$130,000 In Student Loans: Why Some Graduates Are Failing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$130,000 in Student Loans: Why Some Graduates Are Failing to Thrive

The crushing weight of student loan debt is a growing concern across the globe. For many, the dream of higher education is increasingly overshadowed by the harsh reality of a six-figure debt burden. A staggering $130,000 in student loans is becoming alarmingly common, leaving graduates struggling to navigate the early stages of their careers and adult life. But why are so many facing this financial precipice, and what can be done to mitigate this crisis?

The High Cost of Higher Education:

The escalating cost of tuition, fees, and living expenses is a primary driver of this problem. Universities, particularly private institutions, have seen significant tuition increases over the past few decades, far outpacing inflation. This increase, coupled with a stagnant growth in financial aid opportunities, forces many students to rely heavily on loans to finance their education. The allure of a prestigious degree often overshadows the long-term financial implications.

Choosing the Wrong Path:

Not all degrees are created equal in terms of return on investment (ROI). While a degree in medicine or engineering can often lead to high-paying jobs, other fields may struggle to offer commensurate salaries to justify the significant investment in education. Choosing a major based on passion without considering future earning potential can contribute to crippling debt without the financial means to repay it. Careful consideration of career prospects and salary expectations is crucial before committing to a specific field of study.

The Impact of Underemployment and Unemployment:

Graduates facing $130,000 in student loans are particularly vulnerable to underemployment and unemployment. A lack of relevant experience, stiff competition in the job market, and the economic climate can all contribute to difficulty in securing a well-paying job that allows for timely loan repayment. This situation often leads to a vicious cycle of accumulating interest and falling further behind on payments.

The Mental Health Toll:

The stress and anxiety associated with crippling student loan debt can have a significant impact on mental health. Graduates may experience depression, anxiety, and even suicidal thoughts as they grapple with the overwhelming burden of repayment. This financial pressure can affect their ability to focus on career development, build healthy relationships, and enjoy life to the fullest. Seeking professional help and support is crucial for individuals struggling with the emotional consequences of student loan debt.

What Can Be Done?

Addressing this escalating problem requires a multi-pronged approach:

- Increased Transparency in College Costs: Universities need to be more transparent about the true cost of attending, including tuition, fees, and living expenses. This will allow prospective students to make informed decisions and avoid unexpected financial burdens.

- Improved Financial Literacy Programs: Educational institutions should integrate robust financial literacy programs into their curricula, equipping students with the knowledge and skills to manage their finances effectively.

- Targeted Loan Forgiveness Programs: Governments could consider implementing targeted loan forgiveness programs for specific professions or individuals facing extreme financial hardship.

- Exploring Alternative Funding Options: Exploring scholarships, grants, and work-study programs can help reduce reliance on loans.

The crisis of crippling student loan debt is a complex issue with far-reaching consequences. Addressing this challenge requires a collaborative effort between universities, governments, and individuals to create a more sustainable and equitable system of higher education financing. Understanding the factors contributing to this problem is the first step towards finding effective solutions and helping graduates avoid the devastating consequences of a $130,000 student loan burden.

Call to Action: Share your thoughts and experiences with student loan debt in the comments below. Let's start a conversation to find solutions together.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $130,000 In Student Loans: Why Some Graduates Are Failing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Quinshon Judkins A Must Draft Fantasy Rb Analyzing His Potential

