$4 Trillion Debt Reduction? Separating Fact From Fiction In Trump's Tariff Narrative

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$4 Trillion Debt Reduction? Separating Fact from Fiction in Trump's Tariff Narrative

The claim that former President Trump's tariffs resulted in a $4 trillion reduction of the national debt is a bold assertion, frequently cited by his supporters. However, a closer examination reveals a complex reality far removed from this simplistic narrative. While tariffs did generate some revenue, attributing a $4 trillion debt reduction solely to them is a significant overstatement, bordering on misinformation. This article will dissect the facts, separating the verifiable impact of tariffs on government revenue from the inflated claims surrounding their effect on the national debt.

Understanding the Numbers Game:

The $4 trillion figure often appears alongside discussions of the Trump administration's economic policies. Proponents point to increased tariff revenue as a key driver of this alleged debt reduction. While it's true that tariffs did increase government revenue, this increase is far from the astronomical $4 trillion figure. The actual increase in tariff revenue during the Trump administration was significantly lower, and attributing the entire amount to debt reduction ignores other crucial factors affecting the national debt.

The Reality of Tariff Revenue:

The impact of tariffs on government revenue is undeniable. Increased tariffs on imported goods led to higher duties collected by the U.S. government. However, several factors complicate the direct link between tariff revenue and debt reduction:

- Offsetting Costs: The tariffs also led to increased prices for consumers and businesses, potentially reducing overall economic activity and impacting tax revenue from other sources. This effect partially offsets any gains from increased tariff revenue.

- Trade Wars and Retaliation: Trump's tariffs sparked retaliatory tariffs from other countries, impacting American exports and leading to job losses in certain sectors. These negative economic consequences indirectly increased the national debt through decreased tax revenue and increased government spending on social programs.

- Government Spending: It's crucial to remember that the national debt is influenced by both government revenue and government spending. While tariffs may have increased revenue, substantial increases in government spending during the same period counteracted any significant impact on the overall debt.

Other Factors Affecting National Debt:

The national debt is a multifaceted issue influenced by numerous economic factors beyond tariff revenue. These include:

- Interest Rates: Fluctuations in interest rates significantly affect the cost of servicing the national debt.

- Economic Growth: Strong economic growth generally increases tax revenue, contributing to debt reduction. Conversely, economic slowdowns decrease tax revenue.

- Government Spending Priorities: Decisions regarding government spending on areas like defense, healthcare, and infrastructure significantly impact the national debt.

Conclusion: A More Nuanced Perspective:

While tariffs generated additional revenue for the U.S. government, the claim of a $4 trillion debt reduction directly attributable to them is misleading and lacks factual support. The complex interplay of economic factors makes it impossible to isolate tariffs as the sole driver of any change in the national debt. A comprehensive analysis requires considering all relevant economic variables and avoiding oversimplification. Understanding the intricacies of the national debt necessitates a more nuanced perspective, avoiding sensationalist claims that lack a strong basis in verifiable data. For further in-depth analysis, consult reputable economic sources like the Congressional Budget Office (CBO) and the Federal Reserve.

Call to Action: Engage in informed discussions about economic policy, relying on credible sources and critically evaluating claims about the impact of specific policies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $4 Trillion Debt Reduction? Separating Fact From Fiction In Trump's Tariff Narrative. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roma Dan Cifte Transfer Hamlesi Mourinho Kerem Aktuerkoglu Ve Geny Catamo Yu Degerlendiriyor

Aug 28, 2025

Roma Dan Cifte Transfer Hamlesi Mourinho Kerem Aktuerkoglu Ve Geny Catamo Yu Degerlendiriyor

Aug 28, 2025 -

Jaquez Vf B Stuttgart Blesse Fracture Du Nez Contre L Union Berlin

Aug 28, 2025

Jaquez Vf B Stuttgart Blesse Fracture Du Nez Contre L Union Berlin

Aug 28, 2025 -

Injury Update Luca Jaquez Of Vf B Stuttgart Suffers Broken Nose

Aug 28, 2025

Injury Update Luca Jaquez Of Vf B Stuttgart Suffers Broken Nose

Aug 28, 2025 -

Showtimes Dexter Original Sin Axed Despite Renewal Claims What Happened

Aug 28, 2025

Showtimes Dexter Original Sin Axed Despite Renewal Claims What Happened

Aug 28, 2025 -

Live Transfer News Chelseas Garnacho Pursuit Isak To Liverpool And Hincapie Arsenal Update

