Analyst Cuts Lucid (LCID) Price Target: Should Investors Be Worried?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Cuts Lucid (LCID) Price Target: Should Investors Be Worried?

Lucid Group (LCID), the electric vehicle (EV) maker, has seen its stock price fluctuate wildly since its debut. Recently, a price target cut from a prominent analyst has sent ripples through the investment community. Should investors be concerned, or is this just another bump in the road for the ambitious EV company? Let's delve into the details and explore what this means for potential and current LCID shareholders.

The Analyst's Rationale:

Several analysts have recently revised their price targets for Lucid, with some cuts attributed to concerns surrounding production ramp-up challenges, increased competition in the burgeoning EV market, and macroeconomic headwinds impacting consumer spending. While Lucid has showcased impressive technology and a stunning vehicle in the Air sedan, the transition from promising prototype to mass production and consistent profitability remains a significant hurdle for the company. Analysts are carefully weighing the company's ambitious growth projections against the realities of the current market landscape. This isn't necessarily a condemnation of Lucid's long-term prospects, but rather a reflection of the inherent risks associated with investing in a relatively young company in a rapidly evolving industry.

Lucid's Response and Future Outlook:

Lucid has consistently addressed production challenges, emphasizing their commitment to scaling up manufacturing capacity and meeting growing demand. The company’s focus on luxury vehicles and cutting-edge technology positions it differently from some mass-market EV competitors, suggesting a niche approach. However, this strategy also presents its own set of challenges in terms of volume and market penetration.

The company's recent financial reports and announcements should be closely examined by investors. Pay attention to updates on production numbers, delivery timelines, and any revisions to their financial guidance. Understanding the company's strategy to address the concerns raised by analysts is crucial for assessing the long-term viability of the investment.

What Should Investors Do?

The decision to buy, sell, or hold LCID stock is ultimately a personal one, based on individual risk tolerance and investment goals. The price target cut shouldn't trigger panic selling, but it should prompt a thorough reassessment of your investment thesis.

Here are some key considerations for investors:

- Long-Term Vision: Are you a long-term investor willing to ride out market fluctuations? Lucid’s technology and brand positioning suggest potential for long-term growth.

- Risk Tolerance: Investing in a growth stock like LCID inherently involves significant risk. Only invest what you can afford to lose.

- Diversification: Don't put all your eggs in one basket. Diversifying your portfolio across various asset classes can mitigate risk.

- Due Diligence: Thoroughly research the company, read financial reports, and stay updated on industry news before making any investment decisions.

Beyond the Headlines:

Remember, single analyst ratings shouldn't dictate your investment strategy. Conduct thorough research, consider multiple perspectives, and consult with a qualified financial advisor before making any investment decisions. The EV market is dynamic, and Lucid's journey is far from over. The recent price target cut provides an opportunity to evaluate the company's progress and reassess your position based on a comprehensive understanding of the situation.

Keywords: Lucid, LCID, stock price, price target, analyst rating, electric vehicle, EV, investment, market analysis, stock market, investor, growth stock, EV market, production ramp-up, macroeconomic headwinds, consumer spending, financial reports

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Cuts Lucid (LCID) Price Target: Should Investors Be Worried?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Camilla Recounts Attempted Indecent Assault In New Memoir

Sep 03, 2025

Camilla Recounts Attempted Indecent Assault In New Memoir

Sep 03, 2025 -

Longtime New York Representative Jerry Nadler Retiring From Congress

Sep 03, 2025

Longtime New York Representative Jerry Nadler Retiring From Congress

Sep 03, 2025 -

Your Guide To Dancing With The Stars Season 34

Sep 03, 2025

Your Guide To Dancing With The Stars Season 34

Sep 03, 2025 -

Western New York Claims Another Powerball Victory

Sep 03, 2025

Western New York Claims Another Powerball Victory

Sep 03, 2025 -

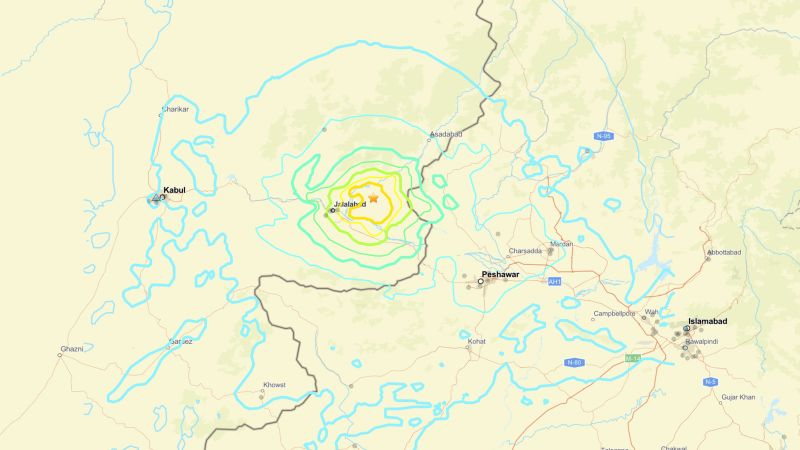

Eastern Afghanistan Hit By 6 0 Magnitude Earthquake Fears Of Heavy Casualties

Sep 03, 2025

Eastern Afghanistan Hit By 6 0 Magnitude Earthquake Fears Of Heavy Casualties

Sep 03, 2025

Latest Posts

-

Kirkpinar Oil Wrestling A Glimpse Into Turkish History And Sport

Sep 03, 2025

Kirkpinar Oil Wrestling A Glimpse Into Turkish History And Sport

Sep 03, 2025 -

Afghanistan Earthquake Taliban Plea For Foreign Assistance Following Heavy Casualties

Sep 03, 2025

Afghanistan Earthquake Taliban Plea For Foreign Assistance Following Heavy Casualties

Sep 03, 2025 -

Political Pressure Mounts Starmer Seeks Clear Distinction From Reform

Sep 03, 2025

Political Pressure Mounts Starmer Seeks Clear Distinction From Reform

Sep 03, 2025 -

Listen To Metal Eden Now On Spotify Apple Music And More

Sep 03, 2025

Listen To Metal Eden Now On Spotify Apple Music And More

Sep 03, 2025 -

Metal Eden New Music Out Now Across All Streaming Services

Sep 03, 2025

Metal Eden New Music Out Now Across All Streaming Services

Sep 03, 2025