Sep 04, 2025

Is Quinshon Judkins A Must Draft Fantasy Rb Analyzing His Potential

Sep 04, 2025 -

I Os 26 Beta Program Concludes Anticipation Builds For I Phone 17

Sep 04, 2025

I Os 26 Beta Program Concludes Anticipation Builds For I Phone 17

Sep 04, 2025 -

British Science Festival Liverpool 10 Reasons To Attend

Sep 04, 2025

British Science Festival Liverpool 10 Reasons To Attend

Sep 04, 2025 -

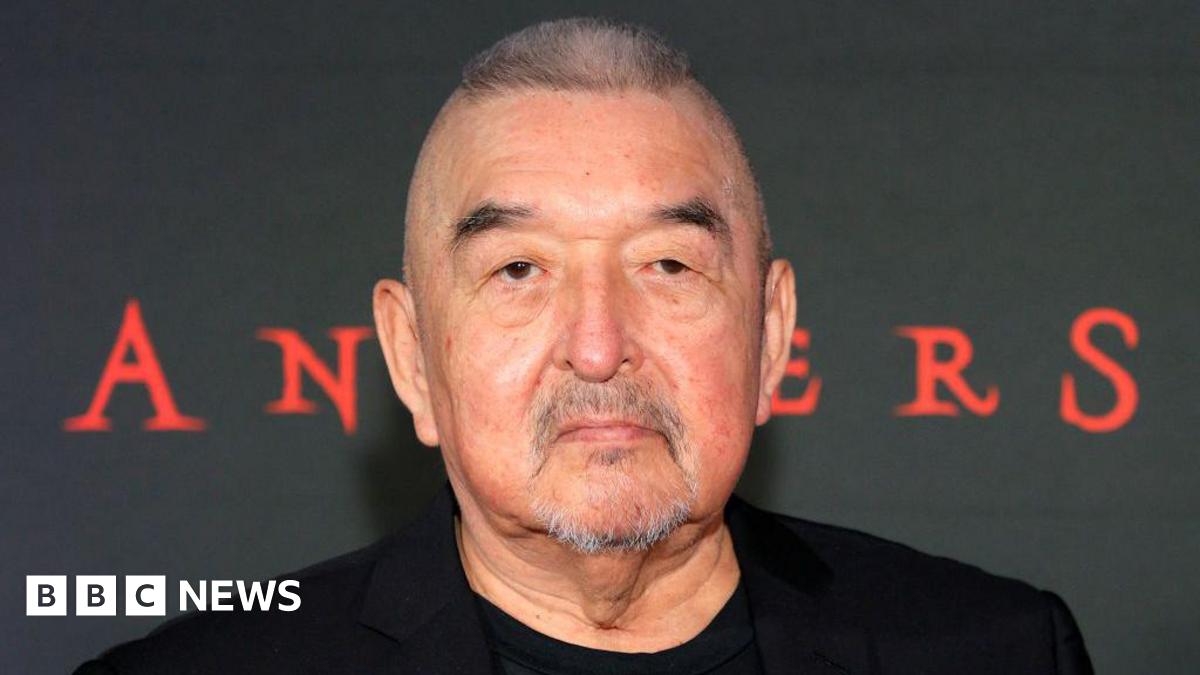

Remembering Graham Greene Dances With Wolves Star Passes Away

Sep 04, 2025

Remembering Graham Greene Dances With Wolves Star Passes Away

Sep 04, 2025 -

Quick Moving Wildfire Burns Through Historic California Gold Mining Town

Sep 04, 2025

Quick Moving Wildfire Burns Through Historic California Gold Mining Town

Sep 04, 2025

Latest Posts

-

Big Bens Refurbishment A Contender For The Riba Stirling Prize

Sep 05, 2025

Big Bens Refurbishment A Contender For The Riba Stirling Prize

Sep 05, 2025 -

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025 -

Moskovskiy Aeroport Zvezda Kholopa Zaderzhan Obnaruzheny Narkotiki

Sep 05, 2025

Moskovskiy Aeroport Zvezda Kholopa Zaderzhan Obnaruzheny Narkotiki

Sep 05, 2025 -

Riba Stirling Prize Shortlist Includes Historic Big Ben Restoration

Sep 05, 2025

Riba Stirling Prize Shortlist Includes Historic Big Ben Restoration

Sep 05, 2025 -

Illegal Sports Streaming Site Streameast Officially Shut Down By Authorities

Sep 05, 2025

Illegal Sports Streaming Site Streameast Officially Shut Down By Authorities

Sep 05, 2025