Analysis: June CPI Shows Continued Inflation In The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: June CPI Shows Continued Inflation, Raising Concerns for the Fed

Inflation remains stubbornly persistent in the United States, according to the latest Consumer Price Index (CPI) data released for June. The report, published by the Bureau of Labor Statistics (BLS), reveals a continued upward pressure on prices, complicating the Federal Reserve's efforts to manage the economy and potentially signaling further interest rate hikes. This persistent inflation poses significant challenges for consumers already grappling with rising costs of living.

The June CPI data showed a [insert specific percentage change here] increase compared to the previous month and a [insert specific percentage change here] increase year-over-year. This surpasses many economists' predictions and underscores the ongoing battle against inflation. While some sectors saw a slight slowdown in price increases, others experienced notable jumps, painting a complex picture of the current economic landscape.

Key Drivers of Continued Inflation:

Several factors contributed to the persistent inflation reported in June's CPI. These include:

-

Persistent Supply Chain Issues: Although supply chain disruptions have eased from their pandemic peaks, lingering bottlenecks continue to impact the cost of goods, particularly in sectors like manufacturing and transportation. This ongoing constraint contributes to higher production and transportation costs, ultimately passed on to consumers.

-

Strong Consumer Demand: Robust consumer spending, fueled by a still-strong labor market, continues to push up demand for goods and services. This increased demand, coupled with constrained supply, fuels inflationary pressures.

-

Energy Prices: Fluctuations in global energy markets continue to influence the overall CPI. Rising energy costs, including gasoline and electricity, directly impact household budgets and contribute significantly to the inflation rate. [Link to relevant energy price data source]

-

Housing Costs: The housing market remains a significant contributor to inflation. Rising rents and home prices continue to exert upward pressure on the overall CPI, reflecting a tight housing market across the nation. [Link to relevant housing market data source]

Implications for the Federal Reserve:

The June CPI data strengthens the case for further interest rate hikes by the Federal Reserve. The central bank is tasked with maintaining price stability and full employment, and persistent inflation necessitates continued action to cool down the economy. While raising interest rates can help curb inflation by slowing down economic activity, it also carries the risk of triggering a recession. The Fed faces a delicate balancing act in navigating this challenging economic environment.

Looking Ahead:

The coming months will be crucial in determining the trajectory of inflation. The Federal Reserve's policy decisions, alongside global economic developments and evolving supply chain dynamics, will play a significant role in shaping the inflation outlook. Consumers should brace for continued pressure on their wallets, while businesses need to adapt to the persistent inflationary pressures. Careful monitoring of upcoming economic indicators, including the Producer Price Index (PPI) and employment data, is essential for understanding the evolving inflation landscape.

Call to Action: Stay informed about the latest economic news and updates. Understanding the factors driving inflation can empower you to make informed financial decisions. [Link to relevant economic news source or financial literacy resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: June CPI Shows Continued Inflation In The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Premier League Live Key Battle As Crystal Palace Faces Nottingham Forest

Aug 25, 2025

Premier League Live Key Battle As Crystal Palace Faces Nottingham Forest

Aug 25, 2025 -

Understanding Black Moons A Guide For This Weekends Event

Aug 25, 2025

Understanding Black Moons A Guide For This Weekends Event

Aug 25, 2025 -

Bobby Flays Take Why Carmys The Bear Style Wouldnt Win

Aug 25, 2025

Bobby Flays Take Why Carmys The Bear Style Wouldnt Win

Aug 25, 2025 -

Matchday Live Evertons Stadium Debut Rangers Vs St Mirren Build Up

Aug 25, 2025

Matchday Live Evertons Stadium Debut Rangers Vs St Mirren Build Up

Aug 25, 2025 -

August 16 2025 Texas Lottery Powerball And Lotto Texas Winning Numbers

Aug 25, 2025

August 16 2025 Texas Lottery Powerball And Lotto Texas Winning Numbers

Aug 25, 2025

Latest Posts

-

August 25 2025 Nyt Connections Puzzle Find The Connections

Aug 25, 2025

August 25 2025 Nyt Connections Puzzle Find The Connections

Aug 25, 2025 -

Nyt Connections Game August 25 2025 Answers

Aug 25, 2025

Nyt Connections Game August 25 2025 Answers

Aug 25, 2025 -

Chelsea Clintons Post Trump Gate Crash Image A Case Study In Nonverbal Communication

