2034 Social Security Deadline: Will Congress Avert Benefit Reductions?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2034 Social Security Deadline: Will Congress Avert Benefit Reductions?

The looming 2034 deadline for Social Security's trust fund depletion is casting a long shadow over millions of Americans. By that year, the Social Security Administration (SSA) projects the trust fund will be unable to pay 100% of scheduled benefits without significant changes. This potential shortfall has sparked intense debate in Congress and widespread concern among retirees and future retirees. Will lawmakers act to prevent benefit reductions, or are millions facing a significant cut to their retirement income?

Understanding the 2034 Social Security Funding Crisis

The Social Security system faces a long-term funding gap due to several factors, including an aging population, increasing life expectancy, and a declining worker-to-beneficiary ratio. Simply put, there are fewer workers contributing to the system to support a growing number of retirees. While the system currently collects more in taxes than it pays out in benefits, this surplus is projected to dwindle to zero by 2034. This doesn't mean Social Security will immediately collapse; rather, it means the system will only be able to pay approximately 80% of scheduled benefits based on current projections.

Potential Solutions: A Political Tightrope Walk

Several solutions have been proposed to address the looming shortfall, but reaching a bipartisan consensus in Congress remains a significant hurdle. These proposals include:

- Increasing the retirement age: Gradually raising the full retirement age is one option, but it could disproportionately affect lower-income workers who often have less access to retirement savings alternatives.

- Raising the Social Security tax cap: Currently, Social Security taxes only apply to earnings up to a certain limit. Raising this cap would broaden the tax base and increase revenue. However, this could be viewed as a tax increase on higher earners.

- Reducing benefits for higher earners: This proposal suggests adjusting benefit calculations to reduce payments for higher-income retirees. The details of such a change are complex and could face significant political opposition.

- Cutting administrative costs: While the SSA strives for efficiency, some argue that further streamlining administrative processes could generate savings. However, the potential savings from this approach are relatively small compared to the overall funding gap.

The Political Landscape and the Urgency of Action

The political climate surrounding Social Security reform is highly charged. Finding a solution that satisfies both Democrats and Republicans is proving to be exceedingly difficult, with each side advocating for different priorities and approaches. The longer Congress delays action, the more drastic the measures required to address the shortfall become. Delaying action beyond 2034 could lead to more significant and abrupt benefit reductions.

What You Can Do

While the ultimate outcome remains uncertain, staying informed is crucial. Understanding the potential scenarios and the proposed solutions allows individuals to engage in the political process and advocate for their interests. You can:

- Contact your elected officials: Express your concerns and opinions on potential Social Security reforms.

- Stay updated on legislative developments: Follow news reports and updates from reputable sources like the Social Security Administration's website and organizations focused on retirement policy.

- Plan for your retirement: Regardless of legislative action, planning for your retirement is essential. This includes diversifying your savings, considering alternative retirement income sources, and consulting with a financial advisor.

The 2034 deadline for Social Security's trust fund depletion is a critical issue with potentially profound consequences. The actions – or inaction – of Congress in the coming years will significantly impact millions of Americans' retirement security. The need for proactive and bipartisan solutions is undeniable. The question remains: will Congress act in time to avert benefit reductions, or will millions face a diminished retirement?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2034 Social Security Deadline: Will Congress Avert Benefit Reductions?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Claim Your 150 Warm Homes Discount A Simple Guide

Jun 20, 2025

Claim Your 150 Warm Homes Discount A Simple Guide

Jun 20, 2025 -

Landmark Ruling Supreme Court Backs Ban On Gender Affirming Medical Care For Underage Individuals

Jun 20, 2025

Landmark Ruling Supreme Court Backs Ban On Gender Affirming Medical Care For Underage Individuals

Jun 20, 2025 -

Serena Vs Venus Vs Navratilova A Deep Dive Into Their Grass Court Winning Percentages On The Wta Tour

Jun 20, 2025

Serena Vs Venus Vs Navratilova A Deep Dive Into Their Grass Court Winning Percentages On The Wta Tour

Jun 20, 2025 -

No More Feline Forensics Parliament Rejects Cat Pest Control

Jun 20, 2025

No More Feline Forensics Parliament Rejects Cat Pest Control

Jun 20, 2025 -

Backlash Over Trumps Self Promoting Phone Advertisement

Jun 20, 2025

Backlash Over Trumps Self Promoting Phone Advertisement

Jun 20, 2025

Latest Posts

-

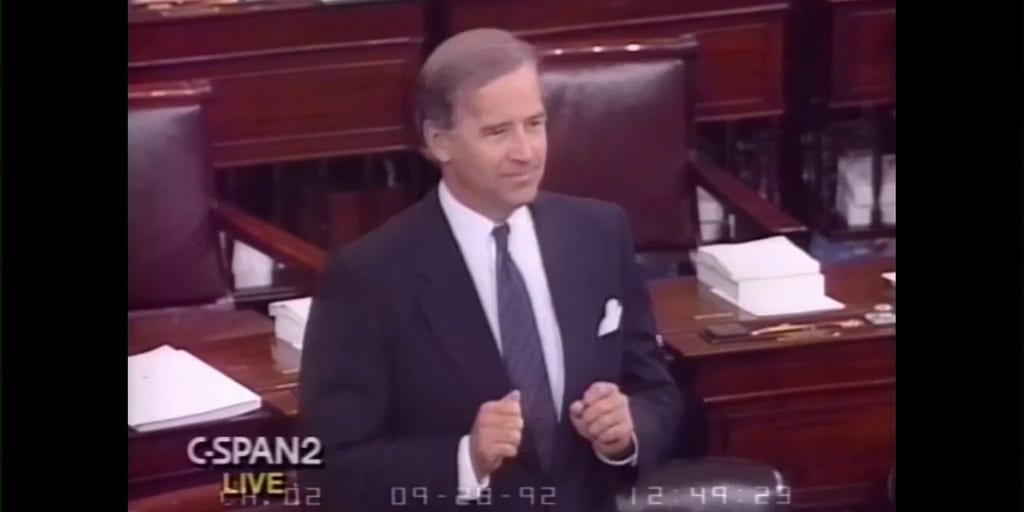

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025