$4 Trillion Debt Reduction: Examining The Validity Of Trump's Tariff Claims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$4 Trillion Debt Reduction: Examining the Validity of Trump's Tariff Claims

The claim that former President Trump's tariffs led to a $4 trillion reduction in the national debt is a bold one, frequently touted by his supporters. But does the data support this assertion? A closer examination reveals a more nuanced picture, one that requires separating fact from political rhetoric. While the national debt did see some changes during his presidency, attributing a $4 trillion reduction directly to tariffs is a significant oversimplification.

Understanding the Complexity of National Debt

The US national debt is a complex beast, influenced by a multitude of factors beyond any single policy. These include government spending, tax revenues, economic growth, and global financial conditions. Attributing a specific reduction solely to tariffs ignores the interplay of these interwoven economic forces.

Examining the Tariff Impact:

While tariffs can theoretically increase government revenue, the impact is often indirect and can be counteracted by other economic consequences. Here's a breakdown of why the $4 trillion claim is dubious:

- Reduced Trade: Tariffs often lead to retaliatory tariffs from other countries, hindering trade and potentially slowing economic growth. Slower growth can actually increase the deficit, as tax revenues fall and government spending on social programs might rise.

- Inflationary Pressures: Increased prices on imported goods due to tariffs can contribute to inflation, impacting consumer spending and potentially harming economic growth. Again, this can negatively influence the deficit.

- Shifting Revenue Streams: While tariffs might generate some additional revenue, this is often dwarfed by the overall impact on the economy. It's crucial to analyze the net effect, not just the increase in tariff revenue in isolation.

- Other Contributing Factors: The national debt's fluctuations during Trump's presidency were also significantly impacted by factors unrelated to tariffs, such as tax cuts and increased military spending. These factors far outweigh the impact of tariff revenue.

Independent Economic Analysis:

Numerous independent economic analyses have questioned the validity of linking a $4 trillion debt reduction directly to tariffs. These analyses often highlight the limitations of such a simplistic claim and emphasize the many other variables affecting the national debt. For example, [link to a reputable economic analysis report], a study by [Institution name], points to [mention a key finding that counters the $4 trillion claim]. Further research is readily available online from organizations like the Congressional Budget Office and the Federal Reserve.

The Importance of Nuance in Economic Reporting:

It's vital to approach economic claims, especially those with strong political undertones, with critical thinking and a healthy dose of skepticism. Attributing complex economic shifts to a single policy, like tariffs, oversimplifies a multifaceted reality. It's crucial to consult multiple sources and consider the full range of contributing factors before accepting such sweeping pronouncements.

Conclusion:

The assertion that Trump's tariffs led to a $4 trillion reduction in the national debt lacks sufficient evidence and ignores crucial economic complexities. While tariffs can contribute to government revenue, their impact is far less significant than other factors influencing the national debt. A balanced understanding of economic policy requires a more nuanced perspective than simplistic claims often presented in political discourse. It is crucial to rely on credible, independent economic analysis when evaluating such bold pronouncements. Understanding the nuances of the national debt is vital for informed civic engagement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $4 Trillion Debt Reduction: Examining The Validity Of Trump's Tariff Claims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Phone 15 Unveiling Date Expected Features And Price Speculations

Aug 28, 2025

I Phone 15 Unveiling Date Expected Features And Price Speculations

Aug 28, 2025 -

I Phone 15 What To Expect From Apples September 9th Event

Aug 28, 2025

I Phone 15 What To Expect From Apples September 9th Event

Aug 28, 2025 -

Confirmed Taylor Swift And Travis Kelce Engaged See The Photos And Reactions

Aug 28, 2025

Confirmed Taylor Swift And Travis Kelce Engaged See The Photos And Reactions

Aug 28, 2025 -

Paul Krugman Highlights The Core Defect In Trumps Harsh Immigration Stance

Aug 28, 2025

Paul Krugman Highlights The Core Defect In Trumps Harsh Immigration Stance

Aug 28, 2025 -

See The Proof Carlos Alcarazs Hair Is Growing Back

Aug 28, 2025

See The Proof Carlos Alcarazs Hair Is Growing Back

Aug 28, 2025

Latest Posts

-

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025 -

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025 -

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025 -

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025 -

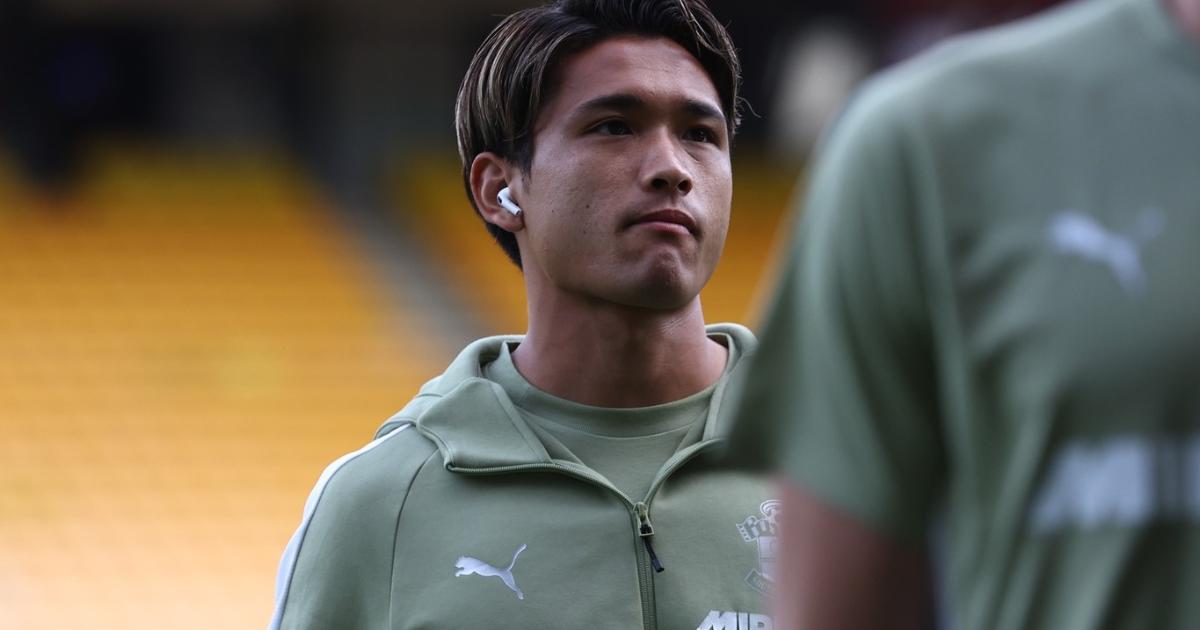

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025