Aug 25, 2025

Chelsea Clintons Post Trump Gate Crash Image A Case Study In Nonverbal Communication

Aug 25, 2025 -

Minnesota College Credit Program Religious Test Ban Overturned

Aug 25, 2025

Minnesota College Credit Program Religious Test Ban Overturned

Aug 25, 2025 -

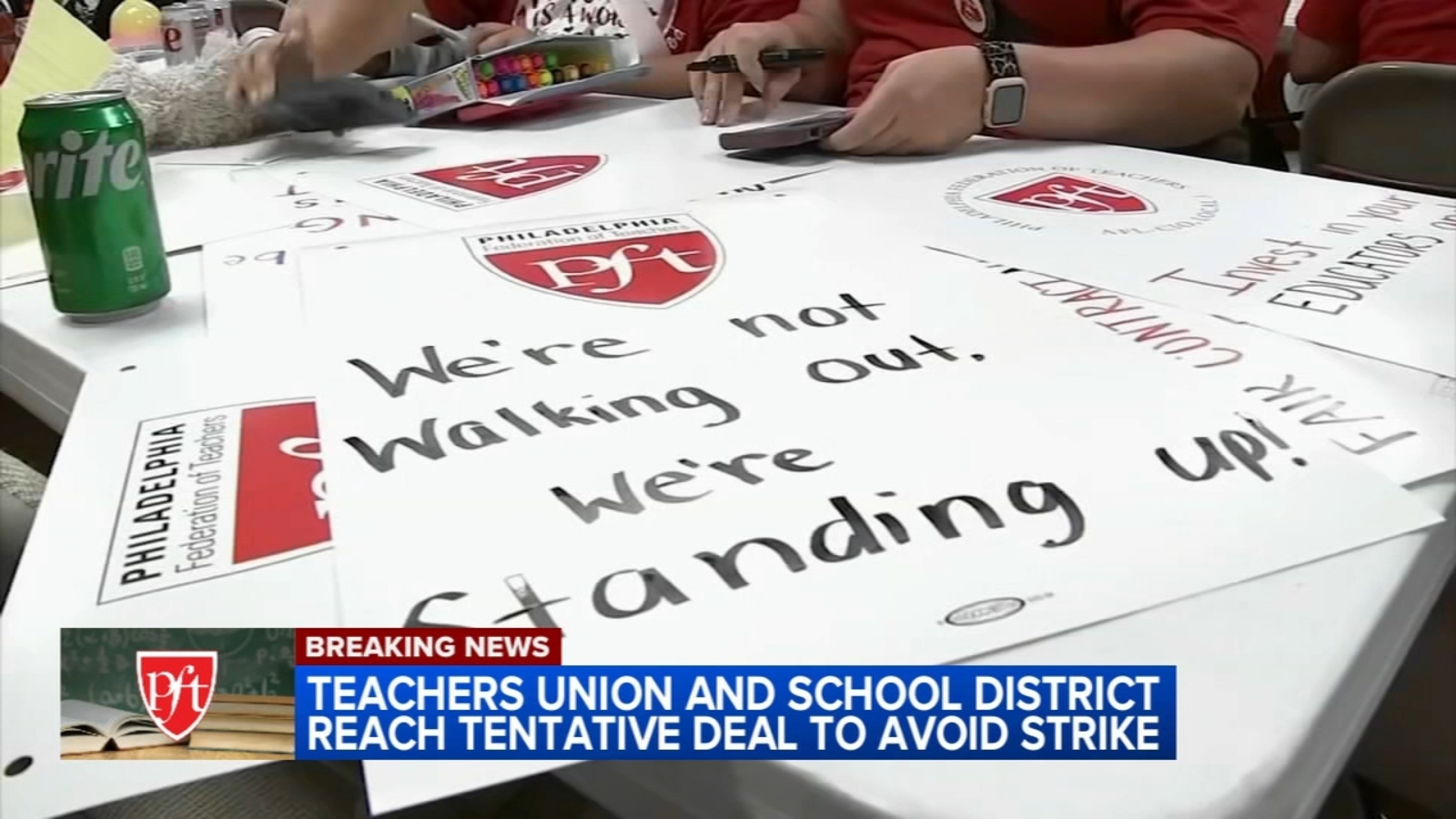

Tentative Contract Averted Philadelphia Teacher Strike Union And District Reach Deal

Aug 25, 2025

Tentative Contract Averted Philadelphia Teacher Strike Union And District Reach Deal

Aug 25, 2025