Aug 28, 2025

Live Transfer News Chelseas Garnacho Pursuit Isak To Liverpool And Hincapie Arsenal Update

Aug 28, 2025

Latest Posts

-

Us Open 2025 Day 3 Complete Coverage Of The Second Round Matches

Aug 28, 2025

Us Open 2025 Day 3 Complete Coverage Of The Second Round Matches

Aug 28, 2025 -

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025 -

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025 -

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025 -

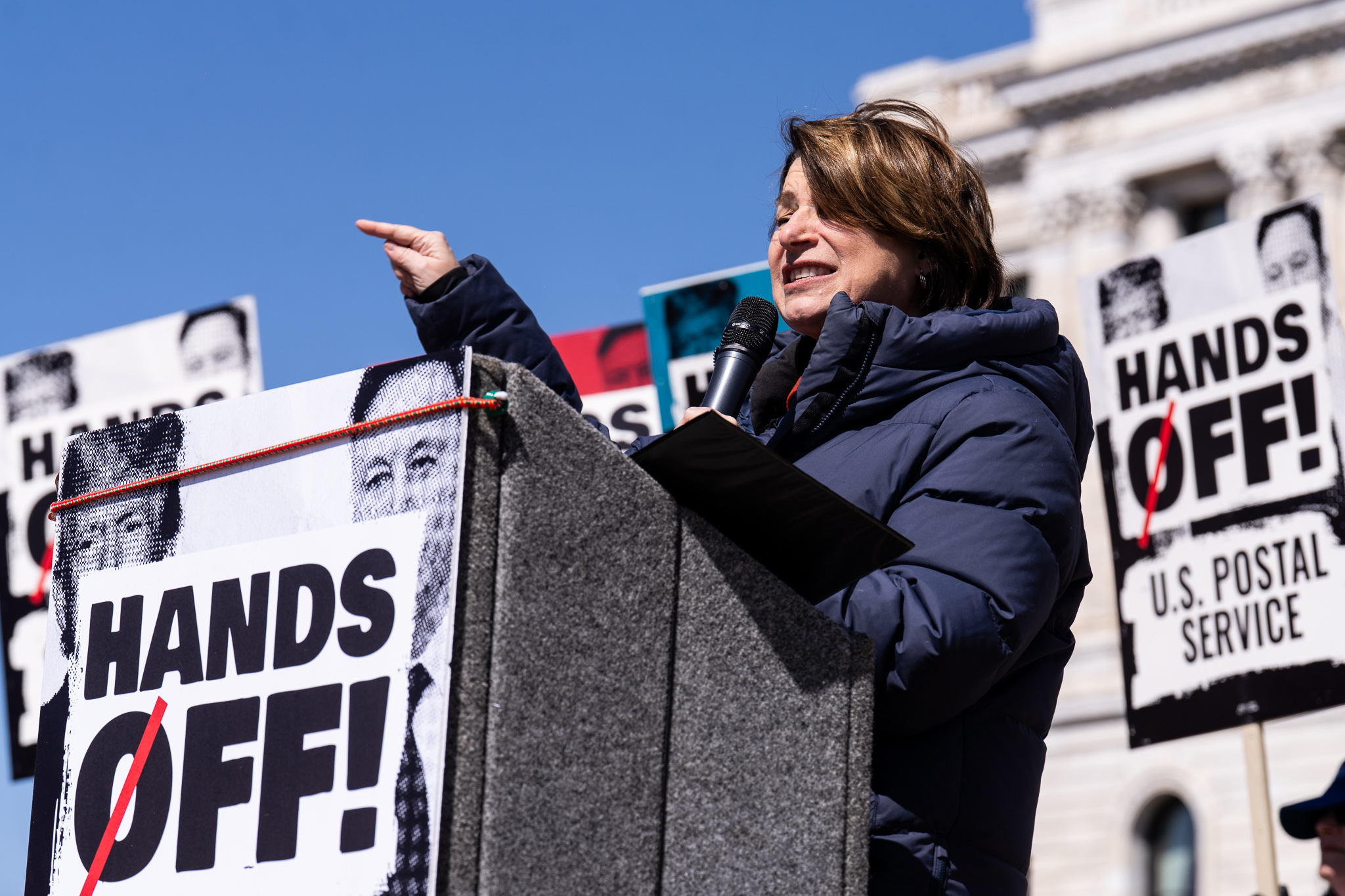

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025