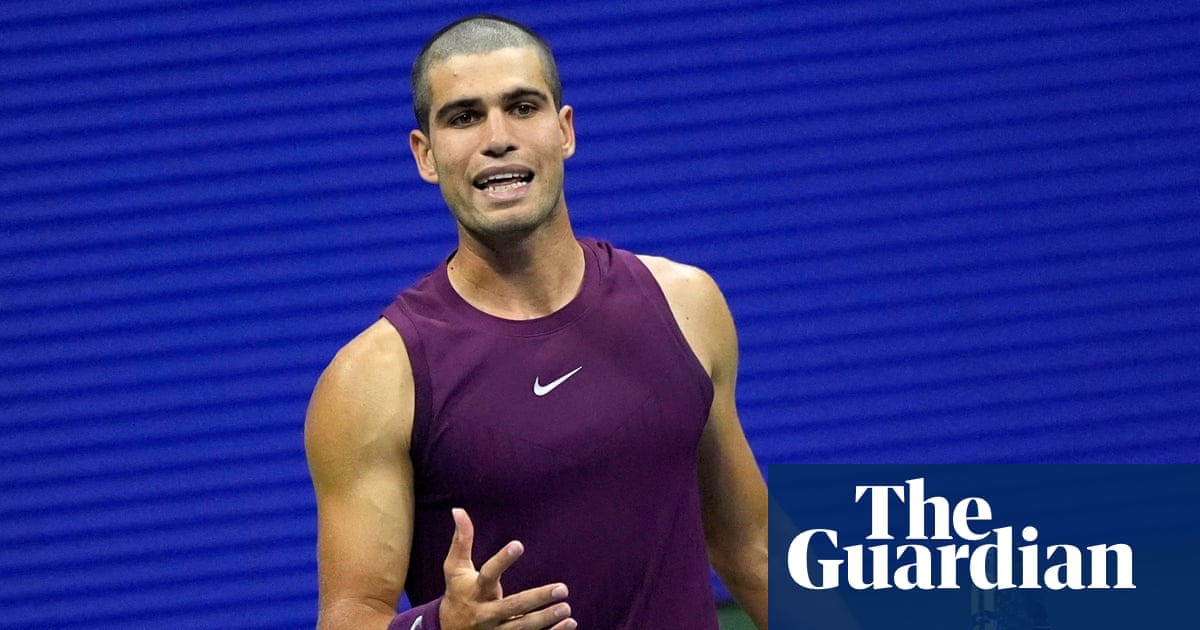

Us Open 2024 Carlos Alcarazs Unintentional Haircut Becomes Viral Sensation

Aug 28, 2025

Us Open 2024 Carlos Alcarazs Unintentional Haircut Becomes Viral Sensation

Aug 28, 2025

Latest Posts

-

Us Open 2025 Day 3 Complete Coverage Of The Second Round Matches

Aug 28, 2025

Us Open 2025 Day 3 Complete Coverage Of The Second Round Matches

Aug 28, 2025 -

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025 -

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025 -

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025 -

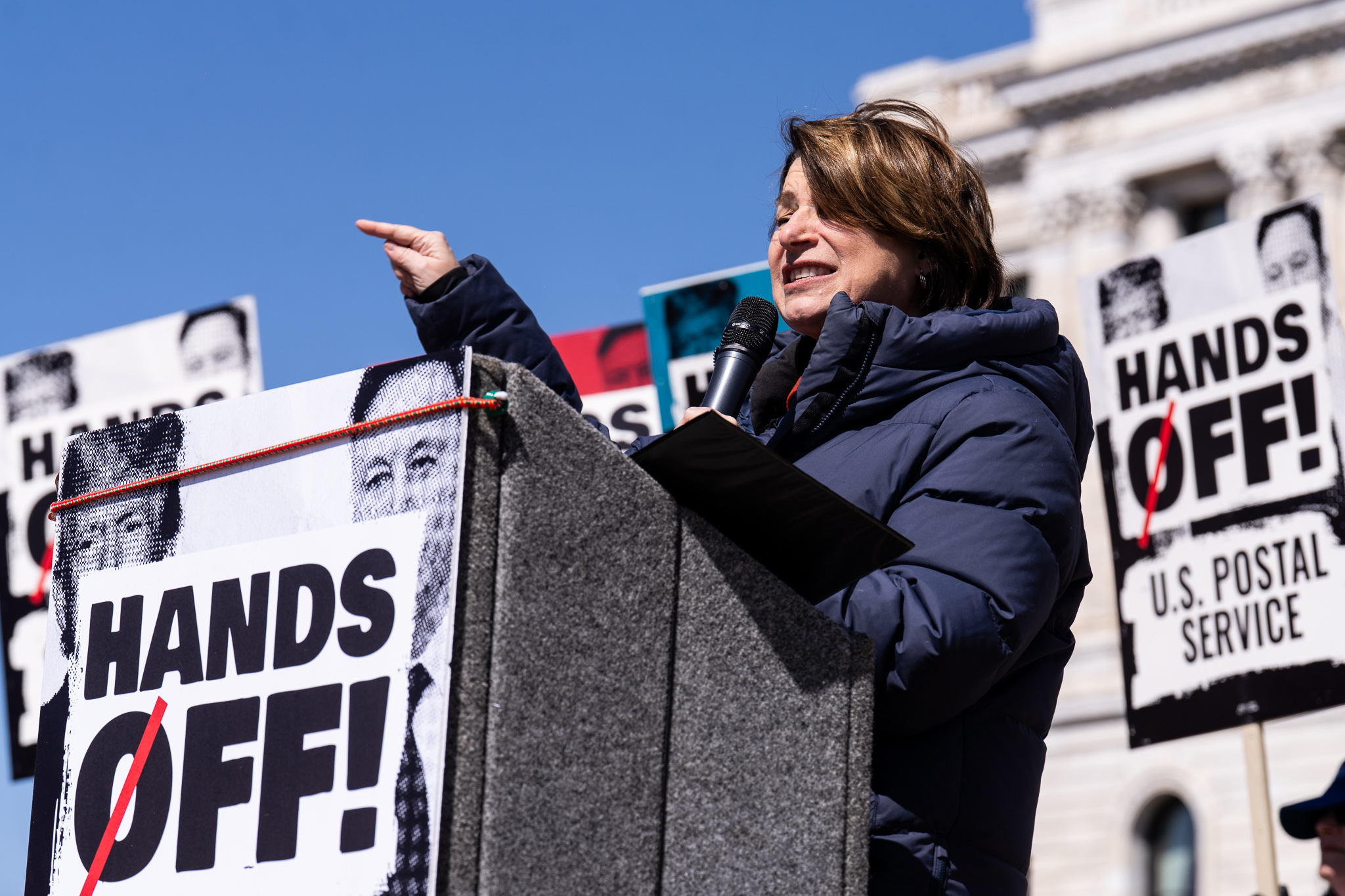

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025